Since the 2008 financial crash, restaurant loans have slowly started to increase. While there are risks to lending to restaurant companies — relatively few barriers to entry and hard-to-protect intellectual property — the size of the global restaurant industry ($2.7t) makes foodservice an appealing market for bank loans and credit lines. At the same time, the dominance of multinational chains and large restaurant operators has reduced the risk on commercial investment to those companies.

Both Bank of America and Wells Fargo have extended credit to major restaurant brands.

Unsurprisingly, larger, more established operations have easier (and cheaper) access to commercial lending. For example, Darden secured a $750m credit line (equivalent to 9% of its annual revenue) and Dave & Buster’s $800m (80% of annual revenue). But some big players — like Chipotle and The Cheesecake Factory — take on no debt whatsoever, choosing to finance their growth and expansion with equity. While debt can become dangerous, equity-only operations may be suboptimal.

Among publicly traded companies in the U.S., those with the most leverage used debt to finance stock buyback and dividend payments. While the steady pace of regular interest payments may keep management teams focused on optimizing performance, rising interest rates may turn these debt obligations into debilitating burdens.

Restaurant Companies Refinancing Existing Debt to Lower Interest Payments

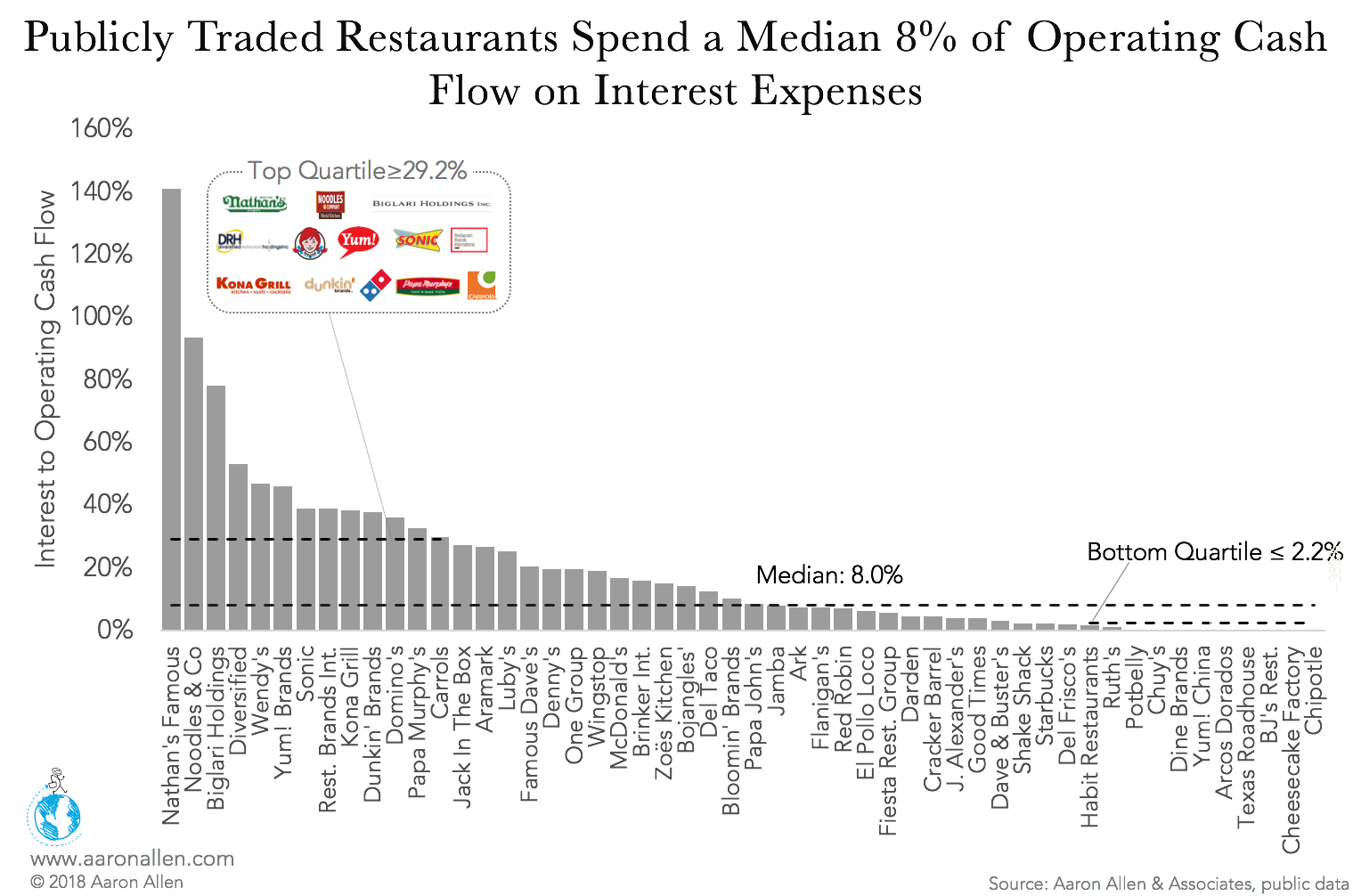

Looking at a restaurant company’s interest expenses as a percentage of its operating cash flows shows which operations are best positioned to meet their debt obligations.

In 2017, the median interest-to-operating-cash-flow ratio for public restaurant companies was 8%. The operations with the largest ratios incurred at least $0.27 in interest expenses for each dollar of operating cash flow — 3.4x the industry median. With a 150% ratio, Nathan’s Famous has the dubious honor of leading the pack: $14.7m in interest expenses with only $10.4m in operating cash flow.

Debt expenses are clearly burdening the heavily franchised hot dog restaurant, and its ability to meet them is questionable. In November 2017, it issued a $150m round of senior secured notes to refinance debt it took on in 2015. The move is expected to lower their interest payments by $3.6m a year.

Several companies have no outstanding long-term debt, including Chipotle, Texas Roadhouse, and Yum! China. Their extremely low financial leverage offers these companies the opportunity to raise debt if they require additional capital. Also, thanks to rising interest rates, these operations are freed from incurring higher expenses that could hurt their bottom line.

However, a debt-free restaurant company may have a suboptimal capital structure as a result of forgone tax shields or simply because equity financing can be more expensive than debt financing. A 100% equity-funded operation may also lead to a lack of cash flow discipline: when management teams have debt, they tend to pursue fewer speculative projects, instead focusing on increasing efficiency and ensuring investments pay off so they can meet their debt obligations.

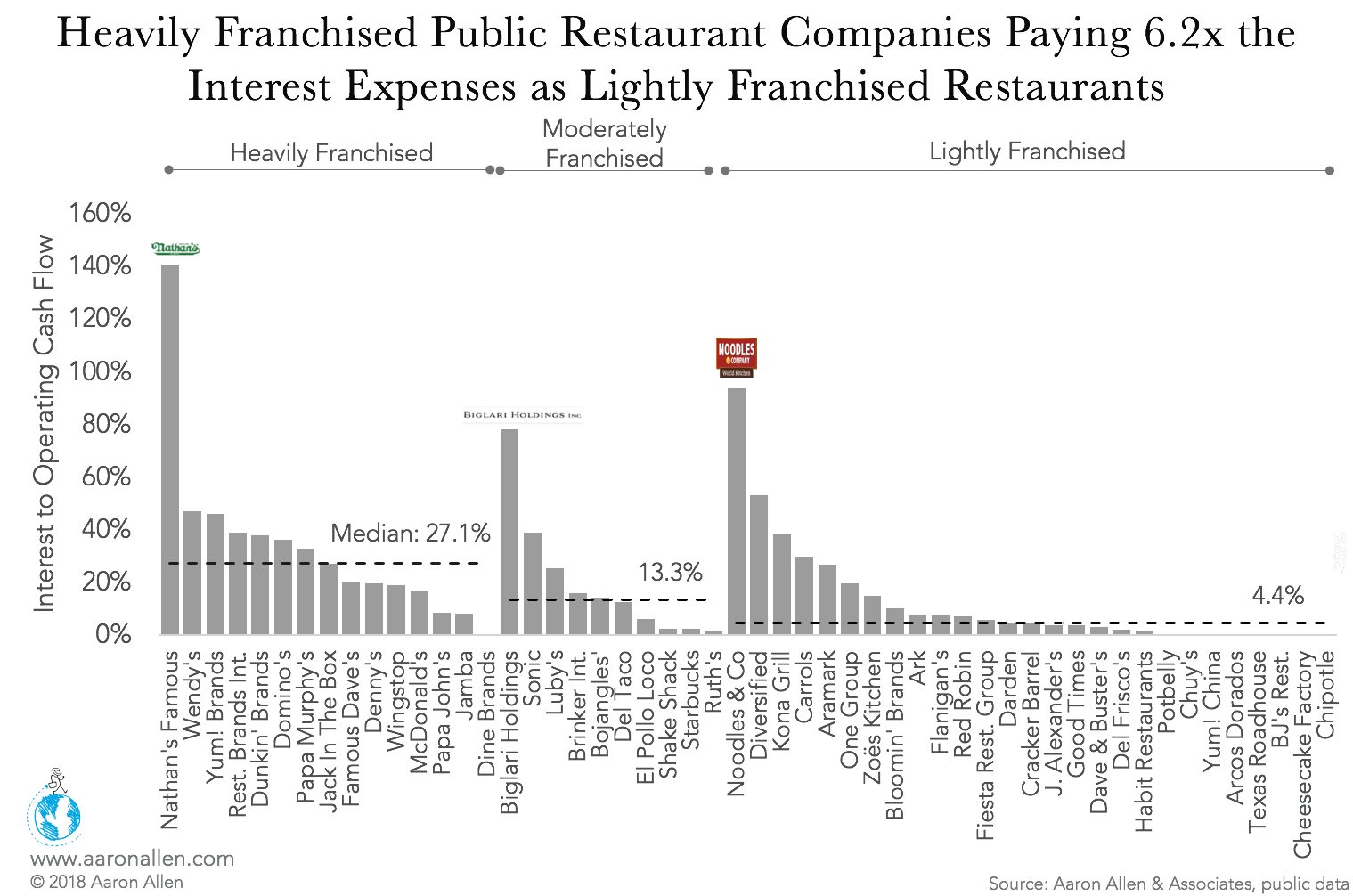

Financing Dividends and Buybacks with Debt Creating High Interest Burden for Heavily Franchised Chains

Heavily franchised restaurants have the highest median interest-to-operating-cash-flow ratios in the foodservice industry. For each dollar generated in operating cash flow, they incur $0.24 in interest expenses: 6.2x the median ratio for lightly franchised operations.

Some of the heavily franchised chains have issued additional long-term debt in order to finance special dividends and to boost share buyback initiatives.

For instance, in connection with their strategic transformation plans, Yum! Brands (in the U.S.) increased its indebtedness from about $4b to approximately $10b. The proceeds from this debt were mainly used to return capital to shareholders through stock buybacks and dividends. The ratio of interest expense to operating cash flow for the company is 45.9%.

Wendy’s ratio implies that the company incurred $0.47 in interest expenses for each dollar contributed by the company’s operations. Between 2014 and 2017, the company’s debt-to-equity ratio went up six times, from 0.8x to 4.8x. Considering the recent rise in interest rates, Wendy’s may have loaded its balance sheet with too much debt.

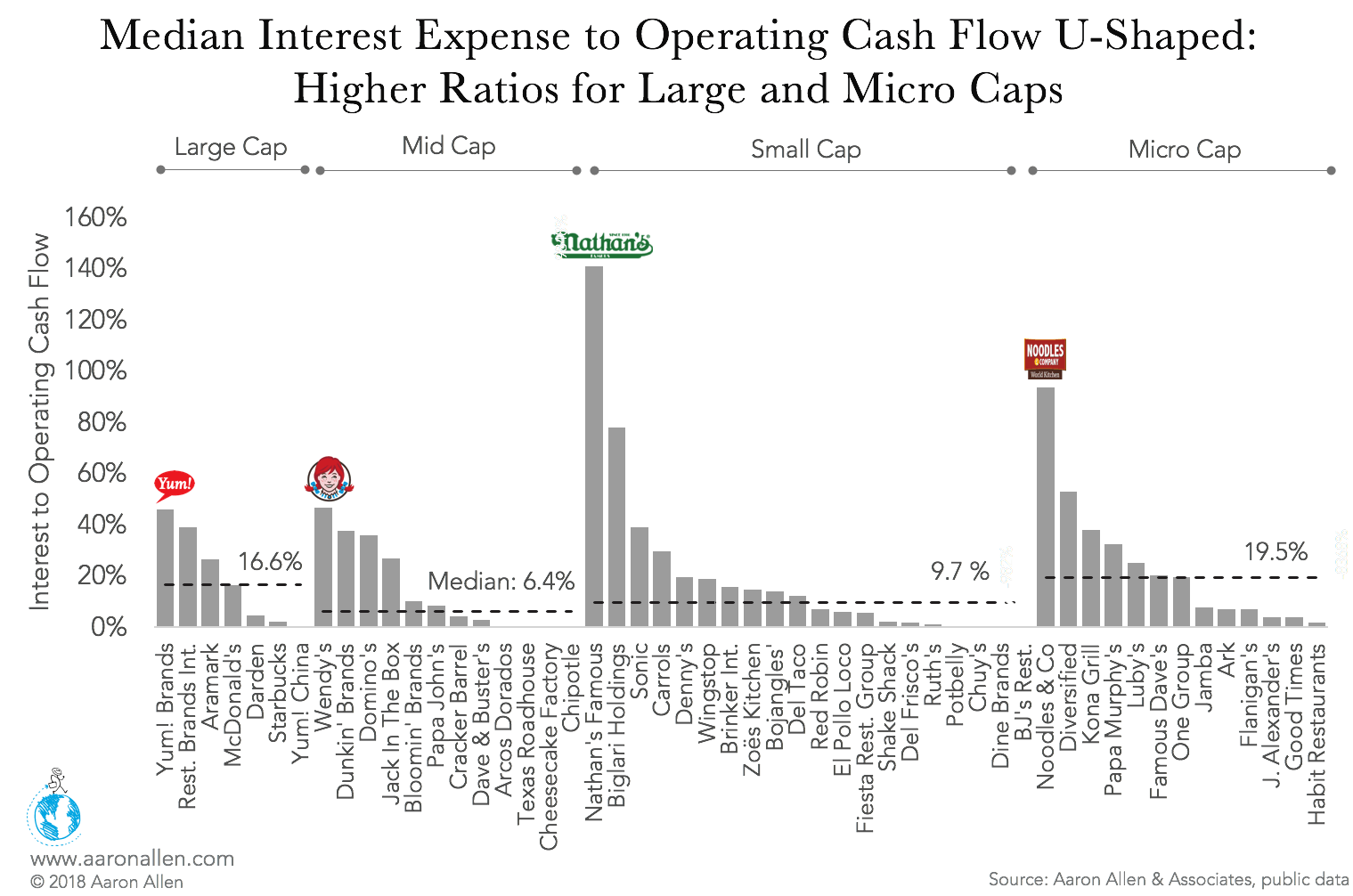

Cheaper Access Allows Large-Cap Restaurant to Take on More Debt

Large-cap restaurant companies have the highest median interest-to-operating-cash-flow ratios in the foodservice industry. They incur a median of $0.17 in interest for each dollar of operating cash flow, 2.6x and 1.7x the median ratios of mid- and small-cap restaurant companies.

Large organizations, including Yum! Brands, McDonald’s, and Starbucks, have cheaper access to outside financing for each dollar borrowed. Based on 2017’s year-end interest expenses and the average debt for 2016 and 2017, we estimate that Starbucks pays 2.5% on its debt, while Yum! pays 5%. In contrast, small-cap companies are paying much higher rates: Carrols pays an estimated 7.8%, and Nathan’s Famous pays 11.2%.

Large-cap operations are also less susceptible to bankruptcy because they tend to be more diversified, with locations across the globe, allowing them to take on more debt. In contrast, small-cap companies have more volatile cash flow streams, which makes servicing debt more challenging.

Right-sizing debt and equity for a company’s strategic goals is an important task, one that can either set an operation up for long-term success or drag it down with ballooning interest payments. In this instance, external advisors with a more comprehensive view of the foodservice landscape, commercial lending benchmarks, trends, and forecasts, and the factors and forces affecting the industry can help executives make the best decision for their company’s future.

About Aaron Allen & Associates

Aaron Allen & Associates works with global foodservice leaders to find, size, and seize opportunities to drive growth, optimize performance, and maximize enterprise value. Collectively, our clients post more than $200b, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands. With specializations in both commercial lending and private equity investments, we help our clients find the most sustainable paths to long-term success.