Human nature is a funny thing. It’s what propels people to fixate on earning points. As kids, we’re rewarded with gold stars — often completing our homework for the reward more than anything else. Not much changes as we grow older — though the gold stars are swapped with points, with people opting to be loyal to one airline, one hotel chain, or one restaurant simply to earn points (even if it means paying more). Enter restaurant loyalty programs, which have long been proven (like similar programs in the airline and hotel industry) to drive sales and create repeat customers.

For a restaurant, the goals of such a program are two-fold: While they offer guest incentives, restaurant loyalty programs also gather information about those guests in the process. The result is value not only for the guest, but for the chain itself. And yet, some of the largest foodservice chains in the world still aren’t on board with loyalty. McDonald’s is reportedly developing a loyalty program, though it hasn’t yet made any formal announcements. Whole Foods is also currently testing a program in select markets, though it isn’t yet widely available.

Those who’ve excelled have done so by ensuring their loyalty program offers something of value to both the company and its customers, and evolving to meet consumer demand. Savvy companies (particularly those that think strategically) are even looking beyond traditional rewards, attempting to solve customer problems and soothe pain points and occasionally even carving out a new niche in the process. Below, we highlight a handful of companies who’ve used loyalty programs successfully, along with some compelling restaurant loyalty stats, for those who still aren’t quite convinced.

At Starbucks, Loyalty Drives Transaction Frequency

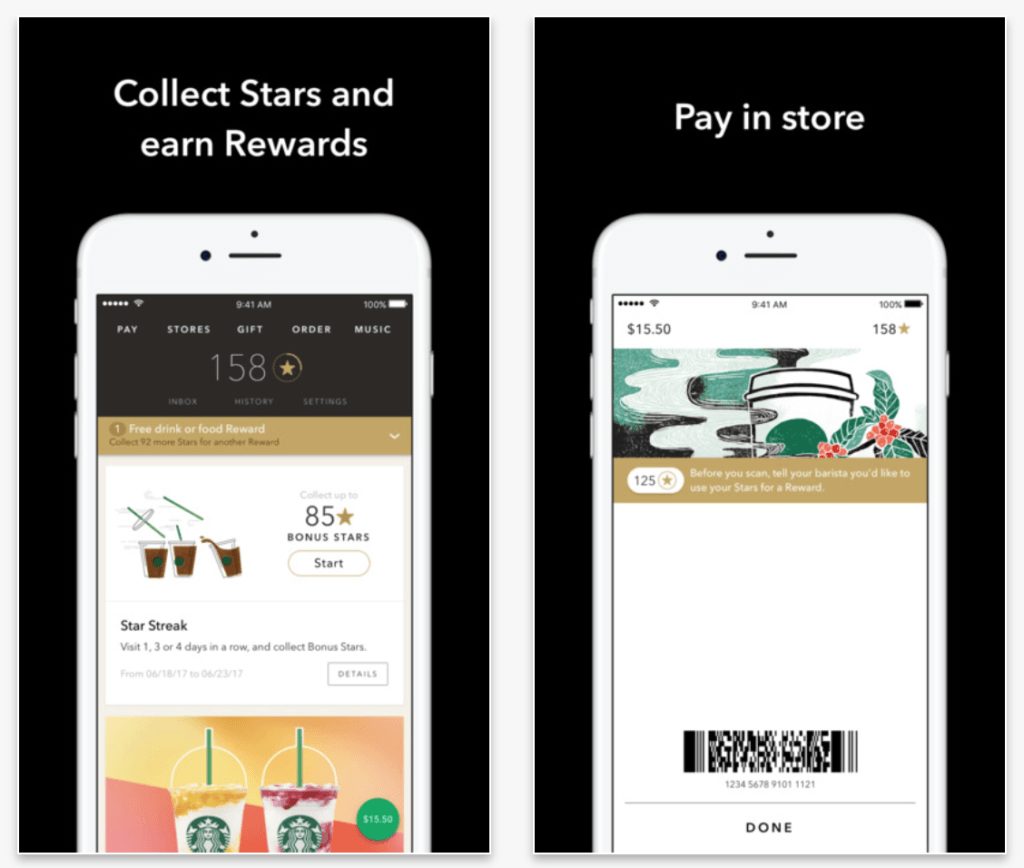

With 12 million members in the U.S. alone, the Starbucks loyalty program is a well-known success story. The coffee giant launched the “My Starbucks Rewards Loyalty Program” in 2010. Comps accelerated shortly after, with the company calling the program “an overwhelming success” that drove both transaction frequency and average ticket size.

It’s evolved in the years since, most notably to include a digital ordering component known as Mobile Order & Pay (offered only to loyalty members). Loyalty programs have demonstrated the most effectiveness when integrated into digital payment and ordering — which reinforces ease of use — and Starbucks is no exception. In 2016, it was reported that the company’s loyalty program held more money than some banks, with $1.2 billion in customer funds loaded onto plastic and mobile Starbucks cards as of the first quarter of the year. According to company filings, that number is now over $2 billion and has more than doubled in just two years (data shows the chain saw $621 million in funds loaded to the program in 2014).

Success hasn’t come without some blowback, however. The increased use of mobile-order-and-pay has caused friction between the chain and its employees, who argue Starbucks stores are not equipped to handle the increased volume brought on by the popularity of the loyalty program and its mobile order option, which has led to congestion in pick-up areas. Though mobile transactions spiked throughout U.S. stores in the most recent quarter, with 1,200 locations experiencing a 20% jump in mobile transactions, the increase in volume caused some customers to leave without making purchases. Starbucks is now aiming to address that with a revamp of its store designs and is currently testing a dedicated mobile order and pay-only store at its Seattle headquarters.

By the numbers:

• 13 million+ members (roughly 18 times the population of Seattle)

• Membership has grown 11% in the past year

• Transactions made using the loyalty program represented 36% of U.S. company-operated sales in the second quarter of 2017, according to company filings

• Starbucks loyalty members’ average ticket size is three times that of the average customer

25 Million Members Are Enrolled in Panera’s Loyalty Program

Since launching rewards program My Panera in 2012, the chain now touts the largest such program in the industry, at 25 million members. Currently, half of all transactions come via the program, which relies heavily on an investment in technology and operations.

Panera recently reported digital sales of more than $1 billion annually made via mobile, web or kiosk — a number projected to double in 2019. President Blaine Hurst has said that the success lies in the chain’s blend of digital innovation and “operational integrity,” which ultimately “translates to the kinds of sales we’re seeing today.”

By the numbers:

• More than 25 million members (which would equate to nearly 8% of the U.S. population)

• As of Q1 2017, sales from mobile, web, and kiosks represented 26% of total company sales

The Palm Rewards Diners in True High-End Fashion

Like most restaurant loyalty programs, The Palm’s 837 Club rewards guests who return to the restaurant again and again. The difference, however, is that diners must pay to participate — a one-time fee of $25. The points redeemed, however, generate higher rewards than at other chains.

As it’s a fine-dining restaurant, users can redeem points for everything from complimentary desserts to weekend getaways, and receive invites to members-only events. In the twenty years since it was launched, the program has evolved, to offer more exclusive rewards and promotions for continued patronage. But despite the continual changes, the club remains in line with The Palm’s brand. As a high-end steakhouse, it makes sense that regulars would be treated to things like three-pound lobsters on their birthday or gift cards to Tiffany.

Subway Evolves Beyond the Punch Card to Address Sales Slump

Gone are the days of the “Buy Ten Subs, Get One Free” punch card. Subway’s loyalty program has evolved considerably over the years. The Subcard eventually became a Subcard app, complete with geotargeted promotions as well as custom sandwich-builder and calorie calculator features. And it isn’t just for U.S. diners. Subcard holders can also earn their way to free food with every purchase at Subway stores across UK and Ireland. In 2015, the sandwich chain began testing a link between its loyalty program and access to in-store Wi-Fi, offering customers in some Canadian Subway locations a free sandwich if they logged into the in-store Wi-Fi network.

Recently, the chain’s been looking to its app (and technology in general) to correct a sales slump. In January, Subway announced it would be introducing touch-screen ordering kiosks and a new mobile app (a bid to catch up with rivals like Panera) and, in a move straight from the Starbucks playbook, said it was also moving away from its five-decade-old format, by testing dedicated pickup areas for mobile orders. A newly revamped mobile app, introduced earlier this year, now includes a sandwich-customizing feature and is available in roughly 26,000 of the chain’s 27,000 U.S. stores.

By the numbers:

• The chain’s app garnered top place among quick-serve restaurant loyalty programs

• “Very satisfied” rating for the program rose 31% between 2014 and 2015

Dunkin’ Donuts Saw Ticket Size Increase as a Result of Its Rewards

The DD Perks Rewards Program was launched in January 2014 as a way to reward guests with points toward free beverages for every visit they make. Three years later, the program now touts more than six million members nationwide. The use of the rewards program, and the chain’s continued emphasis on digital, appears to be leading to larger ticket sizes.

In the second quarter of 2016, Dunkin’ Donuts posted 0.5% growth in US same-store sales. Sales were down from 2.8% a year prior, but there was a bright side: though it saw decreased traffic, the chain noted rising average ticket size was driving same-store sales. Loyalty programs have been shown to increase a customer’s lifetime value by 30% or more through increased visit frequency and spend per visit.

By the numbers:

• More than 6 million members

• On-the-Go ordering (offered only to loyalty members) was close to 2% of total sales during the first quarter of 2017

Chipotle Went from 0 to 3.1 Million Loyalty Members in 3 Months

Chipotle’s loyalty program was largely a move to get the chain on the right track after a widely reported food safety scandal. Many decried the sudden rollout of a rewards program which was launched quickly, only lasted three months, and didn’t appear to make any dent in terms of customer perception. But the program did provide some value to the chain, however short-lived it may have been.

The three-month “Chiptopia” program launched July 1, 2016. By the end of that month, the program already had more than 3.6 million participants and accounted for 30% of all transactions. At the end of the program, Chipotle said it had more than 3.1 million customers register and use their Chiptopia cards, with 85,000 participants visiting at least 11 times each month over the three months. Whether it won back lost customers, however, remains to be seen.

By the numbers:

• More than 3.1 million members in three months

• Chiptopia accounted for 30% of all transactions within its first month

The Restaurant Loyalty Program Space Continues to Grow

There’s already an incredible amount of funding flowing into the loyalty space. MOGL, an online cash back service for dining at affiliated restaurants, has at least $44.94 million as a result of four rounds of funding from investors like Avalon Ventures and Sigma Partners. POS loyalty platform FiveStars underwent a $50 million funding round in 2016. LevelUp, a mobile payment platform that lets users accept mobile payments and engage with customers through loyalty programs, has an estimated $98 million in funding under its belt. Belly, which aims to “help businesses enhance digital connections to strengthen customer loyalty,” has $25.6 million. There are a slew of other companies in the restaurant loyalty space, too: Thanx, Perkville, Dealyze, Brink, and Paytronix among them.

As more loyalty providers enter the space (and, as chains begin to measure the success of their own programs), the programs will gain effectiveness. So, not only are loyalty programs impacting the restaurant industry currently — the way they do so will continue to evolve.

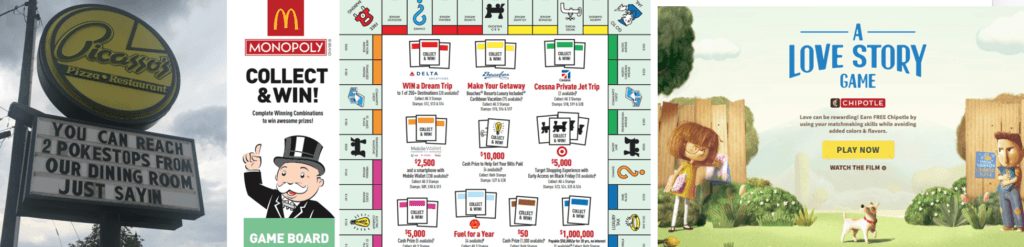

Already, many chains are incorporating gamification into their programs — offering rewards to those who complete a quiz or play a game (and collecting customer data in the process). While it might seem like a blip on the radar, games have eclipsed some of the largest social media sites in terms of daily users. Remember the Pokémon Go craze? At its height, the game surpassed Twitter in daily active users and eclipsed Facebook in engagement.

Restaurant Loyalty Programs Offer the Most Value to Those Who Think Strategically

Rewards drive the majority of the population — parting with our hard-earned money isn’t always easy, but getting rewarded for it lessens the blow. And, as it turns out, generally leads us to spend more. According to a 2016 report, 66% of consumers modify the amount they spend to maximize points — buying more and spending more than non-loyalty members (and resulting in a 5% – 10% revenue increase, on average).

The typical household owned an average of 13 loyalty cards in 2016, but the majority of these cards was inactive, highlighting the importance of ensuring a program is a strong fit for the chain.

As restaurants look to gain a competitive advantage, loyalty programs will continue to greatly expand. But chains can’t expect to launch a loyalty program and immediately see their revenue increase. While the benefits vary among each business, those who roll them out without a proper amount of strategic planning or foresight won’t reap the same benefits. Those who undertake the analysis required to launch such an important project will reap the largest rewards. The secret sauce will lie not just in increasing sales in the short-term, but in better understanding what a chain’s ideal customer looks like: when they come in, what they buy, and how much they spend.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.