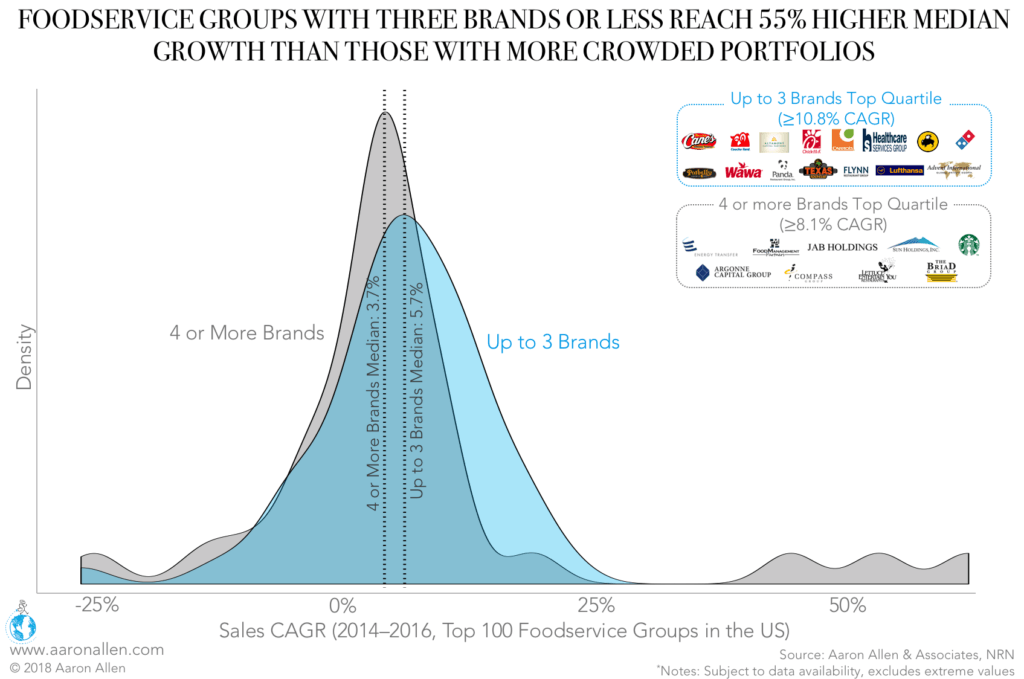

One of the easiest ways for foodservice groups to increase revenue is to make new acquisitions, but our analysis shows that restaurant portfolios with fewer than four brands tend to reach higher total sales growth than those with four or more.

Data for the top 100 foodservice groups in the US shows that those with up to three brands have a median sales CAGR 55% greater than what groups with four or more brands achieve. Similar differences appear in every quartile of the distribution.

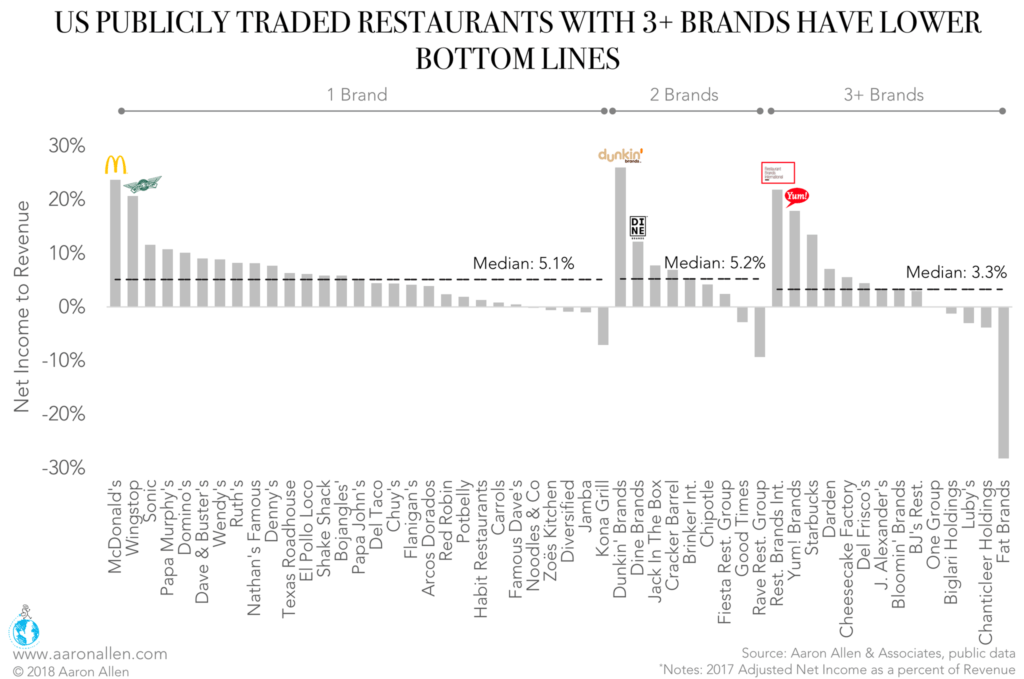

These large restaurant portfolios face challenges that single- or double-brand companies don’t seem to have. For one, companies with three or more brands tend to have lower bottom lines.

Net income to revenue for restaurant portfolios in this segment reached a median 3.3% in 2017. Publicly traded companies with fewer brands had median bottom lines more than 50% higher at a median of 5.1%. SG&A and other expenses seem to be adding up significantly as the number of brands in the portfolio increases.

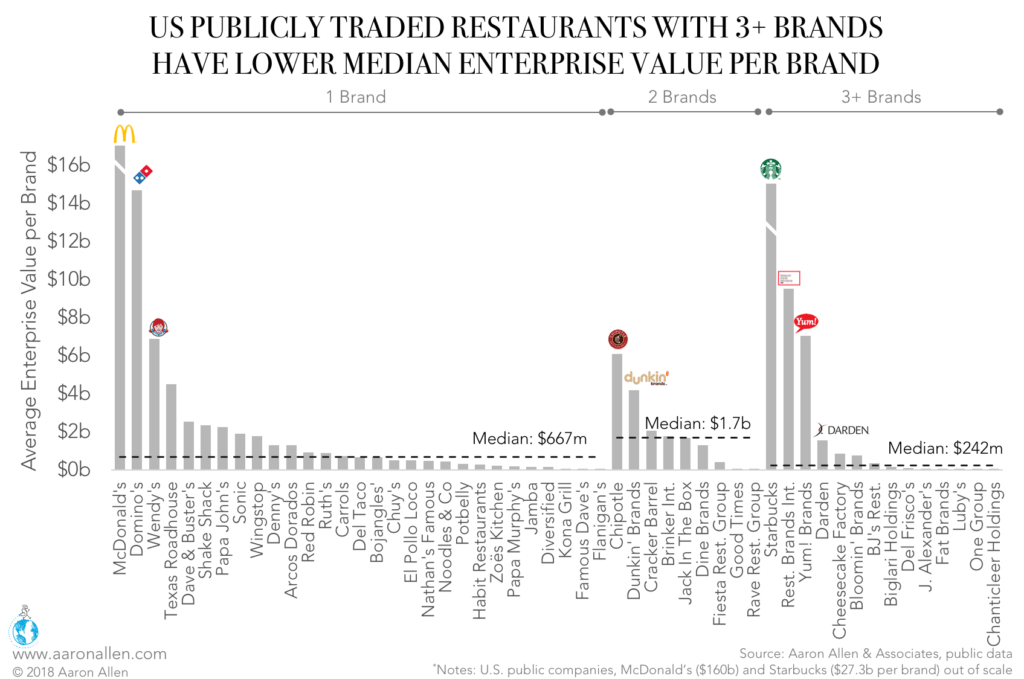

Further, the greater number of brands seems to be stretching out management and shared resources, lowering the potential value of individual concepts within the group.

Publicly traded companies in the US with three or more brands have a median enterprise value per brand of $242m, 86% lower than that attained by companies with two brands, and 64% lower than those with a single brand in their portfolio.

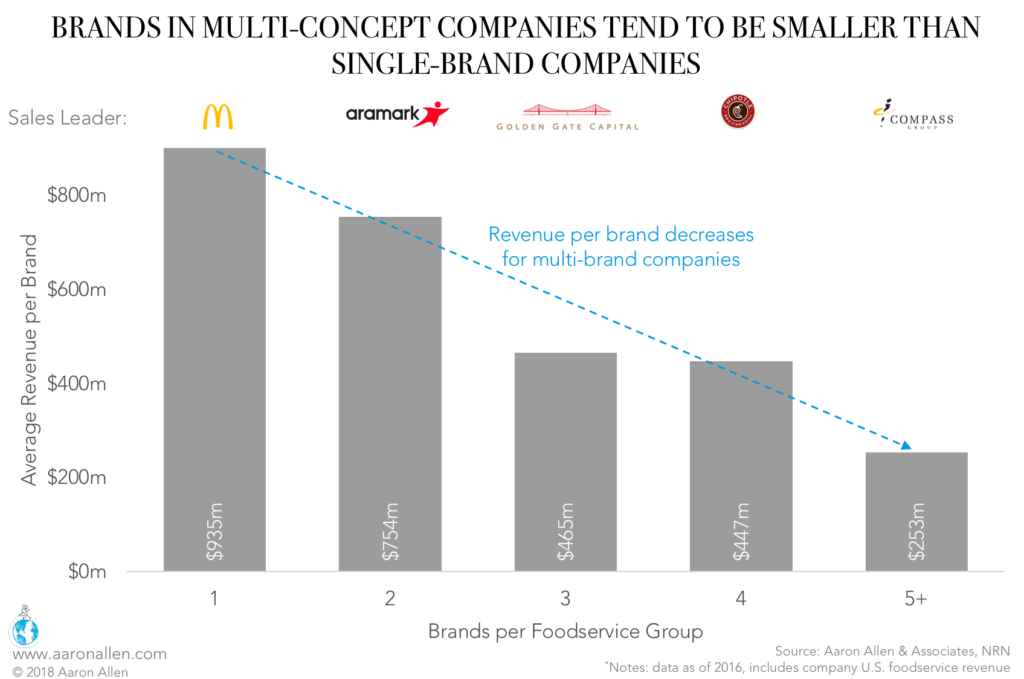

We found the same underdevelopment when we looked at average revenue per brand.

Among the top 100 foodservice groups in the US, the average revenue for brands from single-brand companies was $935m in 2016, while individual brands in companies managing five or more concepts would only bring 27% as much per brand.

There are, of course, outliers. Starbucks, along with other larger restaurant portfolios like Energy Transfer Equity, Food Management Partners, JAB Holdings, and Sun Holdings, had greater than +8.1% CAGR between 2014 and 2016. And, some large-cap operations have multiple brands and a large average EV per brand: Starbucks (again), Restaurant Brands International (RBI), and Yum! Brands. Those same three organizations also have higher profitability.

Though every case is different, it seems likely that underperforming brands are taking time and resources away from their higher-performing counterparts, as CEOs, CFOs, and CMOs must devote energy to each concept in the group’s portfolio.

With a lower number of brands, not only can the executive team focus on properly developing the concept, but they also aren’t required to track sales, growth, revenue, loss, turnover, and other KPIs across different brands, cuisines, and segments.

As a result, multi-brand portfolios appear to struggle to deliver year-over-year growth, and many of their brands cannot develop to their fullest potential. Our data supports the notion that more focused portfolios are better able to deliver strong returns on both a brand level and as a group.

That said, we wouldn’t encourage multi-brand organizations to immediately divest based on this analysis. Rather, this information highlights the importance of gaining an integrated view of how brands in a portfolio fit together.

Is the portfolio diversified? Does each brand cover a specific segment or geography? Is there strong differentiation between the concepts? Are there emerging trends or markets that will change this balance?

With these questions at the center of a portfolio optimization process, foodservice groups can ensure that they are building sustainable growth — rather than just collecting stamps.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy that partners with foodservice companies and private equity firms perform portfolio assessments, acquire new brands, and divest current holdings. With experience on both the buy- and sell-sides of transactions, we have a robust understanding of trends and factors impacting restaurant chains and private equity funds around the world. We help protect, enhance, and unlock value throughout every phase of the investment lifecycle. Collectively, our clients post more than $100 billion in annual sales, span all 6 inhabited continents and 100+ countries, with tens of thousands of locations.