Originally Published in the Aaron Allen & Associates Newsletter on 07/08/2024

The Saudi HORECA Industry Is Struggling with Growth…

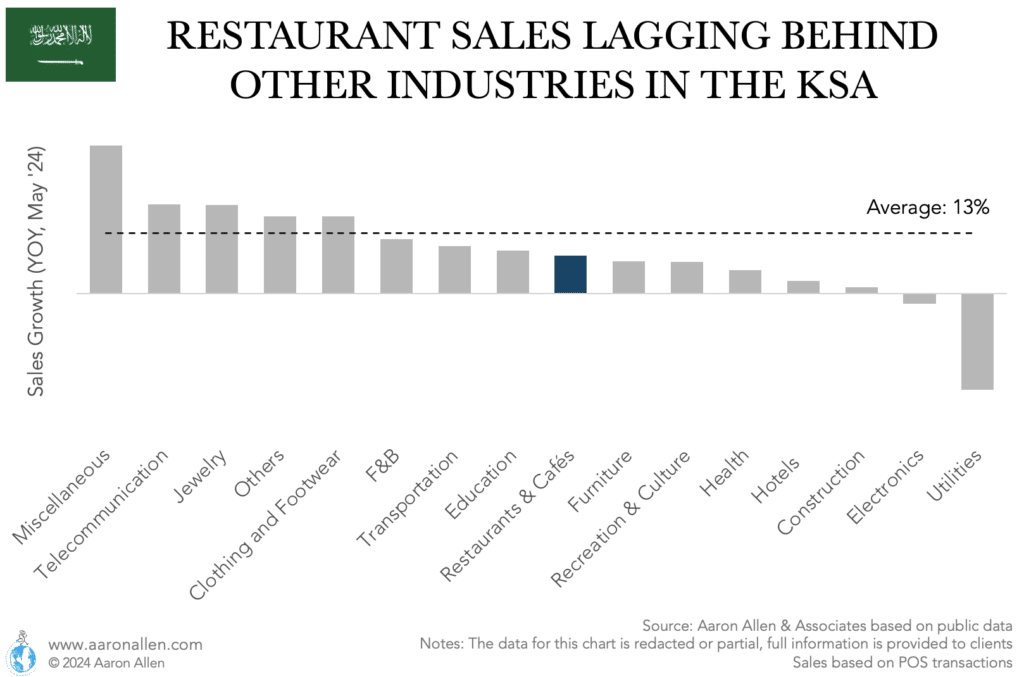

Restaurant and Hotels sales (two segments of “HORECA” — Hotels, Restaurants, and Catering) are lagging behind other industries in the KSA in the last year (taking May 2024 vs May 2023 and based on POS transactions). While, on average, sales have grown by 13% across industries, Restaurants & Cafés have been growing below-average, and were surpassed by indirect competitors such as Food and Beverage at Home.

Weakening sales and falling margins can shake confidence. To cope, many organizations across Saudi Arabia and the Middle East are hiking prices, shrinking portion sizes, and putting off necessary repairs and investments. The percentage of revenue that would typically be allocated for marketing and maintenance is instead used to prop up the falling rate of profit. These developments testify to the incredible uncertainty and caution in the air.

While the challenges facing the foodservice industry in the GCC are more complex than regional operators have had to deal with in the past, the right strategies can put them on the path for long-term, sustainable growth.

…And Competition is Fiercer — Specially in Fast Growth Pockets…

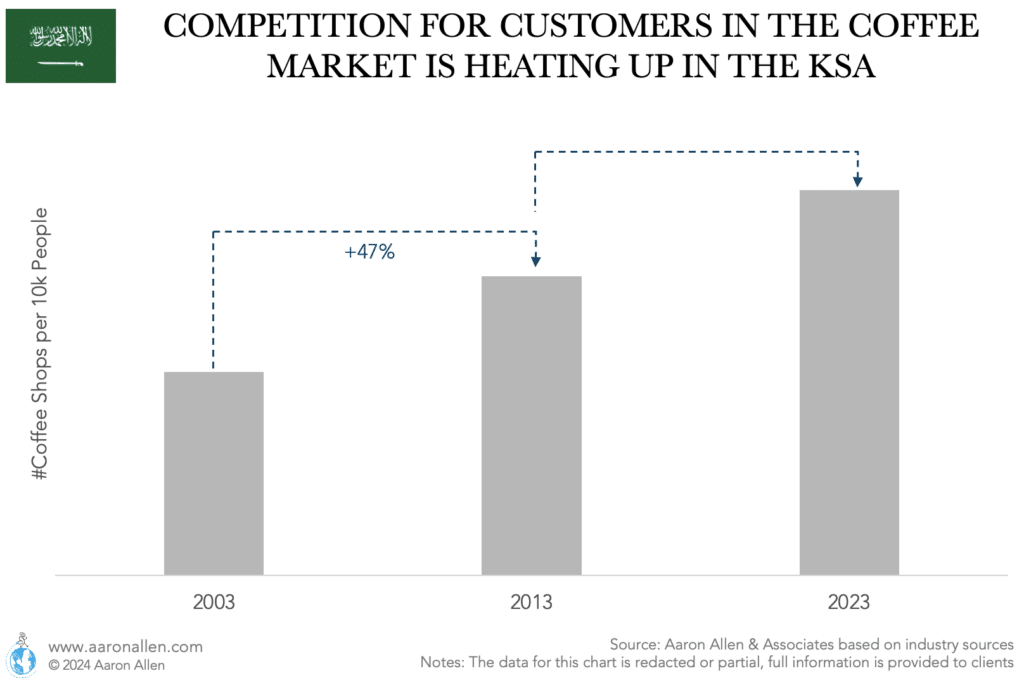

With Saudi Arabia’s youth turning to coffee shops more often as a socialization place and an increase in consumption (and in production), Arabic coffee is on the rise.

And even though the market has grown, over the last twenty years the expansion of local and international coffee shops has been faster than population growth, increasing the competitiveness of the industry and the fight for share of stomach. It can be seen in our data measuring the number of coffee shops for every 10 thousand people. The metric jumped by 47% from 2003-2013 and then by another good amount over the last ten years.

There are opportunities across segments, from chains to specialty to CPG. Consolidation and platforms play will be part of the MENA industry over the next several years, and the importance of quantifying the landscape and competitive threats, diligence, and thoroughly vetted value creation plans can not be overstated.

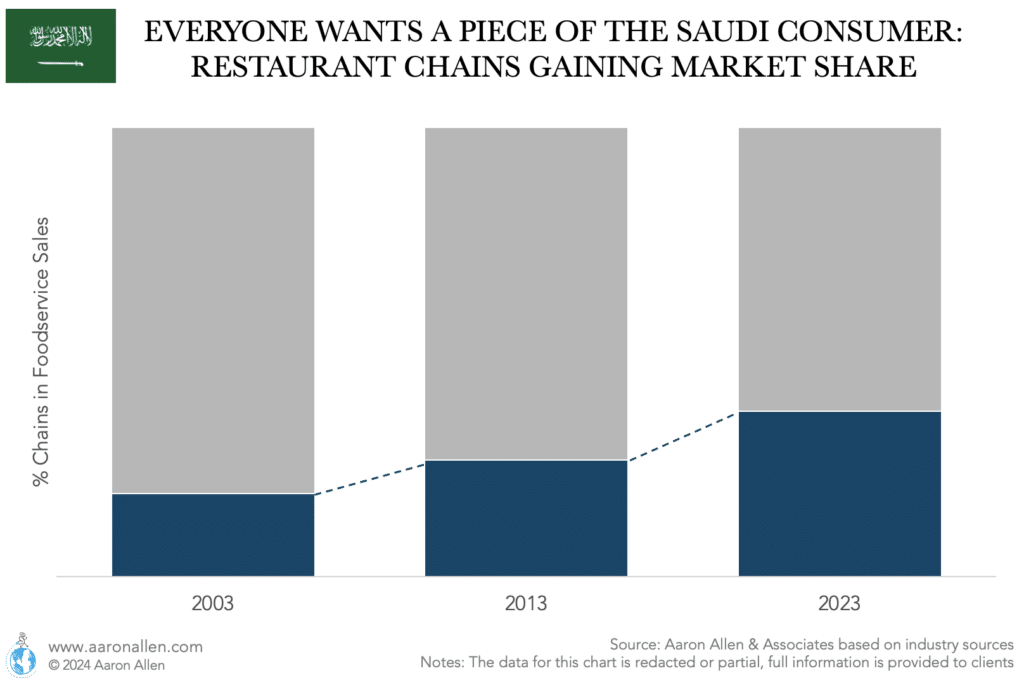

…But It Can Be Done, and There Are Many Winners: Chains Continue to Gain Market Share

Over the last decades, the restaurant industry has been very successful in the KSA (and in the Middle East in general). There’s been a diversification across growing segments, and also an increment in the sophistication level of operators as the penetration of chains has doubled over the last twenty years.

If the brand is local there may be a struggle to set up SOPs, bring systems up to global standards, and gain traction for brand recognition. If the brand is international, there will be challenges to manage regional supply chains, achieve a successful brand translation, adapt marketing and technology, comply with customs and labor laws, and resonate with regional cultures and audiences.

The hospitality business is complex, margins are shrinking, and customer loyalty is a struggle as it never was. But there’s also plenty of opportunity and paths to successfully operate in this ”new normal”.

Join Nearly 300k Global Restaurant Industry Executives and Investors

The Aaron Allen & Associates newsletter is one of the most anticipated weekly reads for those in the know. We cover what’s shaping markets, evolving consumer trends and dining behaviors, and solid strategies for understanding and thriving in the future of foodservice.