Originally published in the Aaron Allen & Associates newsletter on 02/19/2024.

The Power of Long-Term Thinking

Questions like “What’s next?” and “Where should we go from here?” arise a lot with our clients, especially for family-owned middle-market restaurant chains. It’s often the case that the CEO is so pressed with the day-to-day that it’s impossible to find the time to put everything on hold and work on defining (and documenting) what’s the vision for where the company should go, honoring the brand’s heritage and history while adding significant economic value across the portfolio of restaurants.

You cannot enact actual growth plans if you have to focus on quarterly returns rather than multi-year plans. We encourage our clients to think and plan on both time frames: short-term wins are necessary to gain momentum and fund longer-term initiatives, but lasting organizations that transform the industry look past the next few months to three-, five-, and ten-year horizons — and beyond.

Whether you are thinking of acquiring your way to growth, deploying capital to create a unique customer experience, growing in new markets (or with new products or with new formats), setting up the organizational chart and infrastructure to grow, or process and margin optimization, we can help.

It’s Always Possible to Outperform Your Peers

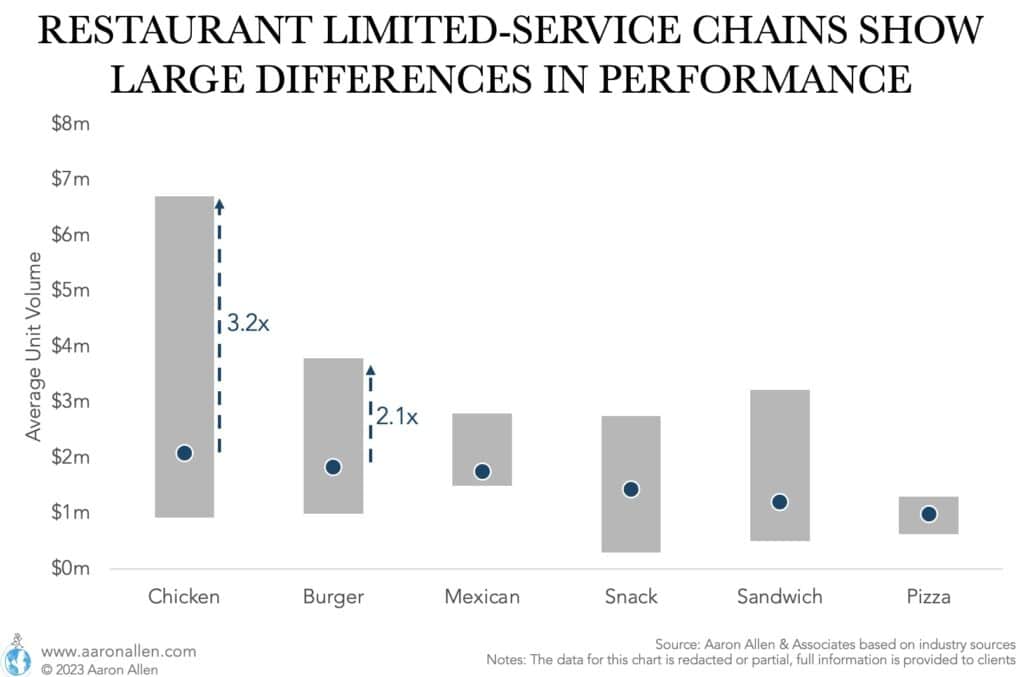

While there are some restaurant categories that are growing fast and others that are shrinking steadily, it’s always possible to find chains outperforming their peers. When comparing Average Unit Volumes, the leading chicken chain sells more than three times the median category performance, and the leading burger chain sells twice as much as the category’s median. Similar situations repeat in Mexican, Snacks, and Sandwich. Pizza is the category where is the hardest to stand out.

From the guest experience to throughput, the share of off-premise, branding, marketing, and technology, multiple factors play into sales volumes. As we start 2024, it’s a good time to decide where to double down and where to back away.

Buying the Competition? Choose Your Targets Wisely

In the post-pandemic era, there have been several high-profile foodservice M&A transactions globally. Here we round up some of those deals. We are seeing a lot of activity in the limited-service segment with record deals such as Subway, Firehouse Subs, and Carrols. There have also been record deals among food delivery aggregators, including Finland-based Wolt (Doordash) and India-based Blinkit (Zomato). For full-service, the highest enterprise value deals have been in the higher-end prices (steakhouses or fine dining).

Restaurant mergers and acquisitions have been much a topic of conversation in the last couple of years, but we’ve been studying (and working with buy- and sell-side teams on diligence, value-creation plans, portfolio rationalization and more) for close to ten years.

There is a spectrum of opportunities for restaurant acquisitions available for operators and investors alike. Consolidation is creating stronger players among those that know how to choose and diligence their targets.

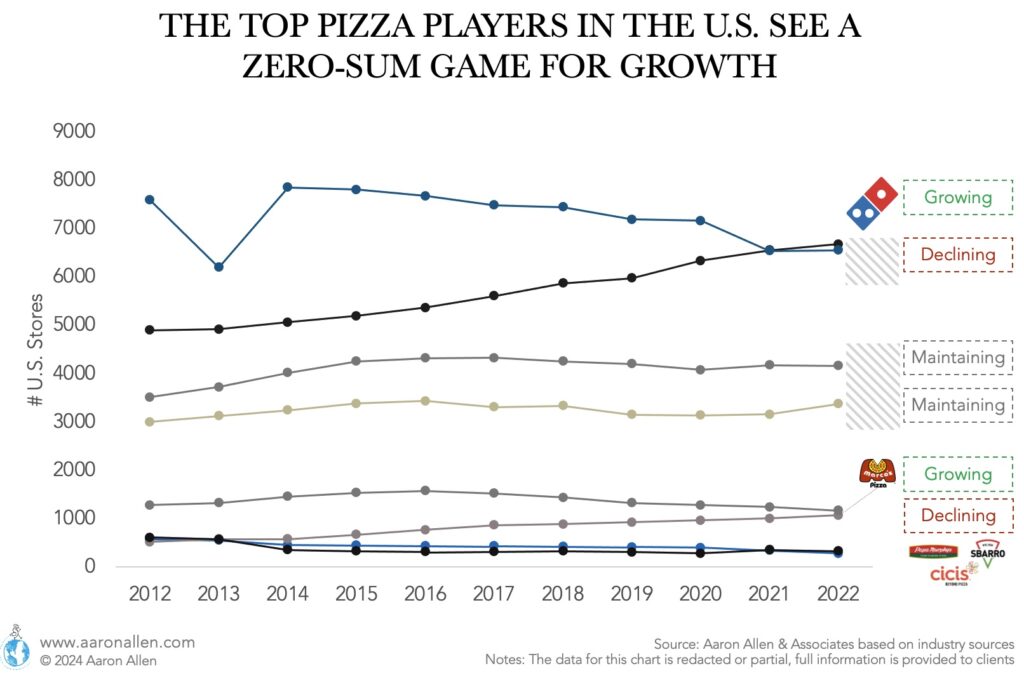

Is the Pizza Industry Saturated? Growing Players Are Taking Market Share from Someone Else

Is the pizza industry saturated? Even though the number of pizza restaurants for the leading chains in the U.S. has seen little growth over the last ten years, there have been a couple of players growing their footprints: Domino’s and Marco’s Pizza have been in the lead for growth.

Whether you’re looking to define growth markets or why some locations are underperforming, deep-dive geospatial analysis can be a key differentiator to support the roadmap, reduce risk, and help support a step-by-step growth plan.

Join Nearly 300k Global Restaurant Industry Executives and Investors

The Aaron Allen & Associates newsletter is one of the most anticipated weekly reads for those in the know. We cover what’s shaping markets, evolving consumer trends and dining behaviors, and solid strategies for understanding and thriving in the future of foodservice.