Ten years after the global financial crisis, America’s restaurant companies continue to sit on large sums of cash. In the U.S., companies have allocated $5.1 trillion to buybacks from 2008–2018, with 2018 being a record year for stock repurchases (authorizations reached $1.1 trillion, with some of those announcements being for multi-year programs).

Restaurant chains with capital reserves this large have a few options: they can buy back shares, boost dividend payouts to investors, or launch capital expenditure (CAPEX) initiatives.

Investors benefit from buybacks as there’s a price appreciation of the stock when the number of shares outstanding is reduced, while companies can see improved financial ratios (EPS, in particular) and advantage from consolidating ownership.

A number of the largest and best-known publicly traded foodservice companies in the U.S. are choosing buybacks and dividend increases over investing in their existing locations, opening new units, or acquiring new concepts. This signals their preference for boosting shareholder returns over investing in long-term projects, which may mean missing out on growth opportunities.

Just How Prevalent Are Stock Buybacks?

Between 2007–2016, S&P 500 companies used 54% of profits on buybacks rather than CAPEX initiatives. In the first half of 2018, buybacks were already surpassing CAPEX investments for the same group. Additional cash availability from tax cuts, with corporate taxes being reduced from 35% to 21% at the end of 2017, also benefitted buybacks recently.

In the U.S., buybacks reached $18b among publicly traded restaurants in 2018 — more than twice the value of CAPEX. Some of the companies with the largest buybacks in comparison to CAPEX were Dunkin’ Brands ($680m in buybacks, $52m in CAPEX), Yum! Brands ($2.4b in buybacks, $234m in CAPEX) and Jack in the Box ($326m in buybacks, $38m in CAPEX).

The median buybacks-to-CAPEX ratio for public restaurants in the U.S. was 1.78x between 2012 and 2017. Dunkin’ Brands leads the group: it has spent 5.6 times as much capital on stock buybacks as it has on CAPEX. At the beginning of 2018, the coffee-and-donut giant entered into an accelerated share buyback agreement with banks including CitiBank and JPM Chase Bank to repurchase an aggregate of $650 million of the company’s shares.

Dine Brands and Jack in the Box had the second and third highest buyback-to-CAPEX ratios, with 4.5x and 3.4x, respectively.

These companies have been accused of prioritizing increasing share price over investing in long-term projects, which is seen as damaging to job and economic growth.

Both strategies create value for shareholders, albeit on different timelines. Investing in assets and initiatives that improve overall productivity grows stock price over time while cutting the number of shares available through buybacks boosts value as soon as the deal is signed. One benefit of the latter strategy is that it avoids the pitfalls for what can be seen as more risky — and irreversible — CAPEX investments.

But this instant-gratification strategy can reduce future growth as much-needed projects, like updated equipment, remodeling plans, or research and development, are put on the back burner in favor of stock buybacks.

Buybacks Are a Global Trend

Companies in other geographies are also allocating capital to buybacks. In France, Sodexo purchased $411 million worth of shares, compared to $392 million in CAPEX investment in 2018. Domino’s in Australia allocated about two times more cash to buybacks than to CAPEX ($142m vs $65m). In the UK, the Ei Group repurchased $8 million of outstanding shares but allocated more than three times that ($28 million) to CAPEX investments.

Since 2012, 11 publicly traded foodservice companies in the U.S. alone have diverted funds from CAPEX while engaging in stock buybacks, essentially acquiring their own shares from stockholders. This process reduces the amount of stock available, consequently boosting prices and earnings-per-share for the remaining shareholders. It also reduces the cost of equity, as the retired shares will no longer earn dividends.

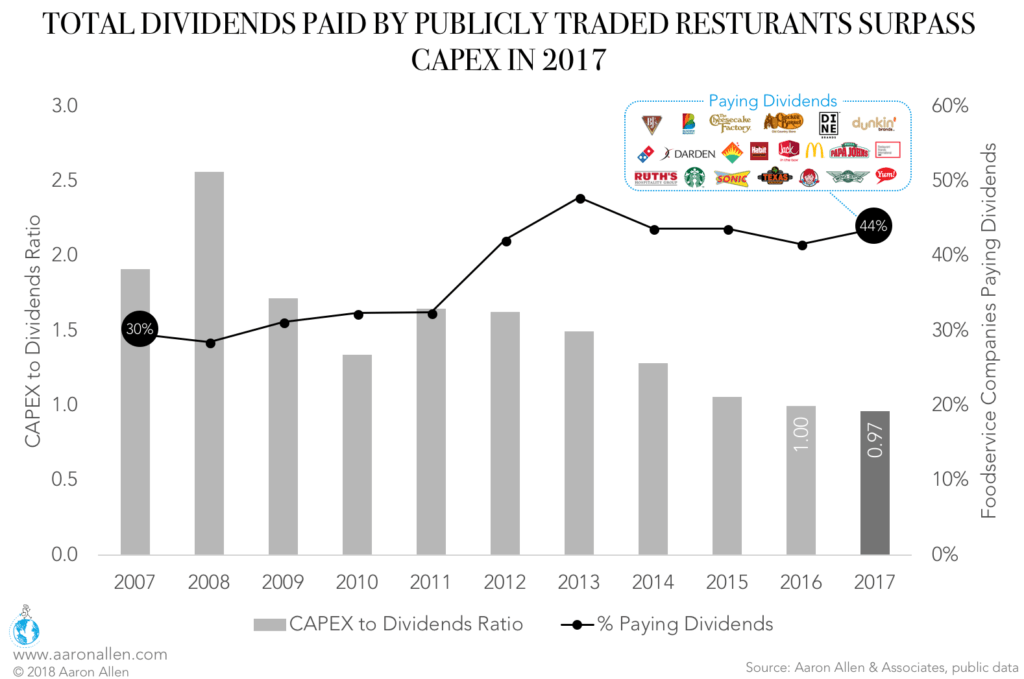

Dividends Overtake CAPEX Investments in 2017

Over this same period, 10 publicly traded foodservice companies have reduced their CAPEX while still paying dividends, with some even increasing the payouts. The majority (70%) of these chains are quick-service restaurants (QSR), and most (60%) are heavily franchised.

In the ratio of average dividends to CAPEX between 2012 and 2017, Dunkin’ Brands doesn’t lead, but it does come second. The median dividends-to-CAPEX ratio for the pack is 0.6x.

Restaurant Brands International and Dunkin’ Donuts have paid out shareholder dividends at 5.7x and 4.2x CAPEX. Both of these operations have 100% franchise-operated units, which explains the decline in capital expenditures: a big portion of CAPEX is absorbed by franchisees.

On average, these 10 companies paid $456m in dividends between 2012 and 2017, led by McDonald’s (which distributed $3.4b against a $2.3b CAPEX spend).

Pleasing current shareholders seems to be a dominant priority for many restaurant companies. Average dividends paid in the restaurant industry have been moving upward since 2007, compared to a downward CAPEX trend. In 2017, total dividends surpassed capital expenditures, and 44% of foodservice companies distributed dividends (up from 30% in 2007).

Like stock buyback programs, a dividend distribution strategy impacts the expected capital growth in the long run. Every time a company pays out a cash dividend, it is sacrificing cash resources that could be reinvested in the firm’s assets and in high-return projects, which would generate long-term positive growth. Therefore, the dividend policy selected by these companies reflects a tradeoff similar to the stock buyback strategy.

In contrast, a number of financially and strategically sound acquisitions and CAPEX investments that boost profitability come with potential long-term gains, which can drive up the stock price over a longer period of time.

Most Publicly Traded Restaurant Companies Still Prioritize CAPEX

It’s true that many publicly traded companies have cut their CAPEX in order to boost their cash dividends and share repurchases over the past decade. But a larger number of foodservice companies has consistently allocated more cash to capital expenditure.

In fact, the median of CAPEX to operating cash flow between 2007 and 2017 is 58.7%, compared to 24% for paid dividends and stock buybacks.

The short-term strategy being pursued by Dunkin’ Brands, RBI, and Dine Brands is seemingly the exception rather than the rule.

That said, buybacks are expected to continue to be popular in 2019, fostered by stock price decreases in Q4 2018 for the market as a whole and restaurants in particular.

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy that collaborates with senior executives of some of the world’s most successful foodservice and hospitality companies to plot their operations’ growth and development. Together, we visualize, plan, and implement innovative ideas for leapfrogging the competition. Our clients post more than $200 billion in sales globally, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.