The Gulf Cooperation Council is facing a set of challenges brought on by sagging oil prices, and the UAE is no exception. Fortunately, financial experts predict non-oil growth in the region will increase some 3% to 3.5% on the back of greater Expo 2020 projects. Below, we’ll take a look at the challenges facing UAE restaurant operators, plus some opportunities on the horizon.

THE BIGGEST CHALLENGE: THE ECONOMY

UAE economic growth is set to rebound, and the region is adjusting well to the realities of a less oil-dependent economy. In May, the International Monetary Fund (IMF) said the UAE’s large financial buffers, diversified economy and the authorities’ robust policy responses will facilitate adjustments while safeguarding the economy and the financial system.

Non-oil growth is projected to rise to 3.3% in 2017, reflecting more gradual fiscal consolidation, stronger global trade, and higher Expo 2020 investment. Oil GDP is projected to decline by 2.9%, a reflection of OPEC cuts in oil production. As a result, overall growth will ease to about 1.3% in 2017, before recovering to above 3% over the medium-term. Average inflation is projected to rise to 2.2% in 2017 (though restaurant prices are unlikely to follow suit).

The Dubai Financial Market Index began 2016 at its lowest levels since the end of 2013, but the index climbed back at the end of 2016, and has remained stable in 2017.

SOME OPERATORS ARE DISCOUNTING IN ORDER TO STAY COMPETITIVE

Food prices (both at home and away from home) have remained mostly stagnant, though we have noticed slight changes.

Since December 2015, Food at Home has grown 0.5% more expensive, while Restaurants & Hotels became 1.5% cheaper. The trend is an indication that restaurant and hotel operators have moved toward discounting in order to differentiate themselves in a crowded market — and lure customers in during a time of poor economic conditions.

RETAIL CONTINUES TO THRIVE

The UAE’s retail sector is expected to grow 25% in square meters in the next three years. This expansion is likely to result in mega malls will thriving, and small malls struggling. Restaurants, in response, will need to balance the need for a high-profile location with the need for affordable rent costs.

The growth of retail is good news for restaurants, as the success of the two industries often goes hand in hand. In fact, some 87% of Abu Dhabi mall shoppers visit a restaurant or café while shopping.

In Abu Dhabi, residential and hotel rents are falling, while rents for retail stores remain stable. In 2018, the opening of the Al Maryah Central Mall will add considerably to the retail space in the region.

TOURISM CONTINUES TO GROW

Dubai ranks fourth globally in terms of number of international overnight visitors and first in terms of spend in the food and beverage sector. The positive affects of tourism haven’t gone unnoticed, though — 138 hotel projects are currently underway in the UAE, with 59 set to open in 2017.

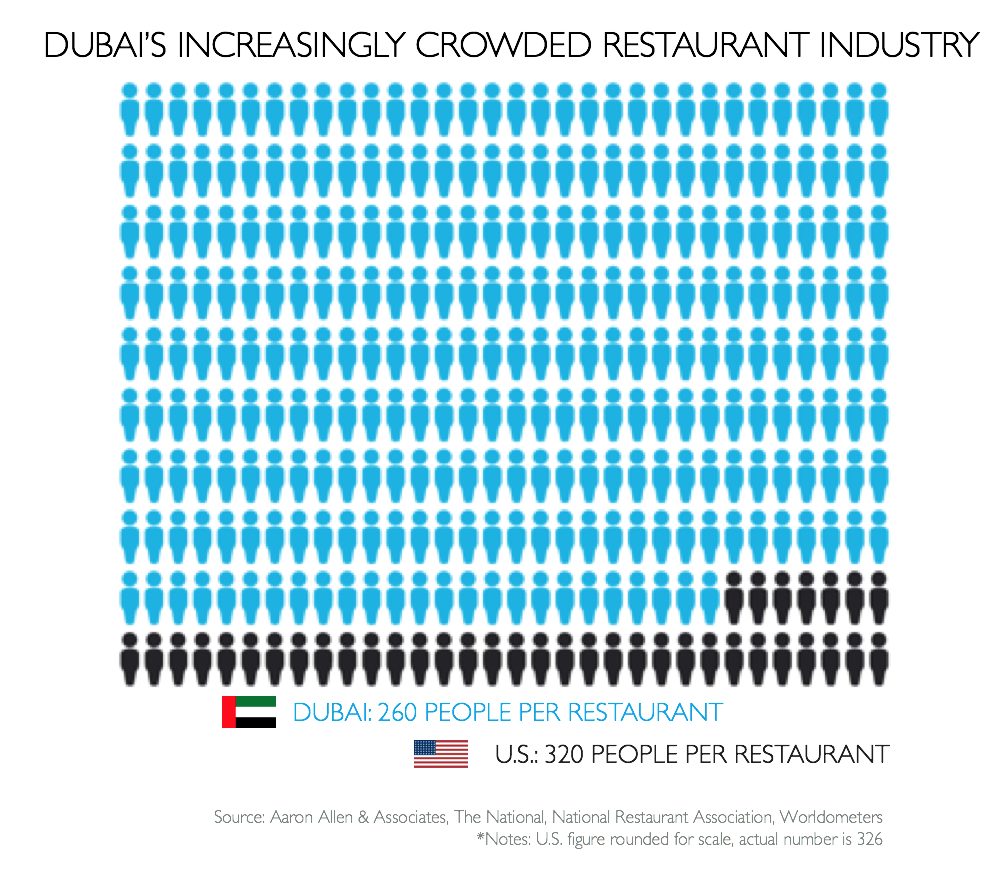

This new crop of hotels will bring with them hundreds of new restaurants — and even more competition in an already crowded market. Dubai sees a rate of four new restaurant openings per day, and has one restaurant for every 260 people (versus 320 people per restaurant in the U.S.).

The bulk of Dubai tourism comes from the GCC, which delivered the highest share of visitor volumes in 2016 with a total of 3.4 million. More than 1.6 million Saudis visited Dubai in 2016. Interestingly, while Dubai has maintained healthy tourism growth, Abu Dhabi has grown twice as much: the number of visitors to Abu Dhabi increased 15% (versus Dubai’s 7.5%) in 2016, according to a MasterCard report. Still, total tourism spend in Abu Dhabi has a long way to go until it can reach the heights of Dubai (where tourists spend $31.3 billion in 2016). Tourism spend was $2.65 in Abu Dhabi, affording the region much room for growth.

THE PRIVATE SECTOR REMAINS STRONG

In March, Dubai’s private sector grew for the thirteenth consecutive month. The growth rate was 12% higher than 2016 Q1.

What’s more is that, in the fourth quarter of 2016, new business licenses recovered in comparison to the number of licenses cancelled.

In 2017, manufacturing reached its highest level since September 2015. Non-oil sectors are expected to drive economic growth in the future.

TECHNOLOGY IS RAPIDLY CHANGING THE REGION

Dubai is among the cities to craft “smart city plans,” which aim to digitize government services and automate traffic light systems. The emirate has announced a goal of becoming one of the smartest cities in the world by 2020, and is utilizing a Dubai Happiness Index to measure residents’ and visitors’ experiences with government services.

Part of that project includes the adoption of a Global Star Ratings Systems for Service, which aims to provide an integrated framework for service delivery and world-class service efficiency, “thus providing an exceptional customer experience and establishing a model for improving services and achieving customer happiness.” Some 7,204 restaurants & cafes are in phase 1 of the adoption of the system, which will motivate restaurants and other hospitality businesses to provide excellent customer service. It should pay off. Studies have found that, for each ratings star added on a Yelp review, businesses saw a 5%-9% effect on revenues.

According to Huawei’s Global Connectivity Index (GCI) 2017, the UAE is already tops in terms of digital connectivity. Digitally-advanced regions nations tend to see stronger economic growth and secure larger ICT investments than less-developed regions.

Investors are certainly intrigued by all things digital in the UAE, where two of the most well-funded tech startups are food companies: Reserveout is a mobile restaurant reservations service and LUNCH:ON caters to the ever-popular food delivery market, allowing users to order lunch for delivery from their phones. With 75% of Emiratis using delivery or take-away services at least once a week, the food tech sector is likely to make even further progress in coming months and years.

The appetite for investment doesn’t appear to be slowing down anytime soon, either. The Middle East’s Venture Capital industry is forecast to be worth $5 billion by 2019 (an enormous jump from $200 million in 2016).

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.