Changing consumer preferences impact every facet of the economy but perhaps none quite so much as restaurants. Urbanization is seeing more consumers move to cities — as a result, restaurants are creating prototypes with smaller footprints and newer ways of dining (grocery delivery, kiosks, etc.) are stealing share from the traditional sit-down models. A move toward healthier eats has made a mark, too — sending same-store sales at fast food chains tumbling as consumers seek out better ways of eating (even trading up when necessary).

Below, we detail a few of the ways in which changing consumer preferences are impacting restaurants.

A Greater Demand for Convenience

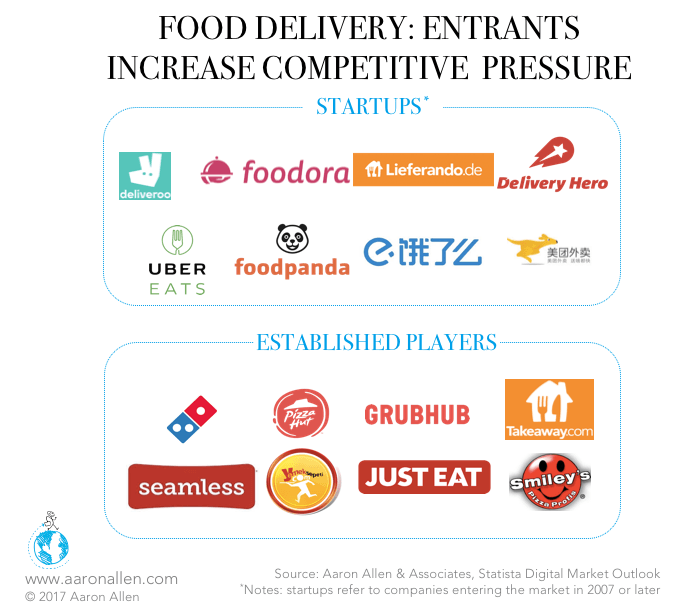

Tech-driven delivery has disrupted the traditional restaurant model, just as grocery delivery is impacting grocers (and restaurant delivery is imapcting restaurants). High-end grocers like Albertson’s and Whole Foods are also offering meals-on-the-go, as well as in-store dining options.

Retailers and grocers alike are increasingly challenging the notion that customers should visit their stores only to fuel up and grab snacks, introducing growler stations, take-and-go meals, and self-service lockers (like USP and Amazon retail outlets). Some convenience stores are even taken a page from the restaurant playbook with the addition of outdoor seating areas, made-to-order sandwiches, and free Wi-Fi or drive-thru windows for convenient pickup. Others are investing in services to drive customers into the store.

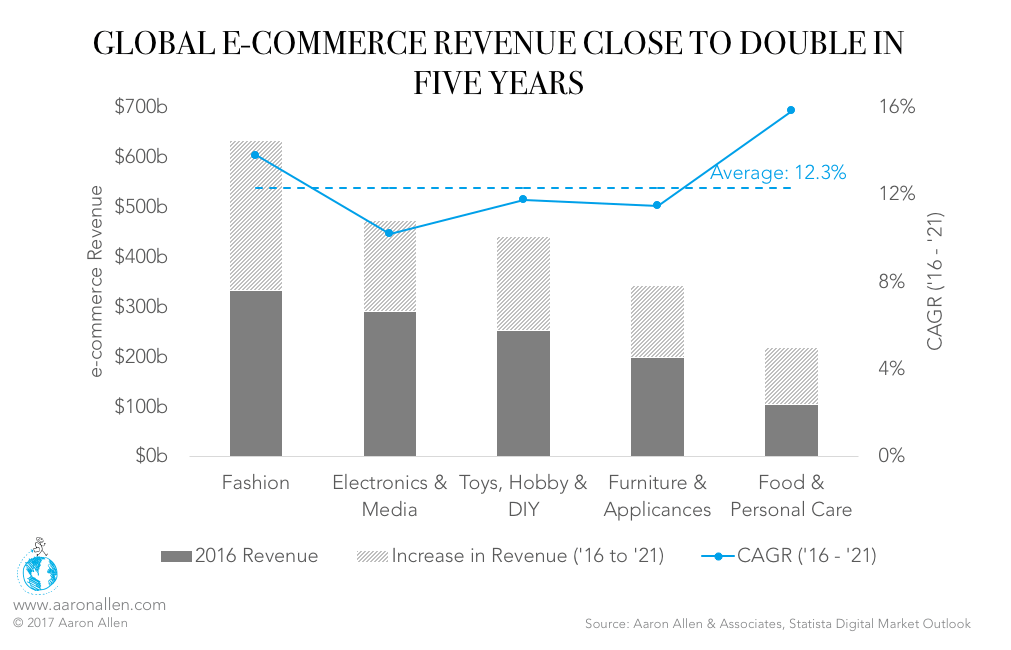

Much of the popularity of convenient options can be attributed to the rise of e-commerce — which continues to grow and impact the restaurant industry. Global e-commerce revenue is expected to grow by 79% between 2016 and 2021 (from $1.2 trillion to $2.1 trillion).

More Discerning Tastes

Consumers in the largest markets in the US are more discerning than ever, and the models which worked during the global recession (lower quality, lower price) are seeing rapidly diminishing returns. Those chains that have adapted quickly and found new paths to growth are reaping the rewards, while those resistant to change have fallen behind.

McDonald’s has struggled with this in the US, seeing same-store sales fall consistently every quarter in 2014 and 2015, as consumers seek out more exciting/higher-quality meals. Even within the fast food category, McDonald’s has lost customers to better burger chains and Chick-fil-A (i.e. better quality food at a similar price point).

The changing consumer preference toward higher quality also means a rise in demand for authenticity, which has impacted everything from magazines (with readers increasingly calling for a ban on photoshopped magazine covers) to food blogs and restaurant marketing (thanks to the rise of social media, consumers crave authentic imagery). In fact, a recent study found that “authenticity” is among the most lucrative words used by sellers on eBay.

As emerging markets mature, and more consumers are able to afford the relative luxury of eating “better” food, the average global consumer is increasingly willing to spend more for a higher quality experience. For chains, a “better” experience helps build the level of trust consumers seek. It certainly seems that better food leads to better sales. After Taco Bell improved its menu with chef-inspired options, the chain grew 6.5% by value in the US and 6.2% globally in 2015, outpacing many of its quick-service competitors.

Opting for Healthier Foods

US Obesity rates are above 20% in every state (as of 2015). The minimum rate was less than half as much (close to 7%) back in 2009.

Faced with numbers like that, consumers are seeking out healthier options. Some 88% of those polled in Nielsen’s 2015 Global Health & Wellness Survey said they are willing to pay more for healthier foods. All demographics—from Generation Z to Baby Boomers–say they would pay more for healthy foods, including those that are GMO-free, have no artificial coloring/flavors and are deemed all natural.

What’s more, wellness has moved beyond a simple fad — today, it’s a status symbol. The modern consumers’ emphasis on health has extended beyond the gym, giving rise to all-new categories (athleisure) and an emphasis on designer workouts and healthy eating habits. Global sales of healthy food products are expected to reach $1 trillion by 2017. Global sales of healthy food products, in fact, are estimated to reach $1 trillion by 2017, according to Euromonitor.

Choosing Cities Over Suburbs

Consumers around the world are forgoing neighborhood communities for areas in which they can live, work, and play all in a smaller vicinity. Euromonitor forecasts that by 2030, 70% of households worldwide will be in urban areas and that the growth in urban households globally is faster than that of total households. Additionally, the organization expect 60.2% of the world’s inhabitants to be urban dwellers by that same year. In other words, there will be an extra 598 million urban households in 2030 compared to 2010.

Urban consumers enjoy higher incomes than their rural counterparts, typically touting higher skills and greater educational levels. Urbanization, therefore, results in greater consumer market gains for restaurants.

The move toward cities, and away from suburbs, has certainly impacted restaurants and will continue to do so. The large, standalone footprint of the Casual Dining Restaurant is fast becoming a relic of the past, one replaced by smaller, fast-casual units and even newer ways of dining — kiosks and street stalls, for instance. Chained street stalls and kiosks saw their strongest performance amongst chained categories last year, increasing by $1.2 billion at an annual rate of 12% (with 90% of this increase coming from the Asia Pacific region).

How Changing Consumer Preferences Will Impact Restaurants in the Future

Though many of these trends are being clearly demonstrated in the US, they are slowly making their way to other markets, as well. The rise of smartphone usage helped spur on the demand for convenience, for instance, and that trend is certainly not relegated to the US.

Cellular services have expanded rapidly across the Middle East and Africa region, for instance, lifting living standards and fueling uptake of broadband services in urban areas. Over 2016-2020, MENA will register the fastest growth in mobile broadband subscribers, according to Euromonitor. Digital transactions are increasing across the region despite the prevalent strong cash culture. The social-media savvy of youth in the Middle East has prompted brands to target consumers with specific language-based tools on social networking sites.

The use of e-commerce will continue to impact the industry in future years. Among the segments to face the most change due to e-commerce are food and personal care, which are forecast to growth the most: 15.8% CAGR – 29% higher than average.

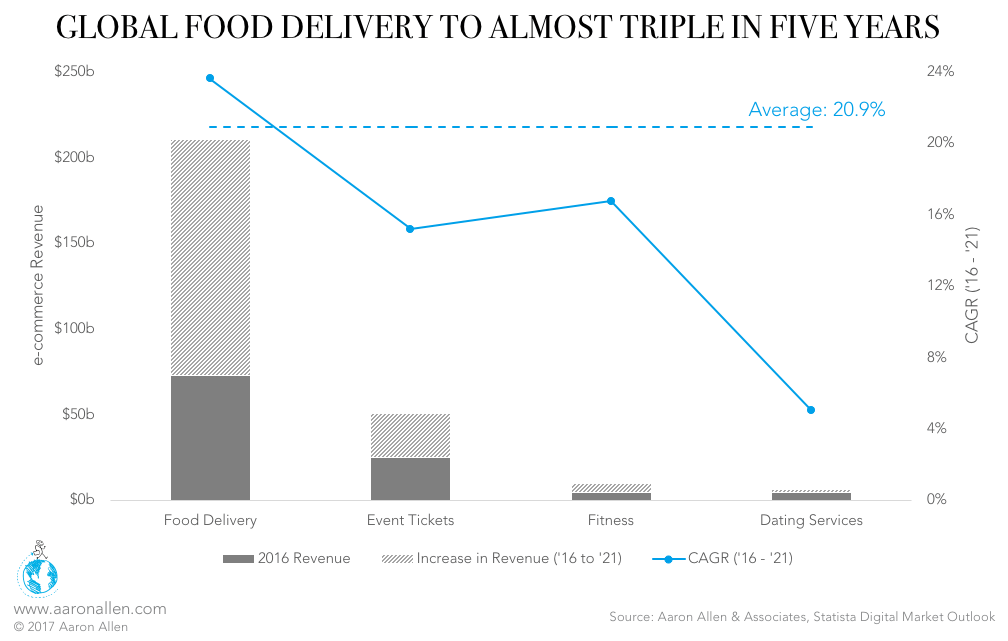

Food delivery is the most dynamic category among e-services, set to grow by 189% between 2016 and 2021 (from $72.9 billion to $210.3 billion).

About Aaron Allen & Associates

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.

Other Relevant Content

Restaurant Debt Ratios

September 21, 2017 No Comments Read More »

2017 Restaurant Mergers and Acquisitions: An Update

September 21, 2017 No Comments Read More »

A Roundup of Restaurant Inventory Management Software

September 18, 2017 No Comments Read More »

U.S. Steakhouse Restaurant Sales: A Bright Spot In the Industry

September 12, 2017 No Comments Read More »