On August 5, 2018, the Saudi Foreign Ministry announced that it would expel the Canadian ambassador from Saudi Arabia, recall its own ambassador from Ottawa, cancel future Saudi Arabia state airline flights to Toronto, withdraw Saudi students and medical patients, and suspend “all new trade and investment transactions”with the nation in response to its interference in the Kingdom’s “internal affairs.” Of note, the Saudi Energy Minister made clear on August 8 that oil, the Kingdom’s economic backbone, would not be impacted by the latest diplomatic row.

At issue was an August 3 tweet from Foreign Policy CAN voicing concern with Saudi Arabia’s arrest of civil and women’s rights activists. The tweet demanded the immediate release of all human rights activists held in Saudi detention facilities. With such a sharp response from the Saudi government, it’s reasonable to wonder about business prospects in the Kingdom.

With headlines like “Saudi Arabia freezes Canada trade ties” circulating, restaurant executives might be wondering if the KSA remains a viable place to do business. Despite this diplomatic disagreement, overall macroeconomic conditions in Saudi Arabia are positive for investors, though select political initiatives risk slowing growth.

Massive Development Projects Create New Space and Demand for Restaurants

Saudi Arabia remains committed to modernizing its economy and attracting new business.

Since 2016, the guiding principal of the Saudi Government’s economic policy has been Vision 2030 — a state-sponsored project aimed at reducing the nation’s dependence on oil through economic diversification.

For the restaurant industry, in the middle of a “new normal”, positive outcomes from Vision 2030 include extensive investment in space for shopping, entertainment, and hospitality.

The country plans to develop entirely new cities for entertainment, business, and tourism, including malls, transit lines, airport expansions, residential developments, and the world’s tallest skyscraper.

Strong Stock Market and Potential IPO Fueling Investment

Other positive indicators include Morgan Stanley Capital International’s (MSCI) June decision to upgrade Saudi Arabia to emerging market status. Meanwhile, the Saudi Tadawul All Share Index (TASI) stock exchange has gained 17% in the first half of 2018, with an additional 20% projected increase by early 2019. The potential Aramco IPO would also help generate significant capital for Saudi investment projects.

Saudi Market Comprised of Young, Tech-Savvy, and Connected Consumers

Saudi Arabia has the largest potential consumer market of the Gulf Cooperation Council (GCC) countries, with a population of 32m accounting for roughly 60% of the GCC. Young people comprise the lion’s share of that population, with 70% of Saudis under the age of 30.

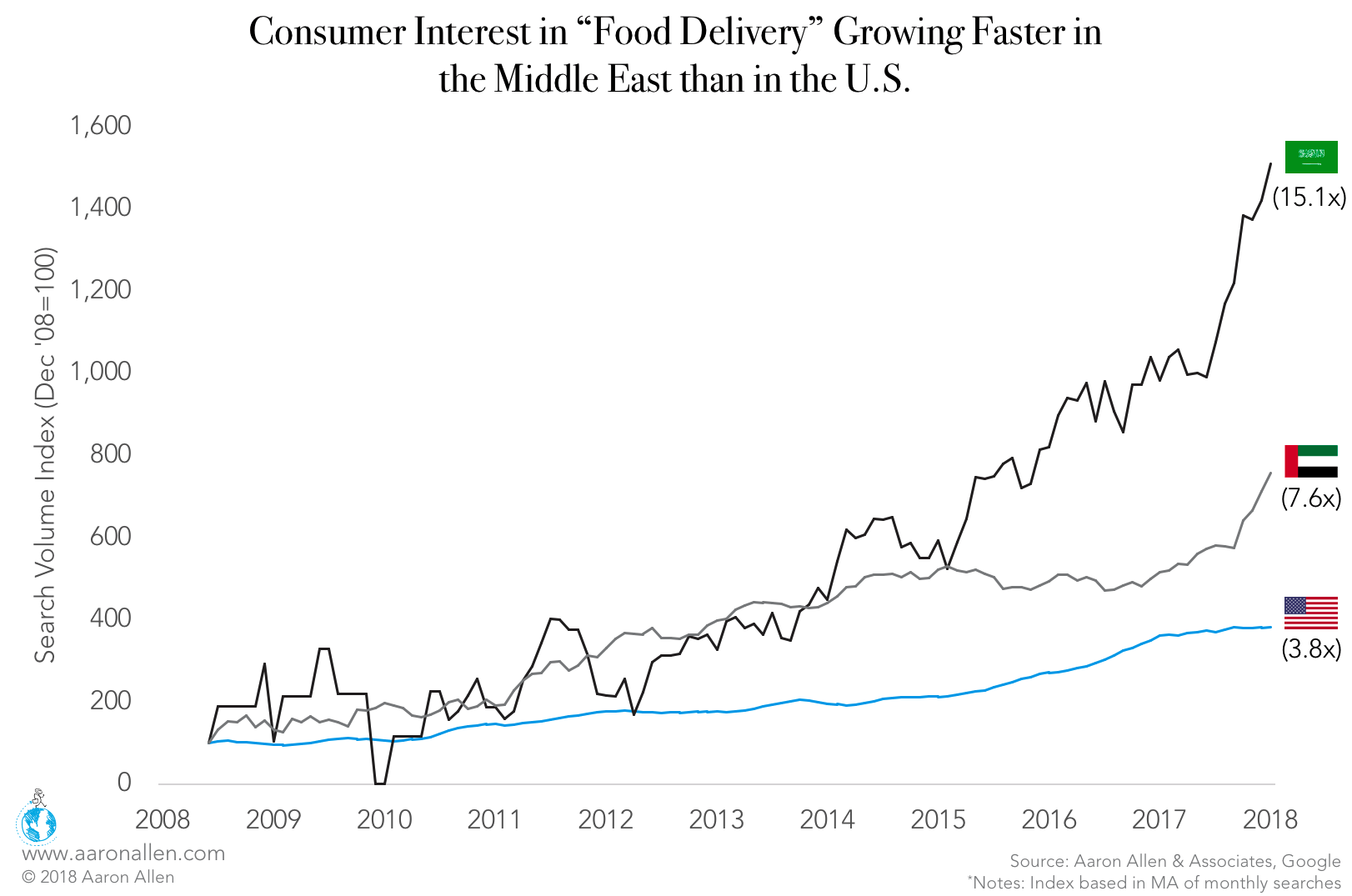

A very tech-savvy population, Saudis have over 44m mobile phone subscriptions and an 88% rate of smartphone ownership, almost double the international average. This is an important metric for restaurateurs, as foodservice operations that leverage smartphone apps for delivery are poised to perform well. Saudi interest in food delivery is growing at 5x the rate as it is in the U.S.

Restaurant operators in KSA could also benefit from social media applications, particularly Snapchat. Saudi Arabia has the highest market adoption of Snapchat, with over 9m daily active users, 55% of whom are women, opening the app 40 times a day on average.

Increased Foot Traffic Near Movie Theaters Prime Real Estate for Restaurants

Notable cultural shifts in the Kingdom over the past few months give more reason for restaurateurs to be optimistic.

In April of this year, KSA reversed a 35-year ban on movie theaters. VOX Cinema will open the first multiplex cinema at Jeddah’s popular Red Sea Mall in December, 2018, and it has plans for an addition 600 screens across the Kingdom over the next five years. Two-thirds of Saudis say they’ll visit these theaters.

Restaurateurs looking to open near cinemas or in malls with theaters are poised to benefit from increased foot traffic.

New Laws Allowing Women To Drive Will Increase Labor Pool

Perhaps the most noteworthy cultural shift with implications for the restaurant industry is the new law allowing women to drive. Already, 120,000 womenhave applied for a drivers’ licenses, and 2,000 have already registeredas rideshare driversfor Careem, the Middle East’s answer to Uber.

This new mobility will certainly help the many Saudi women eager to work.

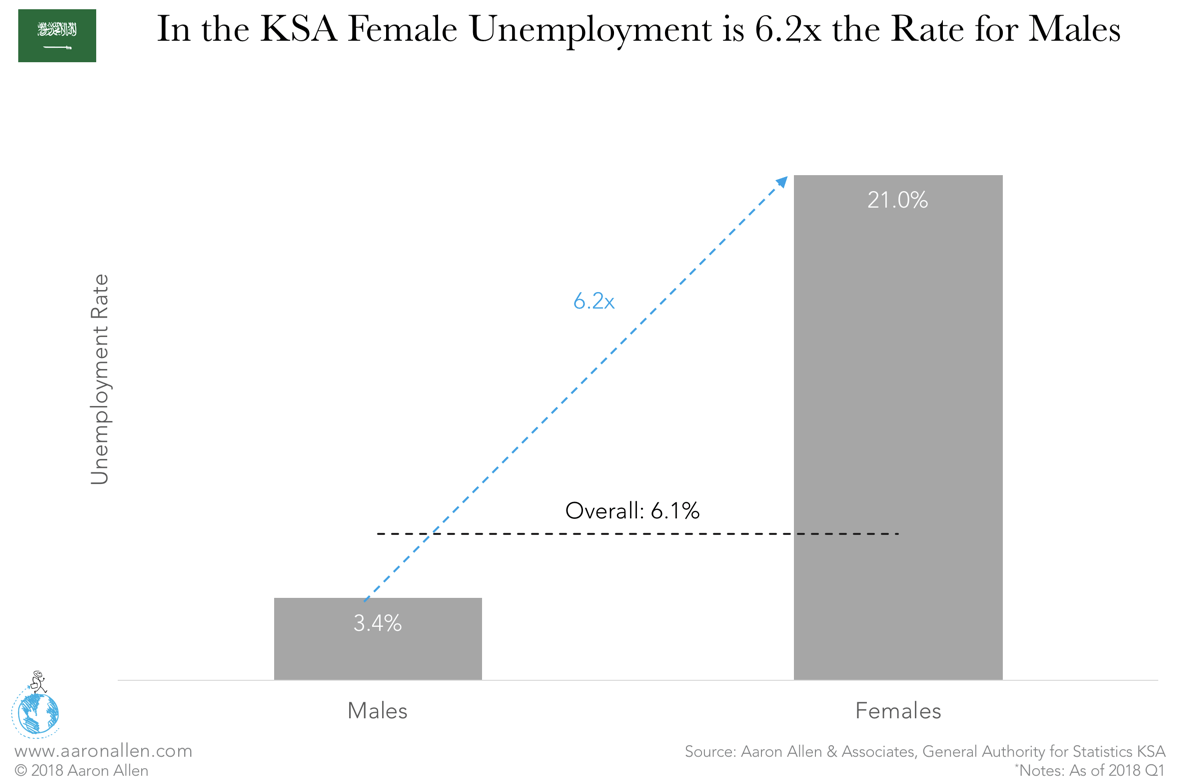

The unemployment rate stands at upwards of 33% for women and rises even higher young women, to around 62%.The Saudi government announced in February that it would test a pilot program for women to work in the food and hospitality sector.

Moreover, more women in the workforce means more disposable income, and a larger pool of consumers for restaurants to attract.

New Taxes & the End of Fuel Subsidies Hitting Restaurants This Year

Certain regulations are likely to pose cost challenges and ongoing political risks for foodservice operations.

The GCC-wide push to implement a 5% Value Added Tax (VAT) for food, beverages, and rent, which took effect in Saudi Arabia on January 1, 2018, will increase prices at a moment when inflation is affecting restaurant prices more than grocery costs.

Likewise,the rollback of energy subsidiesfor fuel and electricity is forcing restaurant operators to make hard decisions about cutting costs, an especially risky proposition in a region where consumers are looking to escape the heat by either dining out or ordering in. Operations that want to save on fuel costs could turn to third-party services.

Expat Fees Scheduled to Increase Every Year

Finally, as part of the Nitaqat system, the government announced plans in January, 2018, to increase fees to $107 per expat employee with plans to continue raising the rates each year. Over the past year alone (comparing Q1 2017 vs 2018), the number of employed expats dropped by 730k workers, or about 6% of the total number of non-Saudi workers. Riyadh lost 220.8k expat workers, and Makkah some 168.3k. The unemployment rate among Saudis however did not improve: rising to 12.9% in Q1 2018, slightly higher than the value registered a year ago (12.7%).

This increase in expat levies has hit the construction industry particularly hard, which lost 126,000 workers or 57% of the total 221,000 expats who have left the labor force in Q1 of this year. Such decline in labor-intensive workers risks slowing much of the country’s development projects that have been so heavily dependent on low-wage expat labor.

With expats willing to work at much lower wages than Saudi citizens, restaurateurs will have to assess the costs and benefits of increasing pay to attract Saudi nationals.

Unemployment and Regional Competition Could Disrupt Trade and Supply Chains

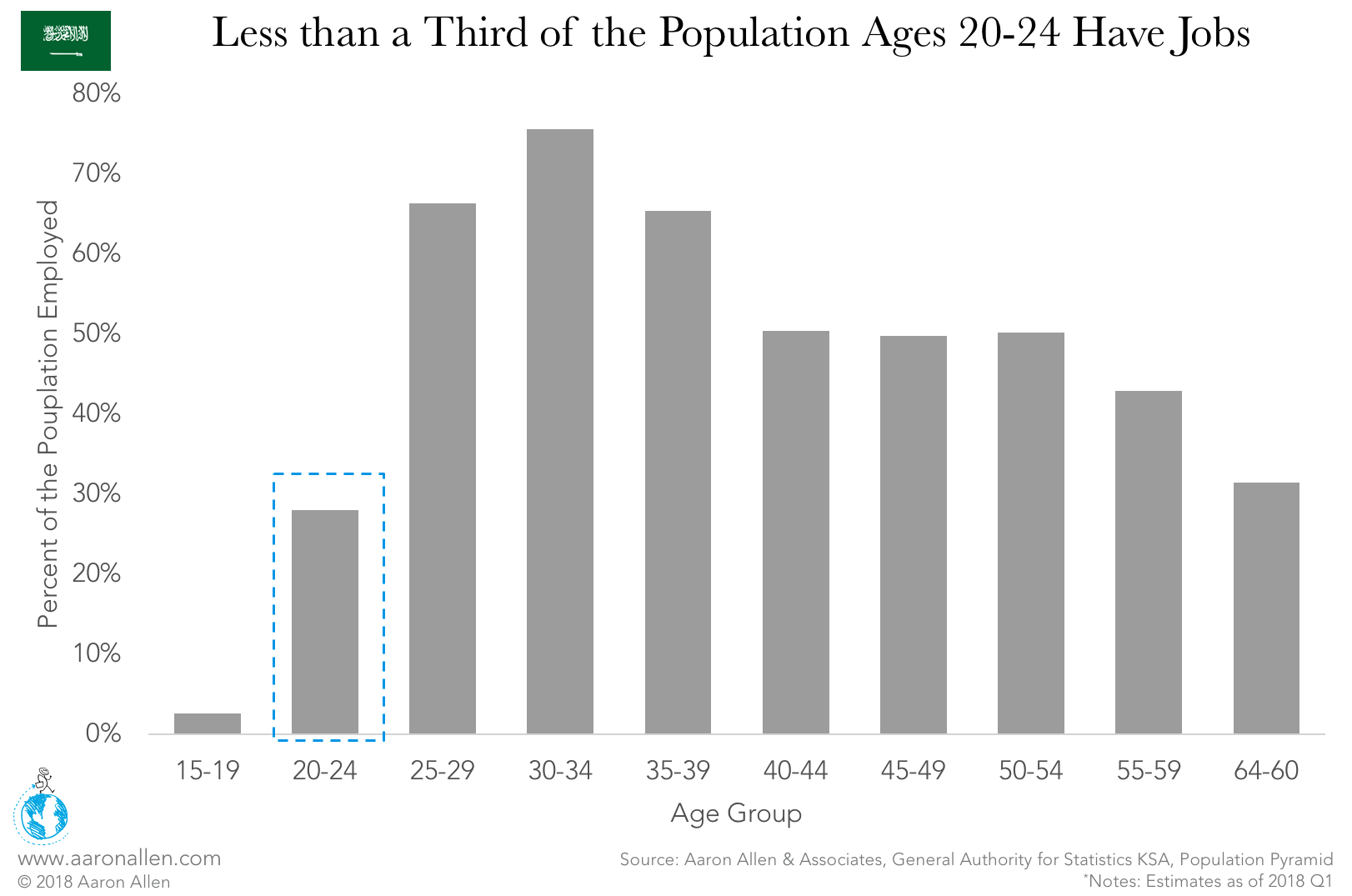

Though the KSA managed to remain above the fray of the Arab Spring protests in 2011 with increased spending, youth unemployment stands at 34%. Educated Saudis are eager to find work matching their skill sets. Job creation in Saudi is therefore essential.

Here, foodservice operators can contribute. Hiring more Saudi nationals at both the crew and corporate levels would not only help bring down unemployment among young people but would also instill these locations with a more authentic and local feel.

Despite some political and government challenges, entering the Saudi Arabian market offers global executives an opportunity to participate in one of the fastest-growing and most dynamic markets in the world and to play a central role in diversifying the economy and ease the growing unemployment crisis.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims. We help businesses identify, size, and seize opportunities within a division, a brand, a company, a country, or on a new continent, finding markets and segments that accentuate the organization’s strengths and mitigate its risks.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.