A multitude of factors are currently affecting U.S. operators, from technological evolutions to shifts in dining behaviors. But some things never change: inflation, restaurant versus grocery prices, and consumer confidence will always have an impact on restaurant operators. Below, we delve into all of the above — plus highlight a couple of other interesting trends that are sure to impact operators in the near future.

RESTAURANT SALES

Consumer spending makes up 70% of the U.S. economy, and restaurants are among some of the most volatile industries (which also include airlines and big-box retailers). Fortunately, U.S. restaurant sales are growing — albeit at the slowest rate of the last three years. Real growth decelerated 37% between the first quarters of 2016 and 2017. Meanwhile, grocery sales grew 2.8 times faster. As a result, consumer are thinking it twice before going out for diner. This trend is likely to have negative effects on already-weak same-store sales. According to May data from Black Box, on average, chain restaurants have had negative same-store sales for more than a year now, thanks to poor traffic.

One problem? Prices. While restaurant prices continue to increase, groceries have become cheaper, raising the opportunity cost consumers face when deciding whether to dine out. Depending on their income and the elasticity of demand, diners are likely to cut restaurant spend so they can save and spend on other things. From 2007 to 2017, the Consumer Price Index (CPI) for all food (grocery store and restaurant food) rose by 24% — a larger increase than the 19% rise in the all-items CPI, which is comprised of several items, including food.

LABOR COSTS

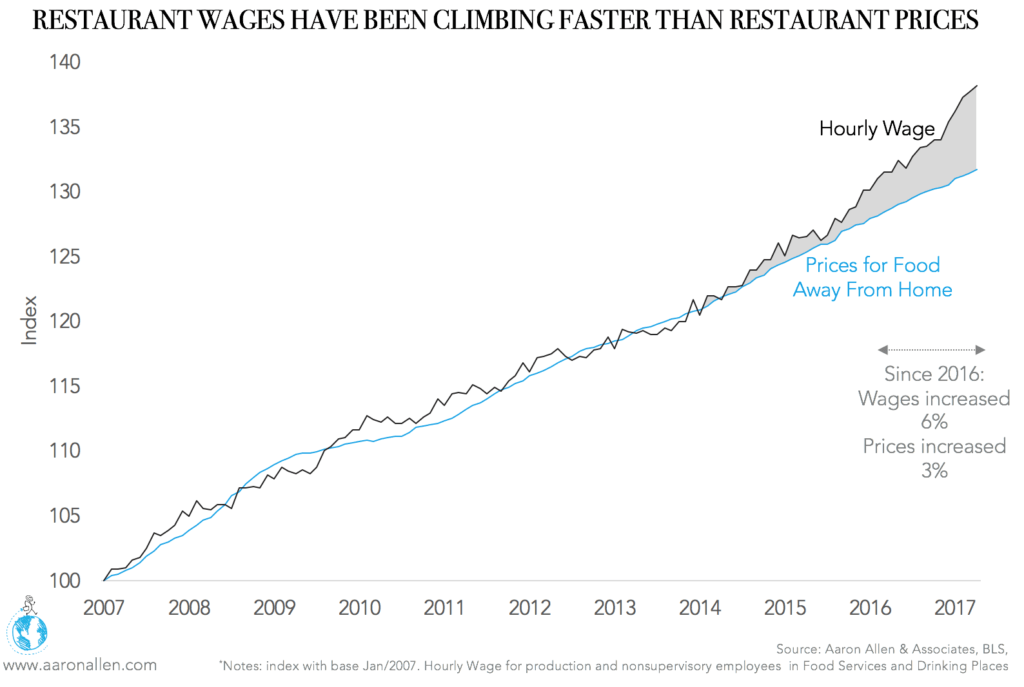

Over the last ten years, restaurant wages and restaurant prices have been highly correlated with one another. Lately, though, wages have been climbing faster than restaurant prices. As a consequence, restaurants, especially those in the full-service category, are struggling to maintain their margins.

Also of note when it comes to labor costs are rising minimum wage initiatives throughout the country. Though the federal government mandates a nationwide minimum wage of $7.25 per hour, several states and cities have pushed legislation to raise wages. In November, four states voted to hike their minimum wage, with dozens more expected to follow suit.

Despite the obvious upside for workers (of the 14.4 million restaurant industry employees, 7.1 million work for minimum wage), rising wages add to the problems of filling vacancies and combatting the high turnover seen in the industry. Restaurant employment is currently at record highs (the highest level of the last ten years, according to the seasonally-adjusted data of the Bureau of Labor Statistics), with an inter-annual growth of 3.7% as of May.

Restaurants with low check averages, and those with a low sales-per-employee ratio, will be hit the hardest by rising labor costs. Despite the challenges, though, there remain many strategies for restaurants to optimize their labor costs.

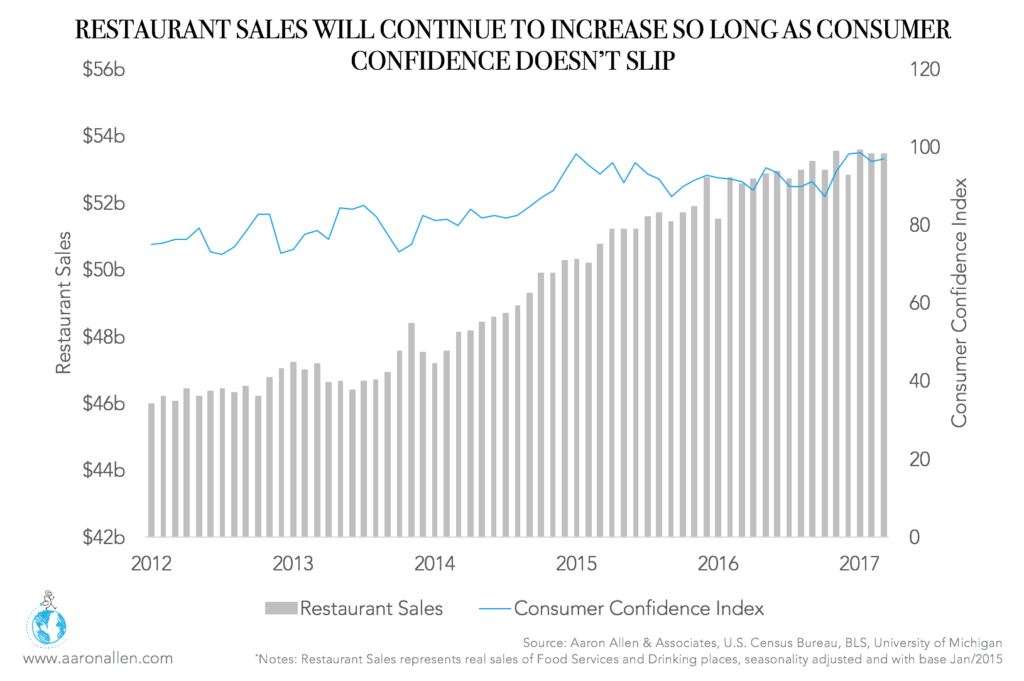

CONSUMER CONFIDENCE

Consumer confidence is just one of the many things keeping restaurant CEOs awake at night, and for good reason, as overall real sales in restaurants bear a high correlation to consumer confidence (87% since 2009). Good news for the industry as a whole? Consumer confidence peaked earlier this year (98.5 in January), and high levels have been maintained throughout the year.

The most recent consumer confidence report, released in May, dropped slightly, but remains high on optimism regarding jobs, rising stocks and home prices. In fact, the index of sentiment about current conditions is at its second-highest point since August 2001. However, consumer sentiment doesn’t always match reality, and some macroeconomic indicators (such as the purchasing manufacturing index and orders for capital goods) are not supporting this apparent enthusiasm.

Of course, increasing competition will mean pockets of the industry (we’re looking at you, CDRs) will continue to struggle.

* * *

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries. Collectively, his clients around the globe generate over $100 billion annually and span six continents and more than 100 countries.