*Originally Published in the Aaron Allen & Associates Newsletter on 06/03/2024

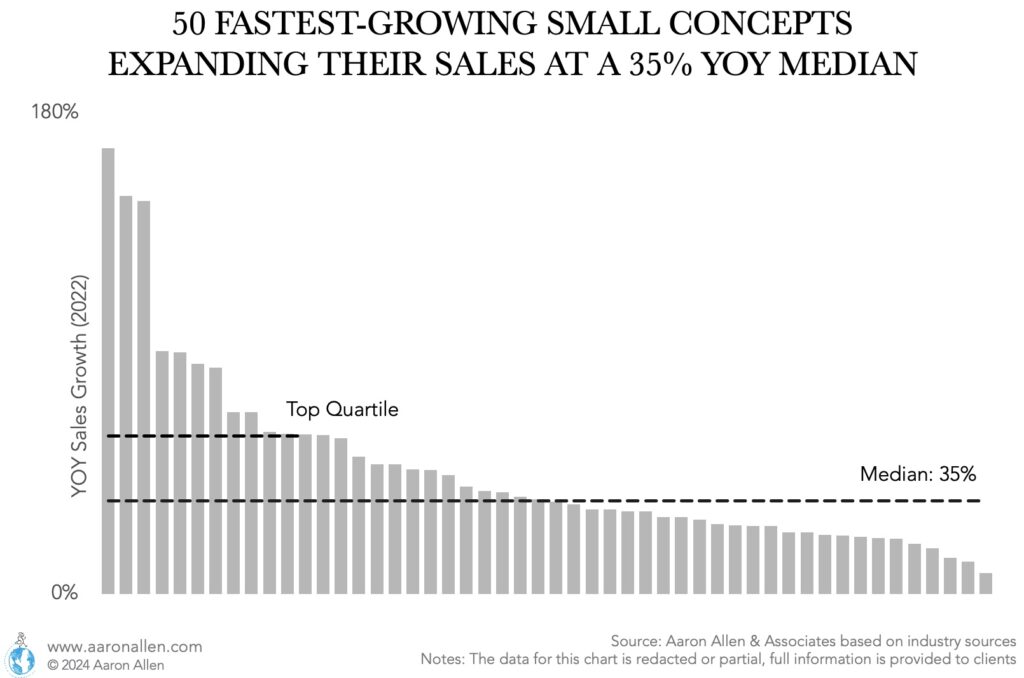

The 50 fastest-growing emerging restaurant chains expanded their sales by a median of 35% year-over-year (in 2022). This growth rate has remained consistent through the years for fast-growing concepts with sales between $20m-$60m.

The competition between these fast-growing emerging restaurant chains and large established chains resembles a lot of competition between an oil tanker and a speed boat.

Through our consulting work we’ve seen that there are different pains of growing at different sizes and some patterns repeat across categories and segments. Whether establishing a franchising system to go from 20 to 200 units or thinking of going public at 500+ units, operational excellence, retooling of systems, bringing up standards and SOPs to top-tier performance is what is feeding a cycle of same-store sales and enterprise value growth.

If you are an investor thinking of investing or acquiring an emerging restaurant chain, you can not skip diligence. Many emerging concepts stagnate or mismanage the growth. Commercial and Operational Diligence can pinpoint weaknesses and give an objective assessment of the investment risk and potential return.

… And Established Casual Dining Chains Are Facing Traffic Challenges Making Them Ripe for Consolidation…

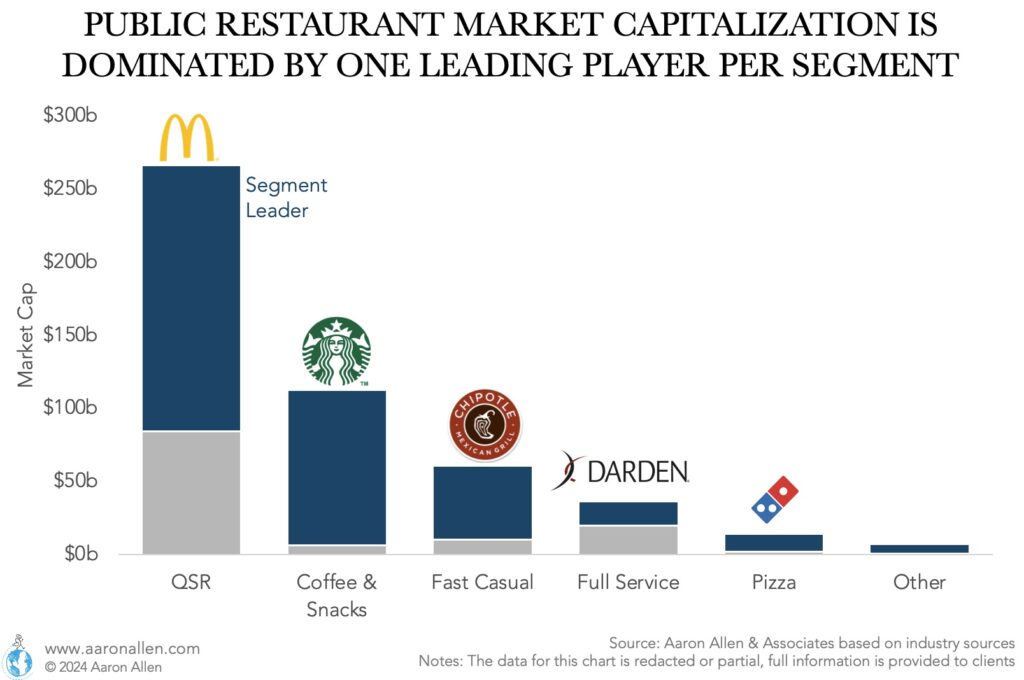

Restaurant chains in the U.S. account for a market capitalization of almost $500 billion (as of the end of 2023) divided among 48 companies.

Every foodservice category has a clear market share leader with one exception – casual dining. While the leaders in QSR, Coffee, Fast-Casual, and Pizza each own more than 60% of the category’s market cap, for Casual Dining the leader accounts for 45% of the segment’s market cap.

This is another fascinating proof point that casual dining is ripe for M&A and consolidation. But it’s a category with such a breath of brands, results, and potential that commercial due diligence is vital.

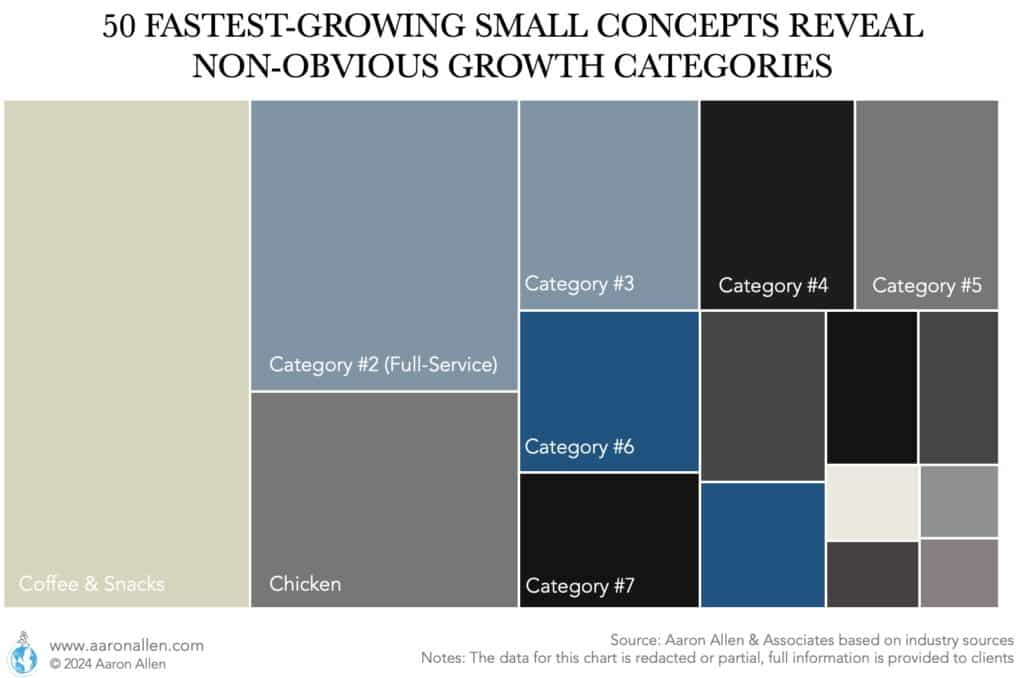

… But Full-Service Is Not Dead: Proof-Points from Emerging Restaurant Chains

The fastest-growing emerging restaurant chains are showing growth in non-obvious categories (based on the 2023 rank for the 50 fastest-growing emerging concepts). While the largest categories were Coffee & Snacks in the first place, and Chicken in the third place, there’s also growth in specific pockets of full-service.

We are often working with multi-national multi-brand groups helping with portfolio optimization, answering questions like: Where is growth going to come from? What brands in our portfolio should we grow and which ones should we divest? Should we invest in a new concept or franchise brands in any new growth concepts? Which are those?

Companies across the globe are working on portfolio rationalization to improve their enterprise value in the mid- and long-term.

Aaron Allen & Associates Services

MENU ENGINEERING

With all the talk about pricing strategies and value-vs-experience, here are some tools for menu engineering we share for free on our website. Interested in a menu overhaul? Get in touch.

EXPEDITED COMMERCIAL AND OPERATIONAL DUE DILIGENCE

We provide an objective assessment of the target business with a focus on surfacing any potential problems (and opportunities) in the P&L and growth plans, the competitive landscape, scalability, differentiation, COGS/purchasing analysis, and expansion-related concerns. Our specialized expertise enables a better informed, confident, and sure-footed investment decision.

- Find Profitability Gaps (you don’t need to be an investor to run diligence on your own brand)

- How Restaurant Due Diligence Enhances Value

- M&A Reshaping Foodservice

- Navigating the Rise in Restaurant Debt

- 10 Reasons to Invest in Due Diligence

BRING GUESTS BACK

Embarking on a business turnaround isn’t just about quick fixes; it’s about setting a foundation for sustainable growth. With Aaron Allen & Associates, you’re not just getting an analysis, you’re gaining a strategic partner committed to navigating through crises and steering towards recovery and growth.

Current Challenges:

- Sales Performance: A consistent decline in sales reflecting broader struggles within the casual dining category.

- Operational Inefficiencies: Potential gaps in operational practices that could be streamlined for better efficiency and cost management.

- Market Positioning: The need to better align the brand and offerings with current consumer preferences and market demands.

Recognizing the need for change and seeking expert guidance is not just a step; it’s a leap towards transformation.

Aaron in the News

Aaron gives his opinion in this article about Soho House and luxury dining experiences. The content was published by Fortune.

Two decades of trouble culminated with the bankruptcy of Red Lobster. Read more for Aaron’s take in this Washington Post article.

Join Nearly 300k Global Restaurant Industry Executives and Investors

The Aaron Allen & Associates newsletter is one of the most anticipated weekly reads for those in the know. We cover what’s shaping markets, evolving consumer trends and dining behaviors, and solid strategies for understanding and thriving in the future of foodservice.