In the world of restaurant mergers and acquisitions, big deals — like 2017’s sales of Popeyes Louisiana Kitchen ($1.8b) or Panera Bread (~$7.5b) — tend to get the most attention. But private equity firms should also look at lower middle-market restaurant investment opportunities for deals that deliver solid growth to their partners.

Across the investment landscape, most middle-market activity has been concentrated in the upper-middle market (enterprises valued between $500m and $1b). Deals in the core middle market ($100m to $500m) and lower middle market ($25m to $100m) have decreased over the last five years.

We expect that this balance will shift, as deal size in the lower middle market has remained steadier than other middle-market segments (-1.6% as opposed to -2.3% and -3.6% for the core and upper-middle markets, respectively).

As dry powder continues to grow and competition for deals becomes fiercer, the lower middle market can offer safe harbor for private equity firms’ investment. But not all lower middle-market opportunities provide the same benefits; fund managers should consult experts in the industry to assess which ones best align with the firm’s strategy.

Lower Middle-Market Restaurants Have More Favorable Valuations Than Large Companies

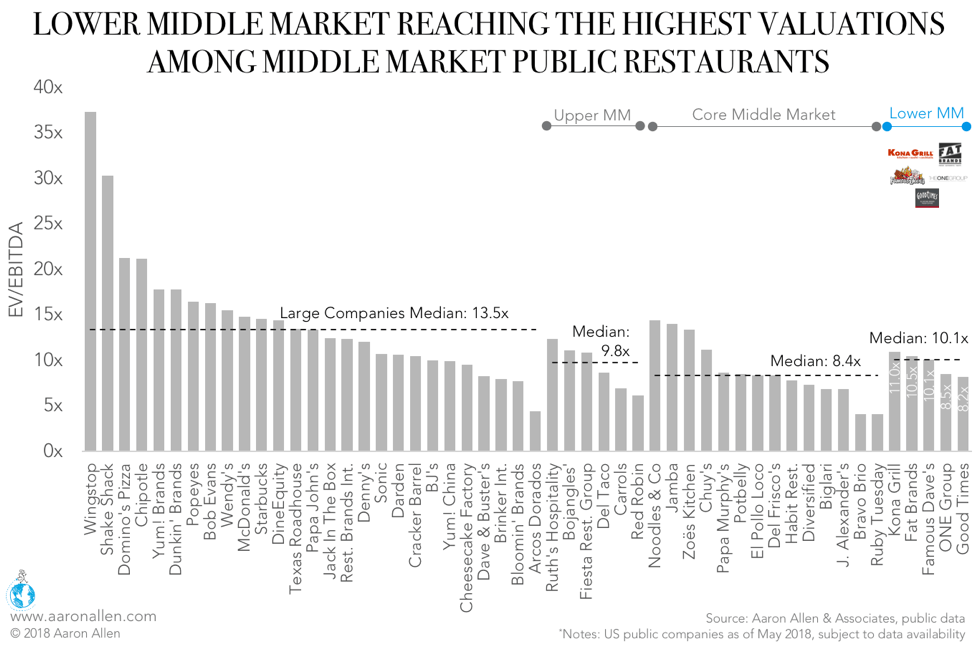

Looking at publicly traded restaurants in the US, we see that valuations and growth in the lower middle market are similar to those found in the rest of the middle-market segment and among large enterprises (valued above $1b), but growth in the LMM can happen more quickly.

Some of these big operations, like Shake Shack, Domino’s Pizza, and Chipotle have EV/EBITDA multiples in the twenties, but none comes close to Wingstop’s 37.4x valuation. These multiples simply price most investors out of deals. In contrast, the lower middle market offers a 10.1x median multiple, showing a large potential upside.

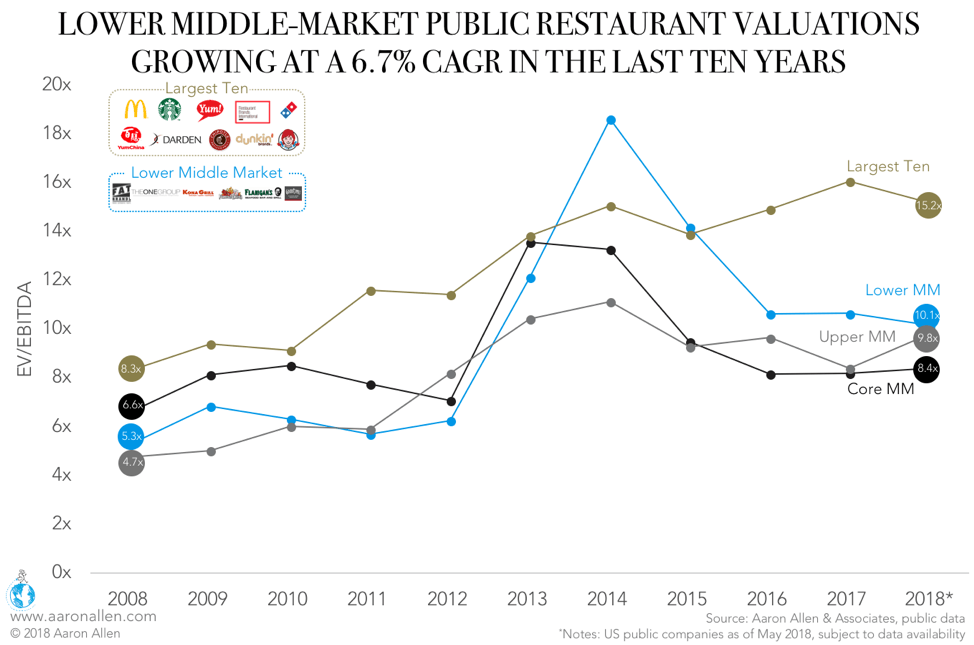

Further, the five publicly traded, lower middle-market restaurants in the US are growing their valuations fairly consistently, at a 6.7% CAGR over the last ten years. (The big spike in 2014 came from Kona Grill’s 27x valuation, which has since come down to 11x.)

The growth in the lower middle-market median valuations beat out both the core middle market and the largest ten foodservice operations, which includes mainstays like McDonald’s, Starbucks, and Yum! Brands, and the core middle market, which only grew 2.4% CAGR.

Industry Experts Guide Private Equity Firms to the Best Investments

Lower middle-market concepts are becoming an investment sweet spot: with valuations attesting to profitability and good growth rates, this segment should provide strong returns. Further, the smaller size of these enterprises makes their systems more dynamic, able to adapt more quickly than many larger businesses. In the restaurant industry, where quick-change consumer preferences can transform the market in a matter of months, speed is key.

Not many private equity firms are active in this segment — our estimates classify only one of the first quarter’s deals in the lower middle market — which cuts down on competition among bidders.

But investing in small concepts can be tricky. Most lower middle-market restaurants are looking for private equity to expand into new markets, a complicated process that can surface a host of underlying issues.

Without careful planning, adding locations stretches an operation’s supply chain — both in terms of volume and geography — pushing costs up and profits down.

The expansion process also puts pressure on a restaurant chain’s executive team. This means they would likely welcome expert advice from their private equity partners, but they will also need much more active guidance from investors.

Before entering into a lower middle-market deal, fund managers should consult with industry experts who have handled both buy- and sell-side transactions. Restaurant consultants can guide private equity firms to promising small concepts, help judge the feasibility of an expansion plan, create unbiased models of future growth, and spot red and yellow flags in the operation.

Done correctly, investments in smaller concepts will not only deliver strong returns but also allow the private equity firm to participate in the excitement of delivering the next best thing to diners all over the country, if not the world.

Private equity firms now have a golden opportunity to enter this promising segment of the restaurant industry. But, as other investors catch on, valuations are likely to start going up, up, and up, just as we’ve seen them do across sectors.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We help restaurant operators and investors make informed decisions, minimize risk, and maximize sustainable value. With experience on both the buy- and sell-sides of transactions, we have a robust understanding of trends and factors impacting restaurant chains and private equity funds around the world. We help protect, enhance, and unlock value throughout every phase of the investment lifecycle. Collectively, our clients post more than $100 billion in annual sales, span all 6 inhabited continents and 100+ countries, with tens of thousands of locations.