In an era where capital efficiency and strategic growth have never been more crucial, Real Estate Investment Trusts (REITs) emerge as pivotal players in transforming the real estate landscape of the hospitality industry. With billions at stake and the need to adapt rapidly to market dynamics, understanding how REITs can support your expansion, renovation, or operational optimization is vital. This article delves into how innovative financing structures can not only safeguard but also propel your business forward in uncertain times.

What Are REITs?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across various sectors. They provide a way for investors to access dividends generated from real estate investments without needing to buy, manage, or finance properties themselves.

REITs in Restaurants and Hotels

These REITs focus on properties within the hospitality industry, such as restaurants, hotels, and resorts. By investing in these properties, REITs can capitalize on the profitability of foodservice and lodging facilities. For instance, a restaurant-focused REIT might own the buildings leased to restaurant operators, benefiting from stable rental income and potential increases in property values due to the high-traffic locations.

Foodservice Manufacturing REITs

This is a niche area where REITs might invest in properties used for manufacturing and distributing food products. These properties could include large-scale kitchens, distribution centers, and storage facilities. The investment appeal here is the essential nature of food production and distribution, which can provide consistent rental revenue streams.

Unlocking Growth: How REITs Offer Financial Flexibility for Restaurants and Hotels

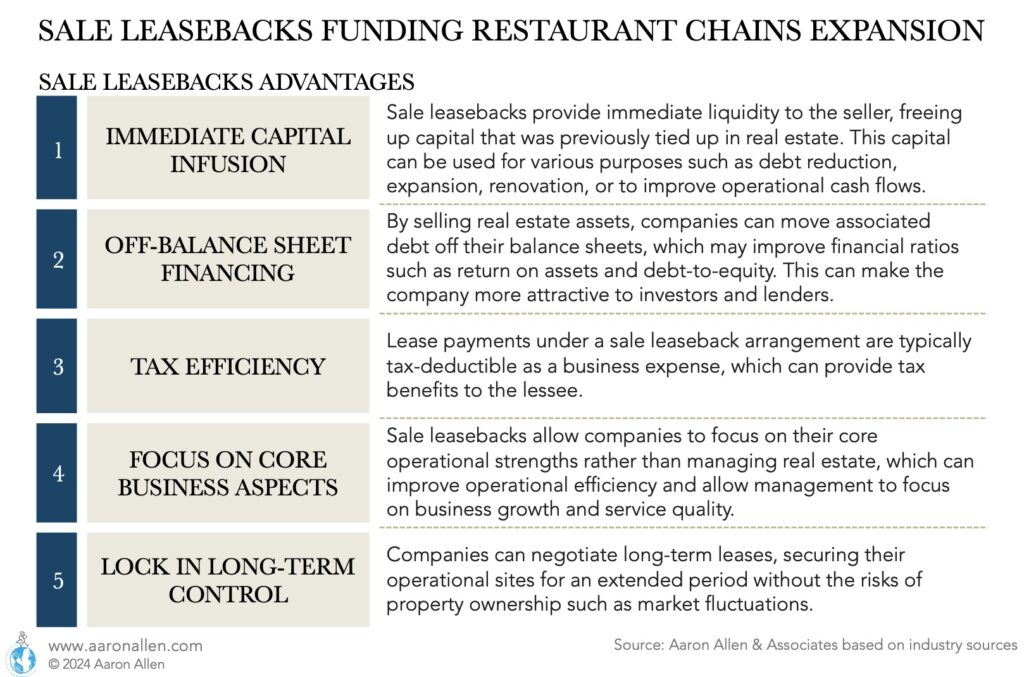

One of the most compelling financial strategies available to restaurant and hotel chains today is the sale-leaseback arrangement. This involves selling real estate assets to free up capital, while simultaneously leasing back the space to continue operations without interruption.

REITs enable sale-leasebacks which have a notable impact on the restaurant industry, primarily by providing financial flexibility and strategic opportunities for restaurant operators. Here’s how:

1 – Restaurant Sale-Leaseback: Unlocking Liquid Capital

Through sale-leaseback transactions, where a restaurant sells its property to a REIT and then leases it back, operators can unlock the capital tied up in real estate. This capital can then be used for expansion, remodeling, debt reduction, or improving operational efficiencies. This is especially beneficial for restaurant chains looking to grow without diluting equity.

2 – Enhancing Operational Efficiency Through Foodservice REITs

By freeing up capital and offloading the management of property, restaurant operators can focus more on core operational aspects like customer service, food quality, and brand development. This shift can lead to better overall performance and customer satisfaction.

3 – Tailored Lease Agreements for Long-Term Stability

Long-term leases with REITs provide predictable rent expenses, which helps in budgeting and financial planning. This stability is crucial for restaurants, which can have fluctuating revenues due to seasonal variations and changing consumer trends.

4 – Strategic Expansion with REIT Financing

REITs enable restaurants to expand into high-value locations without the upfront cost of purchasing real estate. This strategic expansion can be crucial for gaining market share and accessing new customer bases.

5 – Diversification and Navigating Risk with REIT Partnerships

Partnering with REITs can help mitigate the risks associated with property ownership, such as market volatility and maintenance costs. This can be particularly advantageous during economic downturns when property values and customer spending might decline.

REIT Partnerships: a Valuable Tool for the Restaurant Industry

However, there are also considerations to keep in mind:

- Dependence on Lease Terms: The benefits hinge significantly on the terms of the lease. Unfavorable terms, such as high rents or inflexible lease conditions, can strain a restaurant’s finances and operational flexibility.

- Loss of Property Asset: Sale-leaseback arrangements mean restaurants lose an appreciating asset, which could be a disadvantage if property values in the area increase significantly.

Overall, REITs have provided a valuable tool for the restaurant industry, facilitating growth and financial management but require careful consideration of terms and strategic fit.

Creative Financing for Expansion Beyond Traditional Loans

There is a need for creative financing solutions. REITs can offer flexible and tailored financial solutions by buying the real estate where the company wants to grow and leasing it back to the operator.

Restaurant Franchise Financing Programs

These programs are designed to support franchisees in securing the capital required for new outlets. This can include everything from purchasing real estate to outfitting new locations with the latest in culinary technology or guest amenities.

This strategy allows franchisees to unleash the inherent value of their real estate assets, converting owned properties into capital that can be immediately reinvested into core business operations, such as opening new locations, remodeling existing ones, or even funding acquisitions. Sale leasebacks offer a pathway to liquidity while retaining operational control.

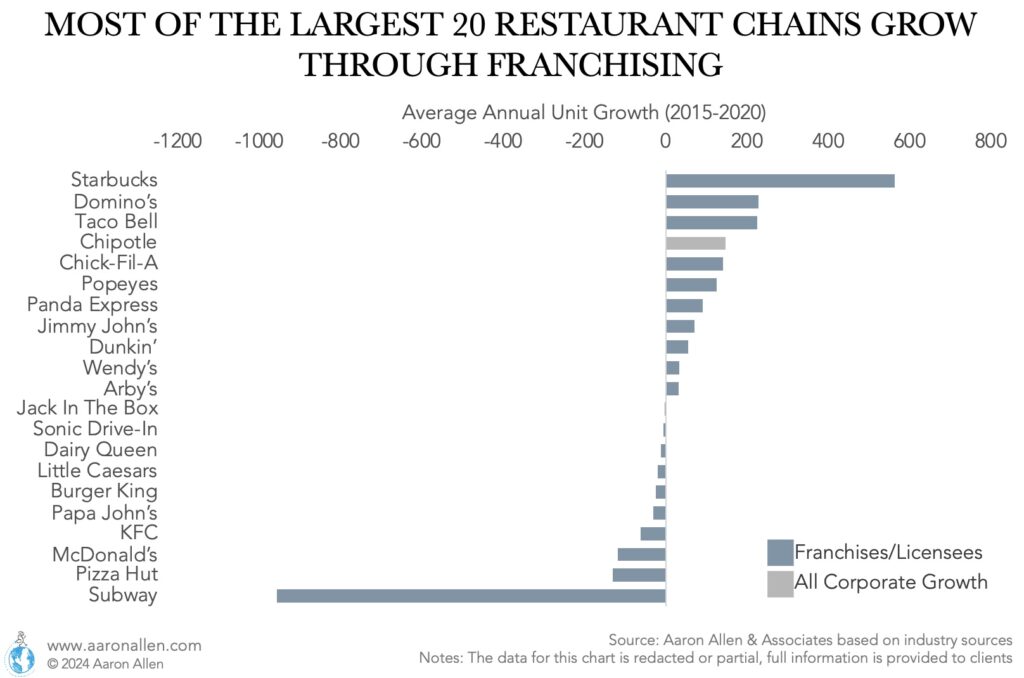

Most of the largest restaurant chains in the U.S. grow through franchising. Between 2015-2020, the leading growth companies (in units) were Starbucks, Domino’s, and Taco Bell, each adding more than 200 units annually. Most of this growth happened via franchisees or licensed stores (rather than corporate stores).

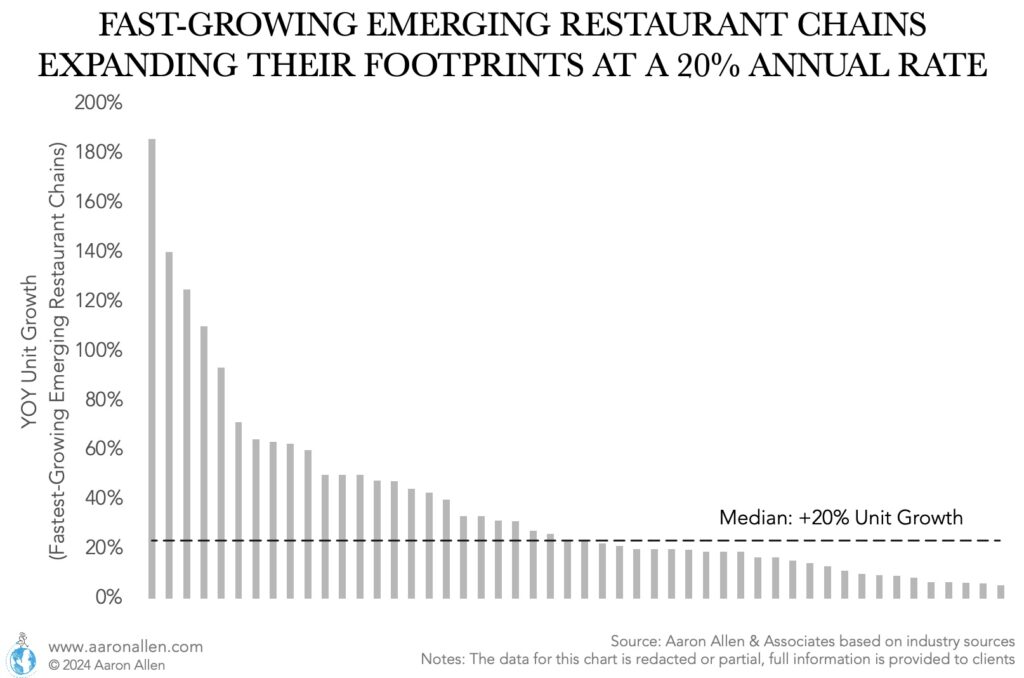

Financing Growth of Emerging Chains

New unit growth reaches 20% of the system for the fastest-growing emerging chains in the U.S. (as a median), with many companies doubling and up to tripling the size of the system in one year.

For those owning real estate (for their locations, headquarters, commissaries, etc.), there is the option to expand via sale-leaseback. The growth is financed without giving up equity or taking cash off the balance sheet.

Financing a Restaurant Chain’s New Headquarters or Plant Development

Investing in state-of-the-art facilities to bolster operational efficiency and brand prestige can also be financed through the sale of real estate.

Restaurant Real Estate Trends

The landscape of restaurant finance and development through the lens of real estate investment has seen several evolving trends over recent years. Here’s an overview of the significant trends impacting this sector:

1. Restaurant Sale-Leaseback Transactions

This has become a popular strategy for restaurant chains looking to free up capital without sacrificing operational control. By selling their real estate and leasing it back, operators can invest in their core business activities, such as expansion, renovation, and upgrading technology. This trend has been particularly useful for chains needing liquidity to navigate the economic impacts of the COVID-19 pandemic.

2. Focus on Prime Locations

There’s an increasing emphasis on securing prime real estate locations as a way to drive foot traffic and sales. This has led to competitive bidding for premium sites in urban and high-traffic suburban areas. Restaurants are also leveraging data analytics more heavily to identify the best locations based on customer demographics and spending patterns.

3. Diversification into Mixed-Use Developments

Restaurants are increasingly becoming part of larger mixed-use developments that include retail, office space, and residential units. This integration helps drive a steady flow of customers and creates a built-in audience for the restaurant. This trend is also seen as a risk mitigation strategy, spreading the potential downturns in one sector across a more diversified portfolio.

4. Rise of Fast Casual over Traditional Restaurant Formats

The fast-casual sector continues to grow, driven by consumer preferences for quicker, healthier, and more customizable dining options. This shift impacts real estate decisions, with fast-casual chains often needing smaller footprints than traditional full-service restaurants, enabling them to enter markets and spaces that were previously inaccessible due to size or cost constraints.

5. Technology-Driven Restaurant Site Development

The use of technology in site selection and customer data analysis has become more sophisticated. AI and machine learning are being employed to predict site performance, optimize restaurant layout, and improve the customer experience, which in turn can enhance property values and attractiveness to investors.

6. Sustainability as a Value Driver for Real Estate Investments

There is an increasing trend towards sustainability in restaurant real estate investments. Properties that incorporate green technologies and sustainable practices are not only more attractive from a consumer perspective but are also often more cost-effective to operate in the long run. Investors are increasingly valuing these features due to their potential for reduced operational costs and higher resale values.

7. REITs and Institutional Investment for Foodservice

Real Estate Investment Trusts (REITs) specializing in restaurant properties or those with significant restaurant portfolios have seen growing interest. Institutional investors are drawn to the relatively stable returns offered by restaurant leases, especially those tied to well-performing chains.

8. Restaurant Real Estate Adaptation to Delivery and Takeout

The surge in delivery and takeout, accelerated by the pandemic, has led restaurants to rethink their use of space. Many are resizing or redesigning their layouts to include dedicated areas for pick-up and delivery operations, affecting how new properties are developed and existing ones are retrofitted.

Seeking Liquidity or Expansion Capital?

How Do I Evaluate Selling Restaurant Real Estate or Doing a Sale-Leaseback?

When a company is approached by a REIT interested in purchasing their real estate or proposing sale-leaseback agreements, several key considerations should be taken into account:

- Financial Impact: Assess the financial benefits of selling real estate assets versus holding them. This includes analyzing the immediate cash influx versus long-term rental obligations. Companies should evaluate how this will affect their balance sheet, particularly in terms of asset liquidity and debt levels.

- Lease Terms: In a sale-leaseback scenario, it’s crucial to negotiate favorable lease terms. This includes lease duration, rental rates, renewal options, and escape clauses. Companies need to ensure that the terms align with their long-term operational needs and market conditions.

- Operational Control: Maintaining control over critical operational aspects in a lease agreement is important. Companies should negotiate terms that allow them to make necessary modifications or improvements to the property without undue restrictions.

- Tax Implications: Understand the tax consequences of selling real estate. This includes potential capital gains taxes and how lease payments will be treated for tax purposes. Consulting with a tax advisor is advisable to optimize tax outcomes.

- Strategic Fit: Evaluate whether the sale-leaseback aligns with the company’s strategic goals. For some, freeing up capital from real estate can support more core business investments or reduce debt. For others, retaining real estate might be strategic for maintaining control and flexibility.

- Market Conditions: Consider the current state of the real estate market. Selling properties in a high market can maximize capital returns, but entering into long-term leases during such periods might lead to higher than average rent payments.

- REIT’s Stability and Reputation: Research the REIT’s financial health, stability, and track record. A reputable and financially stable buyer can provide more security in terms of ongoing lease obligations and commitments.

By carefully considering these aspects, a company can make an informed decision that aligns with its financial health and strategic objectives, ensuring that any agreement with a REIT is beneficial in the long term.

Restaurant Chains Are Getting Creative When it Comes to Financing

The global financial climate is ripe with opportunities for savvy investors and operators in the hospitality sector. Recent shifts have seen a marked increase in the application of creative financing structures, particularly through Real Estate Investment Trusts (REITs) and sale leaseback transactions. These instruments are not just tools for liquidity management but strategic levers that can significantly enhance your operational flexibility and expansion capability.

Seeking Liquidity or Expansion Capital?

About Aaron Allen & Associates

Aaron Allen & Associates works with leaders of global foodservice and hospitality companies on strategic issues related to growing and optimizing performance and value. Specializations of the firm include multinational expansion, system-wide sales building, brand and portfolio strategy, modernized marketing, industry trends, technology, and advanced analytics. Aaron has personally led more than 2,000 client engagements spanning six continents and 100+ countries for companies collectively posting annual revenues exceeding $300 billion.