Foodservice is a tough business. It takes more than “good food, good service, good atmosphere” to launch, grow, and maintain a successful restaurant operation. Capital is also necessary — and often a lot of it — especially for chains in their growth stages. Institutional investors, including private equity funds, step in at these moments to back new concepts or help established chains grow.

In the private equity space, active involvement by investors is the norm. In contrast, shareholders in publicly traded companies are usually happy to sit back and collect their dividends. Occasionally, however, activist investors, concerned about the company’s direction, act as catalysts for drastic change in governance and strategy, often leveraging short-term agendas that directly impact long-term value.

This investor type buys stock in companies they believe are undervalued, then pushes management to make changes aimed at boosting stock prices. Their demands range from replacing executives to increasing share buybacks. Though their goal is to increase shareholder value, they don’t always succeed.

In two case studies, we determine that — like all transformations — a positive outcome depends on the leaders’ understanding of what gives the brand value. We also look at three unfolding disputes between restaurant investors and companies, which we’ll be updating as they unfold.

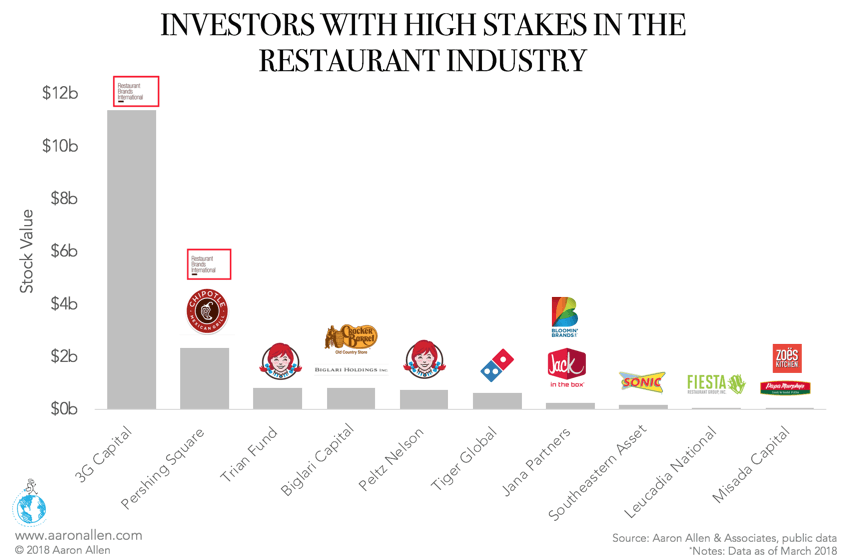

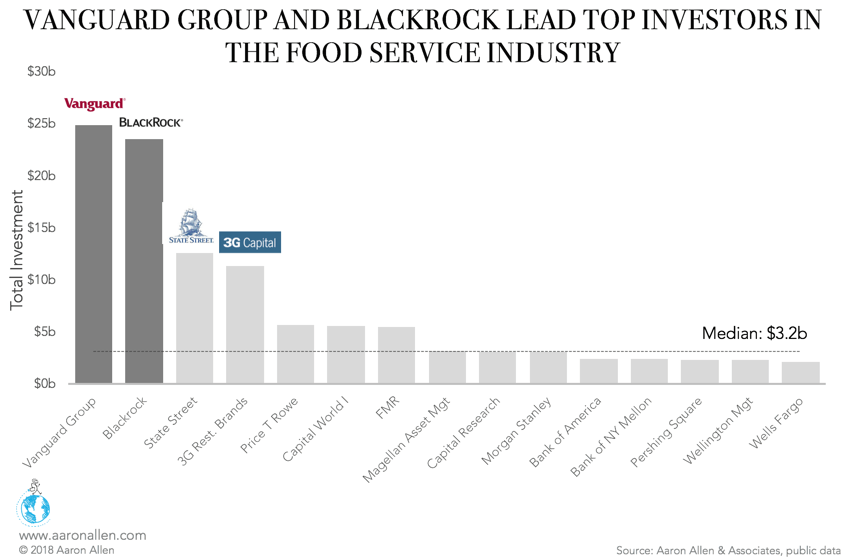

Restaurant Investors Hold $110b in Publicly Traded Restaurant Stock

As of March 2018, the top 15 investors in publicly traded foodservice companies held stock worth approximately $110b. The two largest investors — the Vanguard Group ($24.9b) and Blackrock ($23.5b) — are large public asset management companies. These groups, which account for 13 of the 15 on the list, invest in U.S. restaurant stocks to diversify their mutual and exchange-traded funds.

The top 15 includes two groups, 3G Capital ($11.4b) and Pershing Square Capital ($1.3b), that are acting as activist investors. The restaurant space is particularly appealing to activist investors because even the most established brands face challenges that depress profits. For instance, Chipotle experienced several quarters of declining top and bottom lines due to its repeated food safety crises, not to mention its continued missteps handling these scandals. Activist investors often look for targets that have strong brand names or large asset portfolios, hoping to more effectively monetize those aspects of the brand.

Most often, the market reacts positively to the news that an activist investor has bought stock with a struggling brand, since their involvement can signal increased profit. For example, 3G Capital has turned the $3.3b it initially invested in Burger King — which became Restaurant Brands International (RBI) when it bought Tim Hortons in 2014 — into $11.4b in eight years.

Compared to 3G Capital, Pershing Square has a relatively tiny $1.4b invested in RBI, not to mention another $900m in Chipotle.

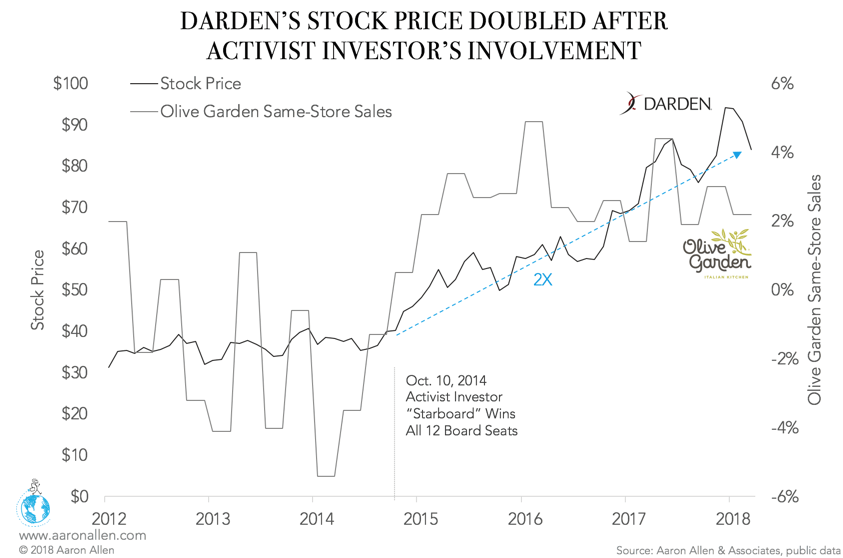

Darden’s Success Story Highlights the Power of Activist Investing

Darden Restaurants experienced an extraordinary turnaround after the activist investor group Starboard Value took control of the company’s board in 2014. Starboard launched a successful revolt that forced then-CEO Clarence Otis out, to be replaced by Gene Lee, the company’s previous COO. Before the shake-up, Darden was underperforming its peers thanks to operational inefficiencies: the company’s sales had fallen from $7.5b in 2013 to $5.9b in 2015 — a 27% decline.

In the infamous Starboard report, the activist investors blasted the Olive Garden parent company for all the ways the current board had hindered the company’s success, from members’ penchant for private jets to failing menu items. After winning all 12 board seats, the group put Darden back on a growth path.

The new leadership revived Olive Garden’s sales by reengineering the menu, expanding alcohol sales, increasing prices, and streamlining kitchen operations, though the most impactful change may have been as simple as improving the breadsticks.

The company witnessed a 155% boost in share price over the past five years. The price doubled from approximately $40 pre-Starboard to $84 in March 2018, growing right along with Olive Garden same-store sales. Since then, prices have continued to rise, standing at $110 as of July 20, 2018.

Jamba Juice: Refranchising Steered by Activists Still Not Paying Off

Jamba Juice’s stock has been a market slacker in recent years, declining 25% since the company gave two activist investors — Glenn Welling of Engaged Capital and James Pappas of JCP Investment — board seats.

When Welling and Pappas assumed their seats, Jamba was in the midst of a refranchising initiative, which drastically decreased the cost requirements of the organization but also deeply cut into revenue. The company introduced lower-margin menu items, like freshly pressed juices, which has cannibalized smoothie sales and also affected the company’s profit margins.

Since the two investors assumed their board seats, the company’s revenues declined by 56%, from $161.7m in 2015 to $70.9m in 2017, primarily due to the negative impact of refranchising. The operation has sold hundreds of locations, including top performing stores, and then used the proceeds to buy back its own shares. By “refranchising” those valuable stores, the company might have raised less money than the revenue and EBITDA those prime locations would have earned.

The difference between the two case studies comes down to whether or not the activist investors understood their investments’ unique value proposition. Olive Garden’s brand is closely associated with its breadsticks, so improving that menu item improved customer satisfaction. In contrast, Welling and Pappas seem to be focused on raising stock prices — not improving the brands’ long-term success.

Restaurant Investors Currently Shaking up Restaurant Operations

There are three publicly traded companies currently trading barbs with activist investors: Bloomin’ Brands, Potbelly, and Fiesta Restaurants. Though none of the activists have taken control, they are fighting to move the companies in new directions, earning some pushback from the current management team.

1. Activist Investor Urging Bloomin’ To Focus on Outback Steakhouse and Slice Off the Rest

Barington Capital (0.44% stake) and Jana Partners (2.58% stake) are both outspoken investors in Bloomin’ Brands. In February 2018, Barington called on the casual-dining chain to spin off some of its brands to improve each concept’s focus. It also suggested revamping the board of directors and implementing more aggressive cost-cutting objectives, highlighting the company’s distance behind the industry’s top players.

2. Sale, Franchising, or Proxy War Potbelly’s Only Options

Potbelly is currently facing pressure from activist shareholders Ancora Advisors and Privet Fund Management, who are demanding the company make changes or explore a sale. Ancora’s chairman and chief executive, Fred DiSanto, has criticized the company for opening too many new company-owned locations, arguing that a heavier mix of franchised restaurants could offer a big push to the stock price. Privet Fund, which owns 5.1% of the shares, recently launched a proxy war, seeking to install four nonconformist directors to the board.

If successful, this would put the struggling sandwich chain the hands of the activists, who would most likely sell the company. It is rumored that several private-equity funds expressed their interest.

If unsuccessful, Ancora and Privet have outlined areas for improvement, including rolling out kiosks in lieu of full-scale stores to cut costs on new locations. They also recommend refranchising some of Potbelly’s current locations, as less than 10% are franchise owned.

3. Fiesta Restaurant: Heated Public Exchange of Insults Between Management and Activist Investor

In 2017, Fiesta Restaurant came under attack by activist investor MCP Investment. The activist investors accused the company of poor governance, weak operating performance, and failing to exploit the Taco Cabana brand and unlock its growth potential. The 2.93% stake shareholder called for the replacement of two board members before either appointing a new CEO or selling the company.

Fiesta received these demands and statements less-than enthusiastically. The company called MCP Investment’s plan a “cookie-cutter” strategy bound to damage the company and described its “last-minute” plan as what one would expect from a “novice investment banker,” containing a “handful of amateurish and shallow back of the envelope calculations.”

The company’s stock started plunging back in 2015. To address the falling share price and dropping sales, management claims that it took many steps, including evaluating strategic alternatives, appointing Richard Stockinger as the new CEO, improving field operations, and canceling the expansion of Pollo Tropical in Texas due to poor sales.

The company has rejected the activist investor’s suggestion to spin-off the Taco Cabana and Pollo Tropical brands, instead investing in marketing to increase the brand awareness and reexamining its development strategy.

We’ll be following these stories as they unfold, as they offer important lessons not only for restaurant investors but also for operators, who can learn from these very public successes and mistakes.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We help restaurant operators and investors make informed decisions, minimize risk, and maximize sustainable value. With experience on both the buy- and sell-sides of transactions, we have a robust understanding of trends and factors impacting restaurant chains and private equity funds around the world. We help protect, enhance, and unlock value throughout every phase of the investment lifecycle. Collectively, our clients post more than $200 billion in annual sales, span all 6 inhabited continents and 100+ countries, with tens of thousands of locations.