More and more investors are considering ROIs together with purpose. Socially responsible and impact investments represent 20% of assets under management in the U.S. as of the last quarter of 2020. And foodservice ESG investments are no different, presenting the opportunity to both earn a substantial return while affecting positive change through how we eat.

There are three major ways to approach these investments:

ESG (Environmental, Social, Governance) Investments

Companies with a good ESG score (based on criteria for items such as community involvement and sustainability) can be better investments than those that ignore these factors. ESG complements existing investment strategies and allows the identification of potential risks and opportunities not commonly considered by business practices.

Socially Responsible Investments (SRIs)

This approach defines investment criteria based on explicit ethical parameters. Some profitable opportunities will not be pursued because they don’t fit certain values, religious beliefs, or political principles.

Impact Investing

Organizations with a goal to generate societal or environmental change besides financial returns are considered “impact investments.” Clear examples are pursuing opportunities in clean technology, sustainable agriculture, or financing services for disadvantaged populations. Assets in Impact Investing have more than doubled in the last ten years.

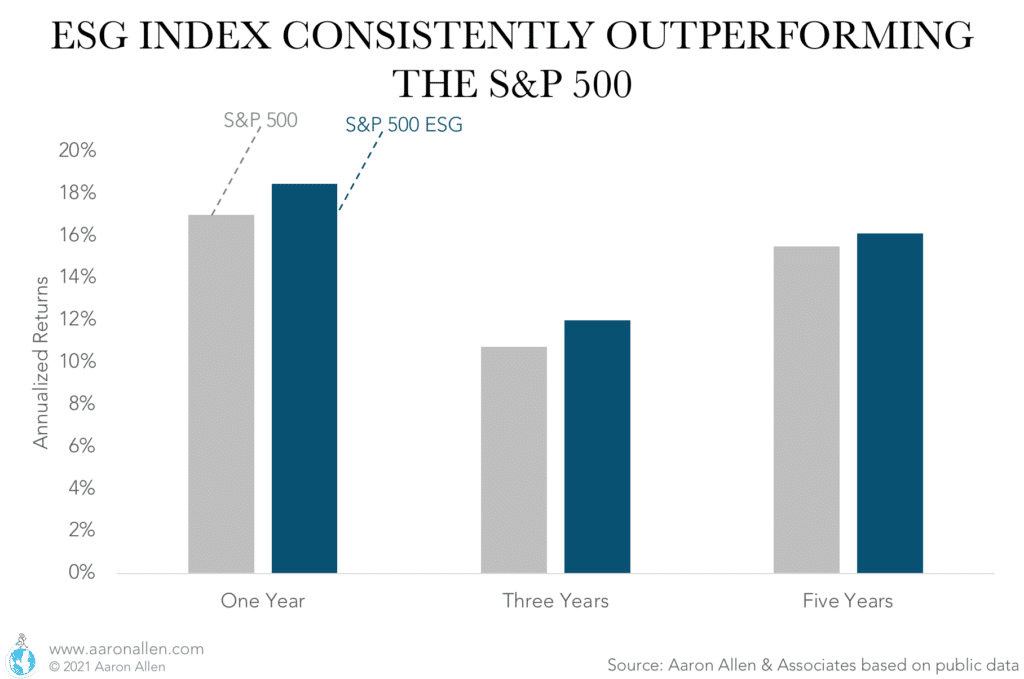

ESG Investments Consistently Outperforming the Market Benchmarks

The S&P 500 ESG index is built based on the S&P 500 (to replicate the risk profile as closely as possible) but only including companies that comply with certain Environmental, Social, and Governance principles. The ESG index outperformed the S&P 500 consistently considering one-, three-, and five-year investment horizons.

Investors are getting serious about deploying capital with a purpose beyond financial profits. LPs and employees are increasingly aware of ESG policies and are determined to make an impact (the AUM for Principles for Responsible Investment signatories grew by 4.8x in the last ten years).

Sustainability and Food Security Generating Millions in Government Support

Governments are also getting the angle on ESG-type of investments. Globalization has made trade easy, and the food supply across the world is more interconnected than ever. Some countries depend heavily (and critically) on food imports. Reports indicate that in the Middle East, for example, half the calories consumed are imported. When something like the global pandemic hits, there is massive disruption to their systems.

Governments are making investments that reduce that dependence. In the KSA, for example, food security is part of the mandate in Vision 2030: SALIC (Saudi Agricultural and Livestock Investment company) is to invest globally in agribusinesses including farming, livestock production, seed and food processing tech, storage, and logistics.

New approaches including aquaculture, urban farms, vertical farming, etc. are finally being seeing as strategic investments.

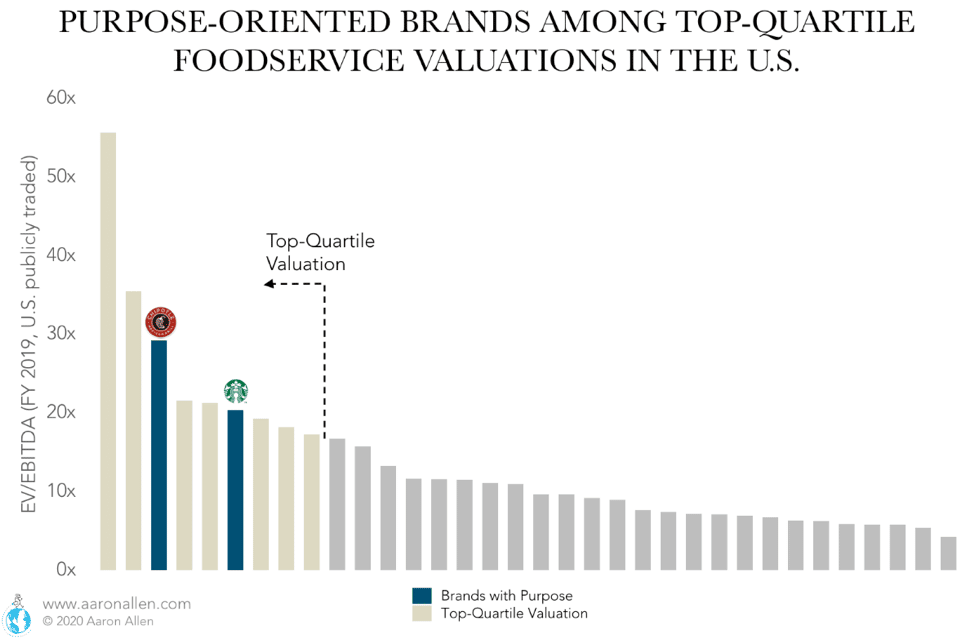

Foodservice Companies Committing to ESG and Purpose

Purpose is not randomly chosen, it’s tightly related to a brand’s mission, values, principles, culture, and other intangibles.

A company’s purpose will contribute to its reputation and relevance and foster loyalty, new trials, and support higher price-points.

- About 20 of Unilever’s 400 brands focus on sustainability and they are clearly outgrowing the rest of the company’s portfolio by 50% and accounting for more than 60% of the total growth.

- KIND Healthy Snacks became the third-largest snack bar company globally by committing to nutrition and transparency for ingredient sourcing.

- Chipotle and Starbucks are among the U.S. publicly traded foodservice companies with the strongest sense of purpose. They also are among the ones with the top-quartile valuation (based on EV/EBITDA multiple).

- Starbucks’ purpose is “To inspire and nurture the human spirit, one person, one cup and one community at a time.” The company, considered an ESG investment, has been strongly guided by employees’ well-being (some initiatives include health benefits for part-time workers and tuition coverage) and is committed to fair trade (backed by initiatives such as issuing sustainability bonds to support coffee farmers).

- Chipotle’s philosophy of “Food with Integrity” shows the company’s inclination to sustainability by using humanely raised pork, screening suppliers for sustainable farming methods, and using non- GMO foods.

ESG Investments: It’s Time to Invest Like It’s Meaningful

We Reap the Seeds (or at Least the Karma) We Sow

It’s an adage far older than the modern foodservice industry. And, yet, we have somehow drifted so far away from what any of us intended that it hardly seems surprising this would catch up with us and would require a reconciliation.

And, we may all be sorry about this crop we’ve seeded and attempted to bring to harvest.

Hunger, malnutrition, obesity, food insecurity, animal welfare, species extinction, sustainability, even clean water is as challenging to get as a clear conscience.

There Is a Growing Movement (and It’s a Good One)

The tide is rising in favor of those companies and professionals that are determined to put profits and purpose in competition. The best ones have found a way to blend them and lift all boats in the harbors that have invited them as caretakers and champions.

And You Can Be a Part of a Better Way Forward

Do you want to help be a curator of change? How about a champion of change? Or even a caretaker of creation?

Do you want to do something that leaves the world in a better place than it was when you were born into it? If so — and if you have any role whatsoever in the global foodservice/hospitality industry — you can help be a part of the solution. It’s actually sort of simple…

We Have to Start Eating — and Investing — Like It Means Something

Hiring. Buying. Investing. Eating. Advocating. Where you apply efforts, mindshare, money — whether you are investing your dollars, your time, your career, your commitments (public and private) — you are reinforcing systems and beliefs that may be more meaningful than you even realize. And we all have the power to affect change.

About Aaron Allen & Associates

Aaron Allen & Associates is a global restaurant consultancy specializing in brand strategy, turnarounds, value enhancement, and accelerating the future of foodservice. We have worked with a wide range of clients including multibillion-dollar chains, hotels, manufacturers, associations, and prestigious private equity firms.

We help clients imagine, articulate, and realize a compelling vision of the future, align and cascade resources, and engage and enroll shareholders and stakeholders alike to develop multi-year roadmaps that bridge the gap between current-state conditions and future-state ambitions.

About Aaron Allen Capital Partners

Aaron Allen Capital Partners is focused on making investments in purposeful companies with high-growth potential on a globally relevant and viable scale. Our aim is to help make the world better one bite at a time (investing across the spectrum of the global foodservice industry; from seed to sewer).

Serving at the intersection of capital, concepts, and management, we connect investors with foodservice operators and technology companies and strive to contribute meaningfully to leading modern hospitality transformation stories.

Backed by decades of experience in consulting, we have worked with clients spanning six continents and 100+ countries, collectively posting more than $200b in revenue across nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle. Learn more about AACP.