Where should lower middle market investors look for investments? The foodservice industry can be a great source of targets with high growth rates, steady cash flows, and moderate risk. As long as industry experts are involved to point the investor in the right direction in terms of categories, cuisines, and formats, investing in lower middle market restaurant chains can have a large upside with reduced risk.

- Lower middle market companies include those with annual revenues between $5 million and $50 million.

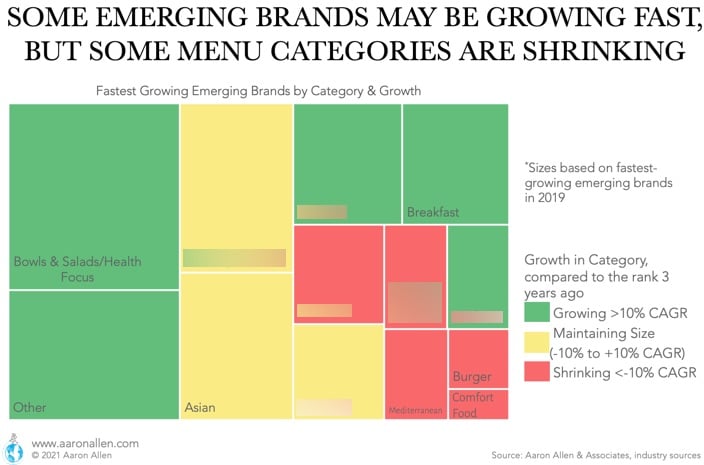

- Among the fastest-growing lower middle market restaurant chains, the fastest-growing categories in the last three years (to 2019) included bowls and salads and Mexican, surpassing a 10% sales CAGR.

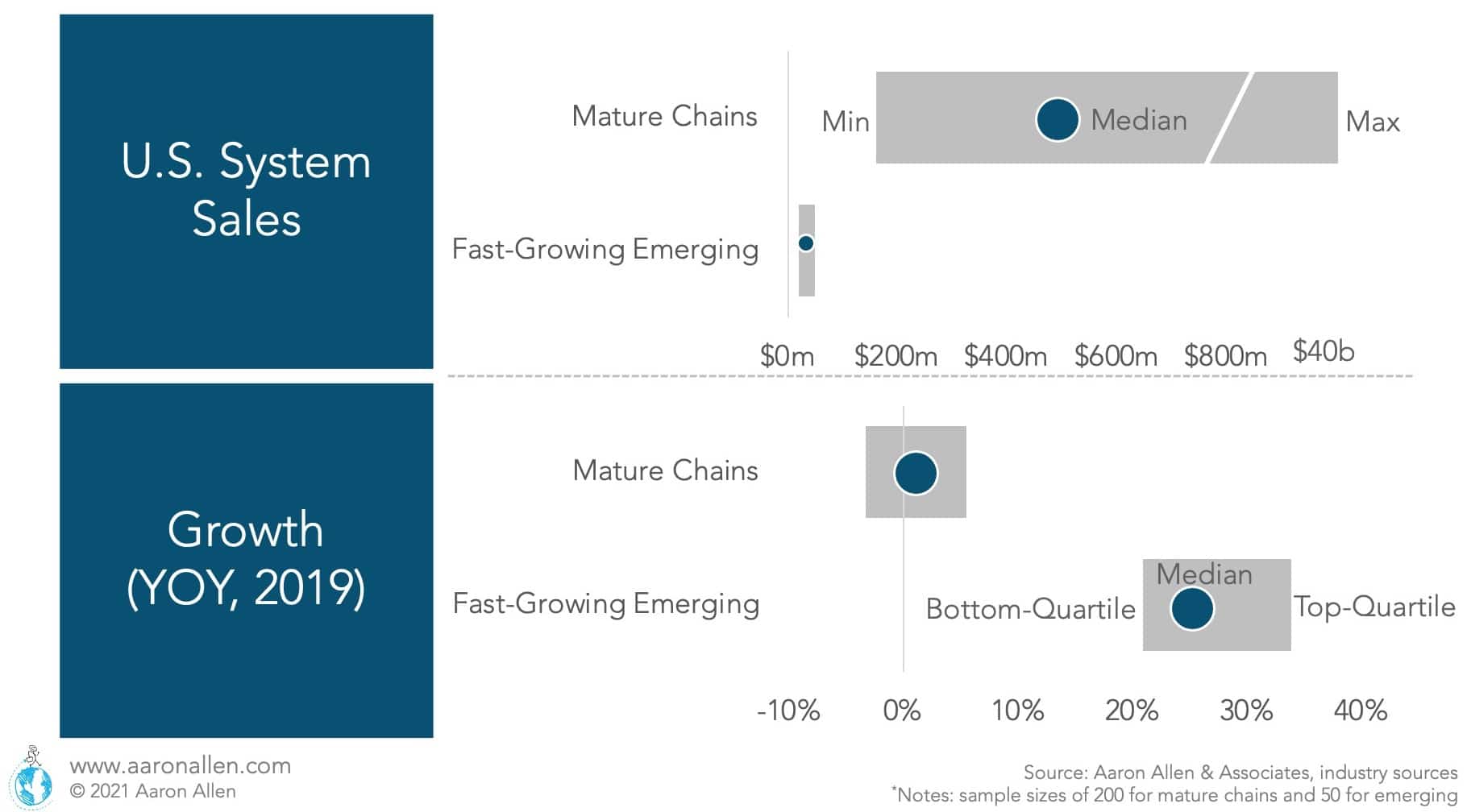

- The fastest-growing lower middle market foodservice brands largely outpace mature chains. The median sales growth for 2019 was 26% for emerging chains (with sizes between $20M-$50M) and only 1% for mature, established chains.

- Because of their size, LMM chains can adopt technology at a faster pace, and even create new categories that dislodge incumbents.

- It’s necessary to be wary: some lower middle market restaurant chains are growing fast, but they are in shrinking categories. Consumer preferences may be changing and this could mean a misalignment with long-term trends and jeopardize future growth.

There are ways to effectively screen for investment ideas in the lower middle market foodservice space and add confidence when considering a foodservice investment earlier in its lifecycle.

The Delta Between Emerging Company and Category Growth Trends Can Be Revealing

To frame our discussion about lower middle market foodservice investment opportunities, we ranked the fastest-growing emerging brands in the U.S. Analyzing concepts across menu categories (from Bowls and Salads to Asian to Pizza and more) and found that though many individual restaurant chains are growing fast, their categories overall are actually shrinking — meaning there were big categories back three years ago that have decreased in share or even disappeared from the rank in 2019.

Naturally, one could think this is attributable to brands outgrowing their “emerging” status, which in some cases may be true. But that still means that other (smaller) concepts are not growing at the same pace in the category as before.

This can reveal a lot about consumer preferences and trends. There are some obvious winners like Bowls and Salads (top category by sales in 2019 and also growing at a 33% CAGR), but there are also others that are not so clear on the surface (and not popular yet among the largest established chains).

It Can Be Tough to Distinguish Between Trend and Fad in Foodservice

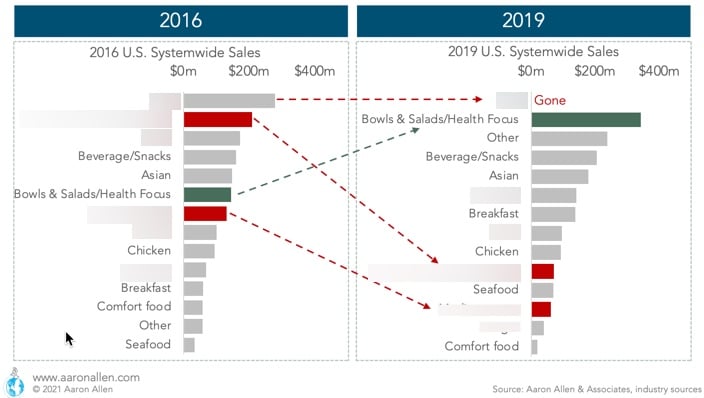

The fastest-growing small restaurant chains in the U.S. are a very diverse and high-mobility group, where the winning categories and segments can be indicative of underlying and emerging consumer trends. Three of the largest segments of 2016 disappeared or got significantly smaller three years later. Bowls & Salads/Health Focus consolidated as the biggest category over that period.

Emerging Brands and Categories Made a Total Switch Between 2016 and 2019

Decisions regarding where to invest today should not be based on what others wanted yesterday or can prove today, it’s much more about predicting what will happen in the tomorrows ahead.

Sometimes trends are like fast-moving cars. They can be deadly if you’re not watching out for them. Trends take time to develop, which is why industry expertise is needed to spot them early on.

High-Growth Emerging Brands Can Be Clever Bets

Lower middle market investors often have challenging investment target parameters, which can make it more difficult for them to find targets. They want astronomical growth and strong EBITDA but also established brands that are past the proof-of-concept stage (we’ve found out it’s easier to raise $50 million than $5 million in today’s environment).

Reality is a bit different. Large chains usually don’t have astronomical growth. We compared a sample of emerging fast-growing chains to the largest 200 restaurant chains: the median sales growth for 2019 was 26% for emerging chains (with sizes between $20 million-$50 million in system sales) and only 1% for mature, established chains.

Size vs. Growth: Emerging Chains Growing 28X as Fast as Mature Chains

Certainly, those operators and investors that entered the pandemic with a strong balance sheet are coming out the other side in an even stronger position. But it’s also amazing the unique opportunities that are starting to surface among emerging restaurant chains (not to mention foodservice technology and suppliers and distributors).

Lower middle market concepts are becoming an investment sweet spot: with valuations backed by strong growth potential and improving profitability through new technologies, this segment should provide strong returns for investors. Further, the smaller size of these enterprises makes their systems more dynamic, able to adapt more quickly than many large organizations. In the restaurant industry, where quick-change consumer preferences can transform the market in a matter of months, speed is key.

Three Questions To Ask Before Making a Lower Middle Market Foodservice Investment

Ahead of pursuing an investment in a lowe middle market asset in the foodservice sector, having answers to the below questions would be helpful:

Is the emerging brand outgrowing its category?

An emerging brand posting impressive growth numbers doesn’t automatically mean it’s a great investment. We often see “rising tide lift all boats” scenarios where a fast-growing brand is benefitting from category-level changes rather than company-specific investment attributes. Brands with longer-term potential tend to have the ability to outgrow the category even as new competitors enter the market.

Is the brand’s category a fad, or is there longer-term potential?

Separating between foodservice fad and trend is not easy, especially since it typically takes several years for a trend to take hold. Still , some indicators can still be found in a category’s year-over-year and quarter-over-quarter growth trajectories (especially breaking down growth further into transaction and average ticket). The categories that end up being fads tend to take pricing earlier on to offset sluggish transaction growth, while the categories with longer-term growth potential tend to drive a higher percentage of their growth from transactions.

Do I have the right data to manage the risks of this emerging foodservice investment?

Writing a big check can for an established restaurant brand can drive healthy internal rates of return. However, we believe investors armed with the appropriate data points about a company’s expansion plan and operations can be in a position to take on more risk and make investments in lower middle market concepts.

10 Reasons to Invest with an Industry Insider

Acquisitions typically drive one-fourth of restaurant industry growth. And there’s plenty of capital to put behind foodservice companies. But there is an even bigger opportunity

Foodservice ESG Investments: Investing with Passion and Purpose

More and more investors are considering ROIs together with purpose. Socially responsible and impact investments represent 20% of assets under management in the U.S. as

Lower Middle-Market Restaurants Hit Valuation & Growth Sweet Spot

In the world of restaurant mergers and acquisitions, big deals — like 2017’s sales of Popeyes Louisiana Kitchen ($1.8b) or Panera Bread (~$7.5b) — tend to

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $200b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.

About Aaron Allen Capital Partners

Aaron Allen Capital Partners is an investment group focused on funding the future of foodserviceTM. A consortium of esteemed restaurant industry executives, investors, and family offices, we are combining resources to solve some of the biggest pain points for the foodservice industry globally.

We back high-growth-potential restaurant companies and foodservice technology enterprises and find a home where smart money can realize top-quartile returns while helping the industry advance.