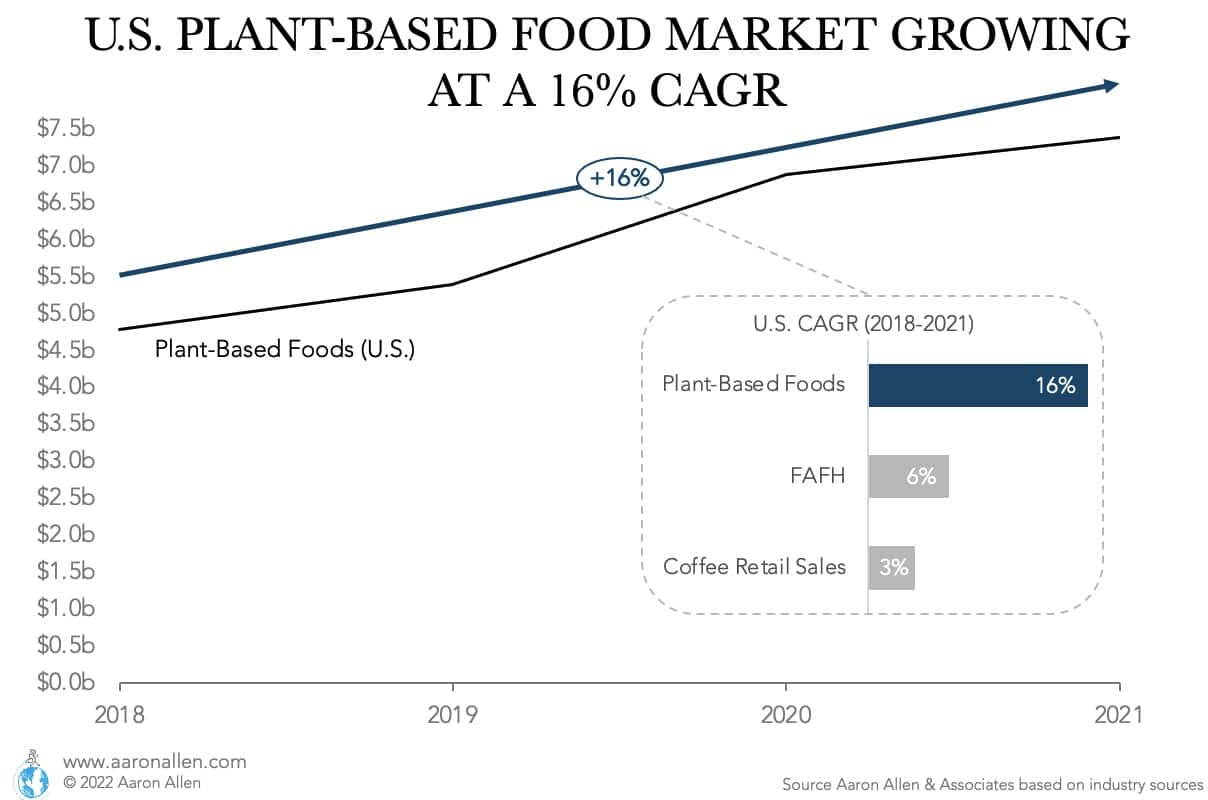

Plant-based foods and alternative proteins have seen incredible growth over the last few years. In the U.S., the plant-based food market has been growing at a 16% CAGR (2018–2021) — more than twice the growth of foodservice (6% CAGR) and more than four times the growth of coffee (3% CAGR).

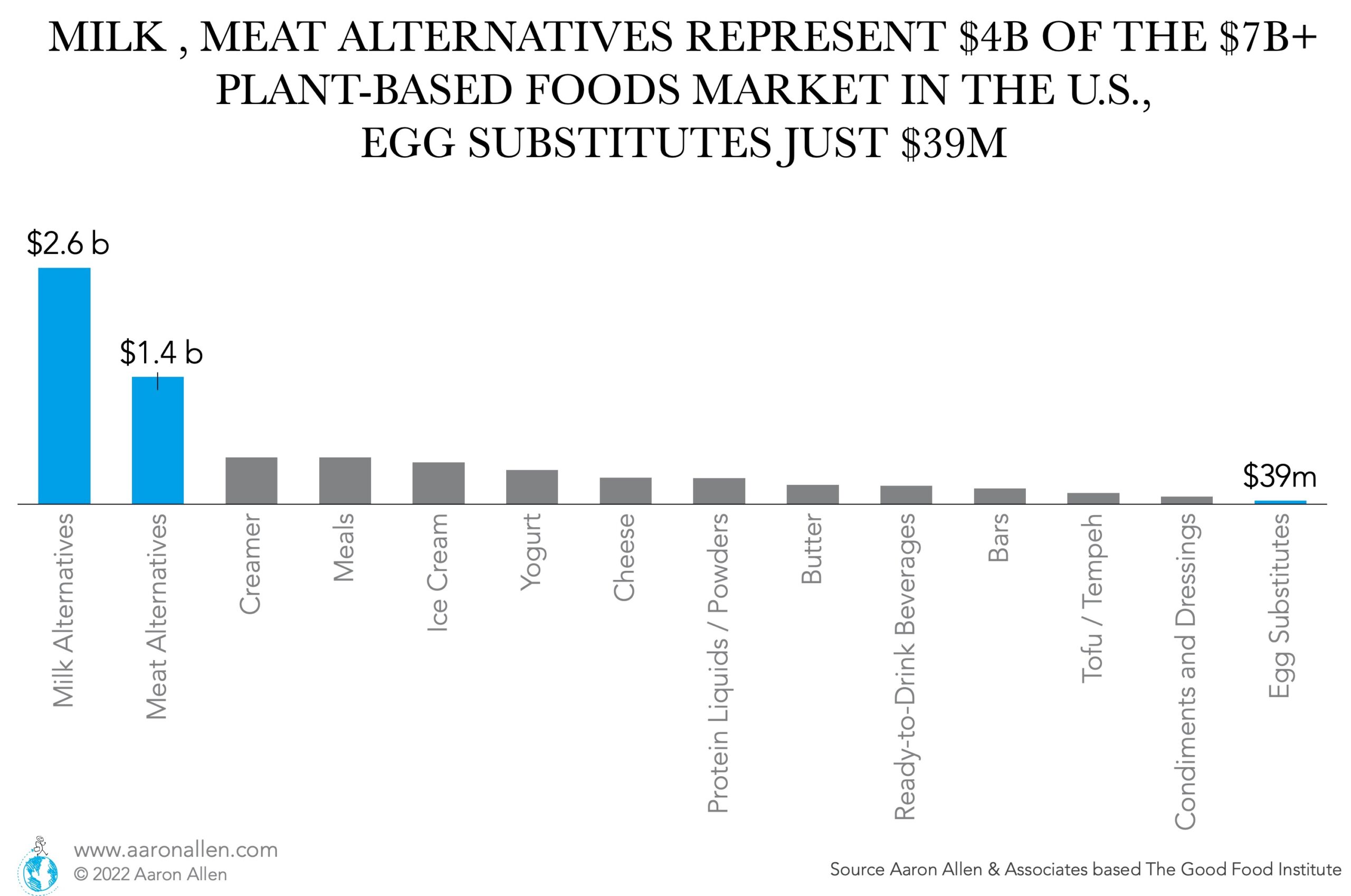

With many consumers looking for healthier alternatives and to replace meat in their diets (a recent report indicates that 40% of consumers are purchasing dairy alternatives or plant-based proteins, and plant-based offerings in restaurants were estimated to save 700,000 animals in 2021), we expect to continue to see these levels of growth over the mid-term. As of 2021, the total addressable market in the U.S. for plant-based food was reaching the $7 billion mark.

Whether you are a restaurant chain looking for ways to innovate the menu and bring more frequent or new visits, an investor hedging bets on what plant-based companies will lead the segment, or a supplier looking to sell into restaurants, here are some of the most important plant-based trends impacting the foodservice industry.

Plant-Based Meat Alternatives in a Test Phase in Restaurants

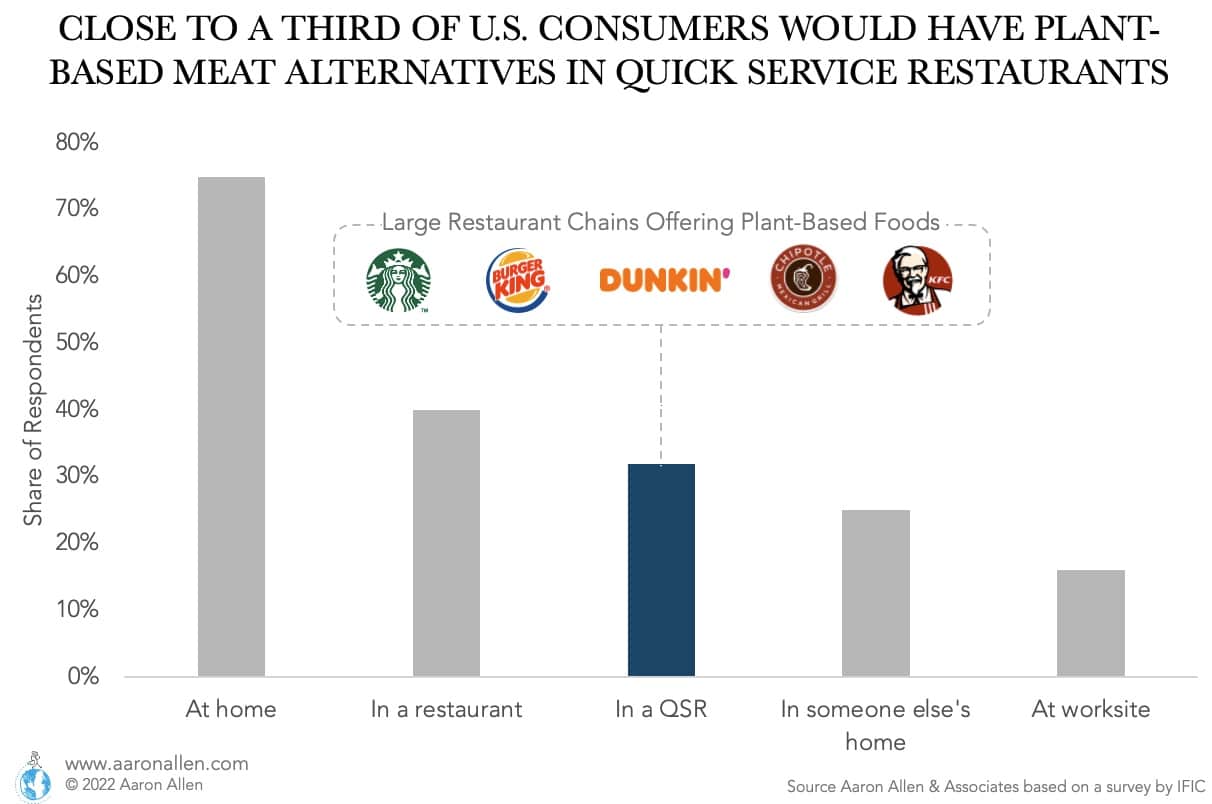

Close to one-third of U.S. consumers say they would order plant-based meat items in quick-service or fast-casual restaurants. This number is quite significant compared to the number of chains actually offering plant-based alternatives. Burger King offers the Impossible King and is testing plant-based chicken, Chipotle offers plant-based chorizo, and KFC offers Beyond Fried Chicken — in addition to Starbucks and Dunkin’ offering non-dairy, plant-based milks.

The list is longer for those testing plant-based meat alternatives that didn’t make it to the mass market. McDonald’s discontinued the McPlant in the U.S., Wendy’s tested a black-bean burger, Pizza Hut offered a Beyond Meat pizza but it’s no longer available.

Are you a plant-based producer or supplier looking to get a foothold in the foodservice industry?

Plant-Based Chorizo in Chipotle’s 3,000+ Restaurants

In 2022 Chipotle added plant-based chorizo to its menu (for a limited time). Customers could choose to have plant-based chorizo in their bowls. This was the second vegan protein to go national at this restaurant chain (the first one was tofu-based sofritas back in 2014, which are now a regular menu item). Unlike other chains that outsource R&D, the plant-based chorizo was developed by Chipotle’s culinary team.

Like most large limited-service restaurant chains, Chipotle first run a test in two markets (Denver and Indianapolis) in 2021 before launching at a national level. The company has a stage-gate process in which it sets up a pilot and monitors consumer feedback to then decide to extend the offer to other restaurants.

Some statistics indicate that 12% of restaurants serve chorizo in some form.

With this market, Chipotle is not the only one betting on plant-based chorizo:

- Abbot’s Butcher is made of pea protein, paprika, salt, and olive oil

- The Beyond sausage is a brat that was created with the intention to mimic pork, it also has pea protein as one of the main ingredients

- Trader Joe’s offers a vegetarian soy chorizo

- Tattooed Chef sells a frozen breakfast burrito with plant-based chorizo

- Hungry Planet and Rollin Greens sell plant-based ground chorizo (chub)

Plant-Based Burgers Are Part of an Industry Growing at a 20% CAGR

Estimates for the plant-based burger market range from $1.5–$2.7 billion globally, as of 2021, and the plant-based meat industry is growing at an outstanding 20% CAGR. The two most well-known brands are Beyond Meat and Impossible Foods, but these were not the first in the market. Other players are Maple Leaf Foods, Conagra, and Morningstar Farms.

Several restaurant chains have plant-based burgers on their menus, or have at least tested them. Some examples include:

- Burger King was among the first QSR chains to offer a plant-based burger, the Impossible Whopper has been on the menu of more than 7k restaurants since August 2019

- McDonald’s discontinued the McPlant (a creation in partnership with Beyond Burger) in the U.S. after launching it in early 2022 (attributed to a lack of sales)

- Wendy’s tested a black-bean burger

- Carl’s Jr. introduced a Beyond burger on its menu in December 2018, a meatless Famous Star

- White Castle launched the Impossible slider in January 2019, after tests in three regions resulted in a 250% market share increase over the locations that did not have this menu item

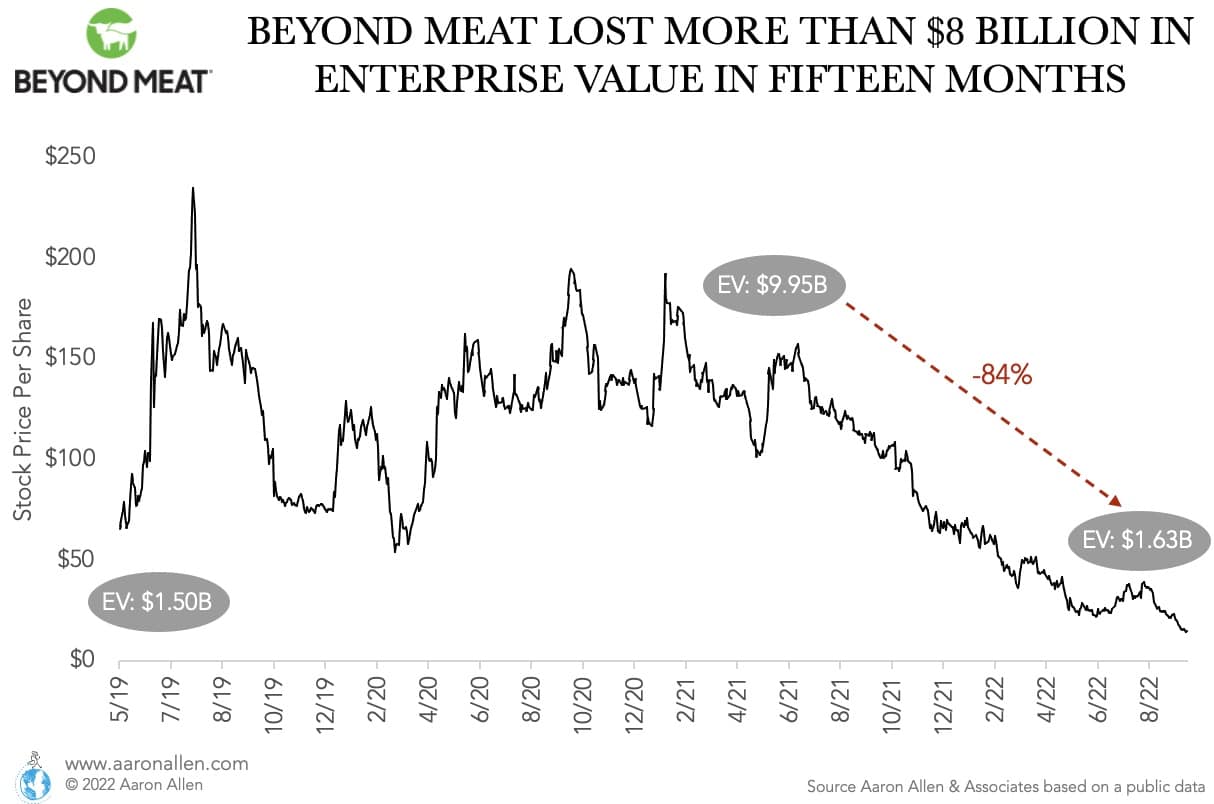

Despite the rising popularity of plant-based burgers, not all suppliers are performing very well. Beyond Meat, for example, has lost more than $8 billion in market capitalization in 15 months.

The timing of the decline coincides with some chains like McDonald’s discontinuing the McPlant (in August 2022) but most important efforts to make the product cheaper failed and retail orders dropped. The company dismissed 4% of its workers in August. Currently, revenue for 2022 is at $460m and about three-quarters of sales are in wholesale with about a quarter of sales being in foodservice.

Other companies like Memphis Meats and New Age Meats are experimenting with lab-grown meat. These are not plant-based meat replacements, but could also be a significant part of the movement away from animal agriculture.

Are you an investor looking for a better understanding of the market, players, and potential in the industry?

Restaurant Chains are Just Starting to Dip into Plant-Based Breakfast

There are a few alternatives for plant-based breakfast and restaurant chains are taking notice.

- Starbucks offers an Impossible sausage breakfast sandwich with plant-based egg and cheddar (completely vegan)

- Peet’s Coffee has an everything vegan plant-based sandwich

- Dunkin’ offers a Beyond breakfast sandwich (not fully vegan, as it comes with eggs and cheese)

Plant-Based Sausage Market Is Growing Steady

The global plant based sausage market was worth roughly $4.3 billion in 2020, and is expected to grow to $8.3 billion (at a 11.3% CAGR) by 2026. Leading players in the space include Beyond Meat (offering patties and links in original and spicy flavors), Impossible Foods (which sells ground sausage, patties, and links in a variety of flavors), and Morningstar Farm (owned by Kellogg, offering crumbles, patties, and links). More than 39% of global plant-based sausage sales took place in North America, with a boost in consumption coming behind the Coronavirus pandemic-related shutdowns of traditional meat processing plants.

Many restaurants have been trying plant-based sausages on their menus as a vegetarian-friendly option. Some of the top examples include:

- Jamba sells Imposisble sausage sandwiches as a part of their “fuel-good” menu

- Pizza Hut launched a test of Beyond Meat Pizza in select markets, which was subsequently discontinued (though it does still feature a Beyond MEat menu

- Cracker Barrel made headlines when it added vegan sausage (from Impossible) to its menu across all 600+ of its locations, with some vocal customers posting on social media about how they did not think the move was aligned with the brand’s clientele (alleging “wokeness”)

Plant-Based Pizzeria Trends Starting to Emerge

The pizza industry sells $160 billion worth of pizza in the world every year. And while not every pizzeria has a vegan option, some plant-based pizza alternatives are starting to come onto the scene:

- The vegan cheese market size is currently surpassing $2 billion and is expected to grow double digits over the next few years

- According to a survey, one in every five consumers are choosing cauliflower-based crusts

- According to a survey, almost 80% of consumers prefer sausage as a topping — even though this is a high figure, the new plant-based sausage alternatives will appeal to many

- In 2021 Little Caesars launched a plant-based pepperoni (the PlanteroniTM) in partnership with Greenleaf Foods Field Roast (the test was focused in five markets)

Consumers looking for lower-carb or Keto-friendly options would also find the cauliflower crust options to be attractive.

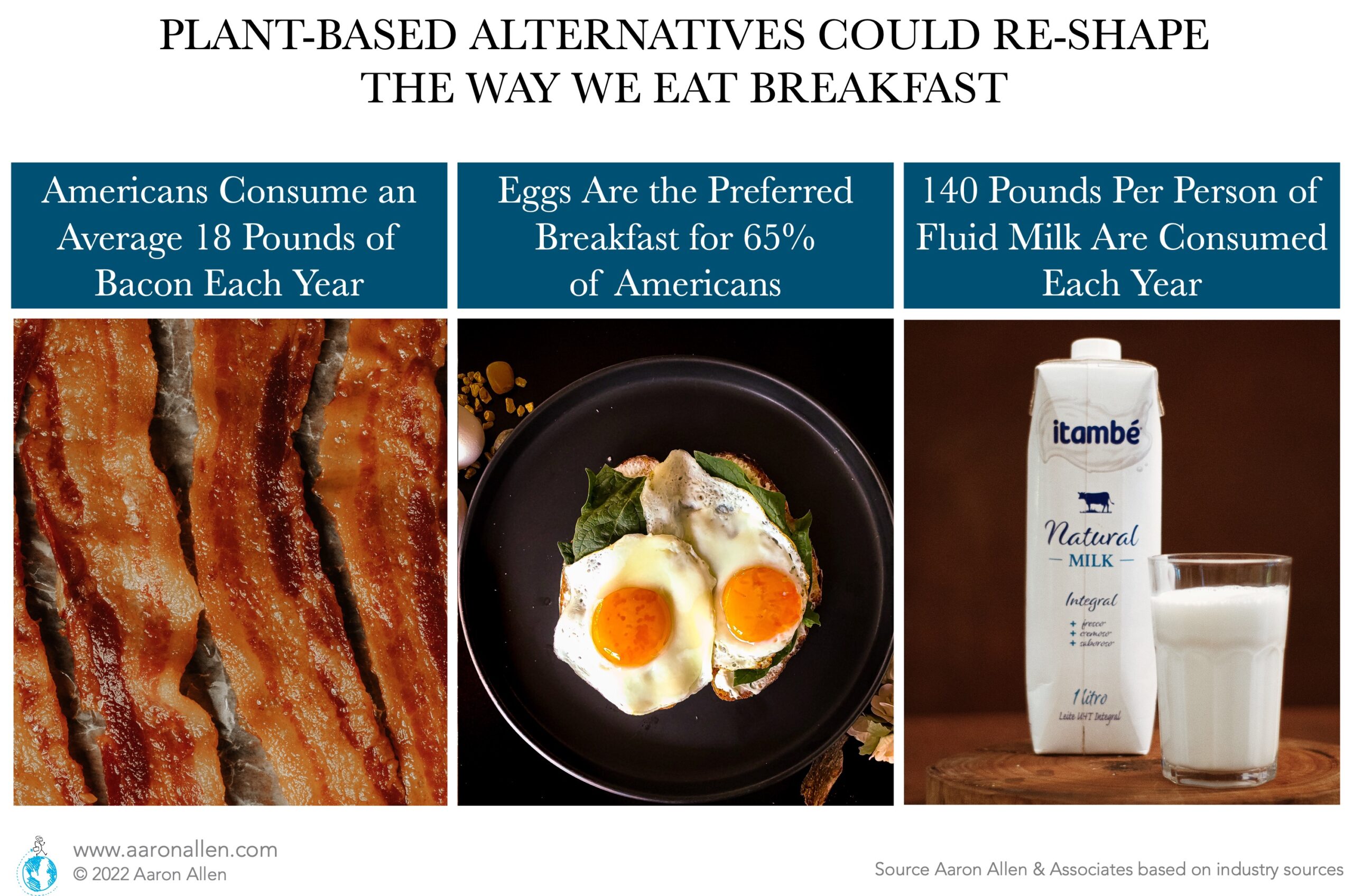

Plant-Based Bacon Could Help American’s Health

The average American consumes 18 pounds of bacon every year. Bacon has been known to be used as one of the most effective add-ons to traditional menu items (and even in cocktails) by restaurants to improve profitability — some estimates indicate that more than 80% of restaurants have bacon on their menus in one way or another.

There is naturally much debate about whether plant-based bacon tastes like the real thing. Notwithstanding, some restaurant chains are already embracing the trend:

- For a six-month trial that started in mid-2022, Burger King’s veggie steakhouse burger has La Vie’s vegan bacon made of soy and konjac in 500 restaurants in France

- Umaro Foods, a plant-based bacon formulated with seaweed protein, launched in 2022 in a few high-profile restaurants including Sorrel Restaurant, Egg Shop, and D’Andrews Bakery and Café

- Bareburger is an ethical-eating chain based in NYC with 30 plus locations that offers tempeh bacon

The Growing Plant-Based Chicken Trend in Restaurants and Retail

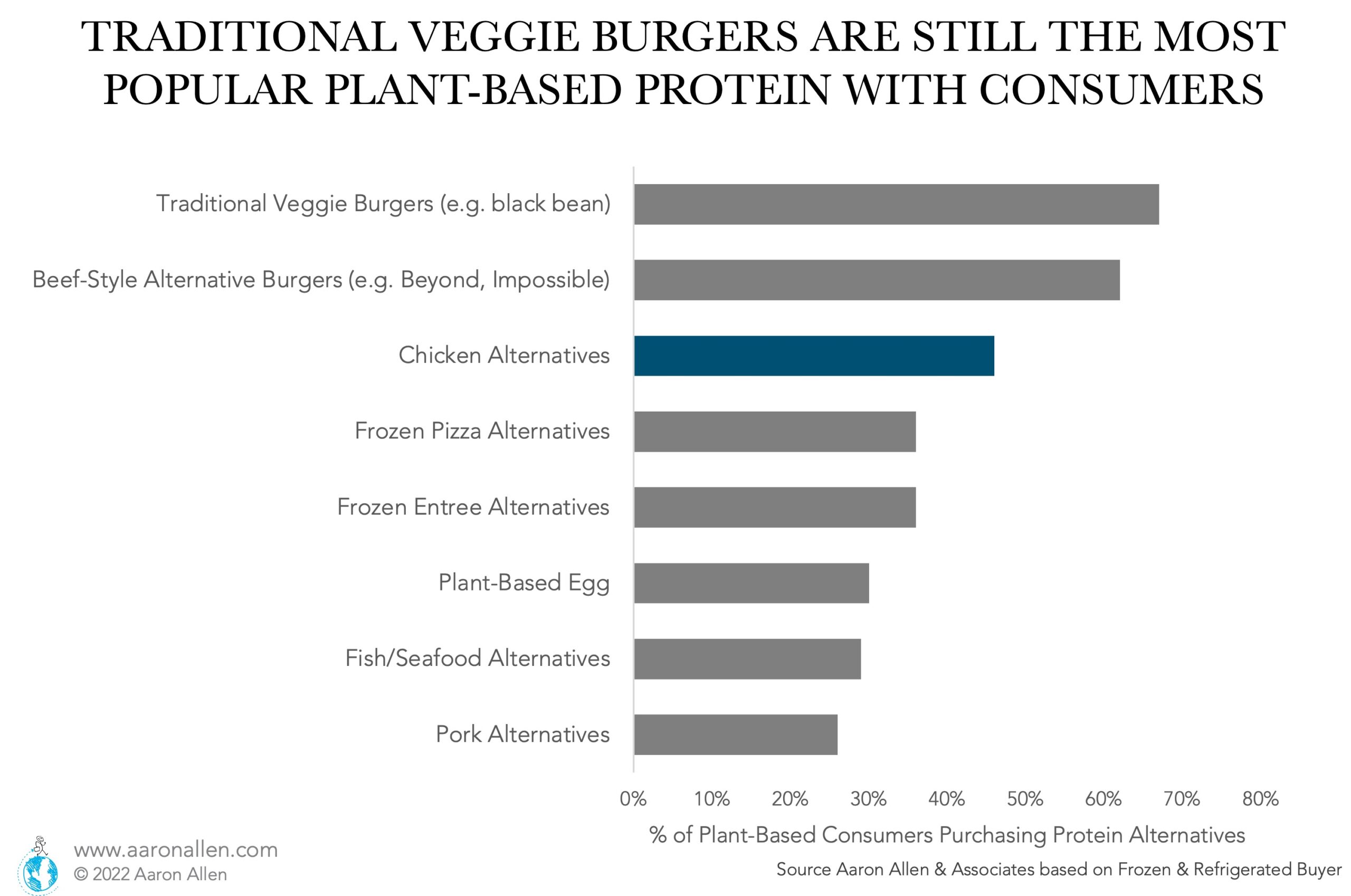

Plant-based chicken is the third-most-popular meat alternative purchased by consumers in the U.S. (behind traditional veggie burgers and other beef-style alternatives).

In early 2022, KFC re-launched their Beyond Fried Chicken nuggets as a limited-time offer, in either a 6- or 12-piece option. KFC does caution that the nuggets are cooked in the same oil and fryers as their traditional chicken, so the plant-based option is not marketed as fully vegan or vegetarian, but does provide an alternative offering still featuring the brand’s famous “11 herbs and spices.”

Some other plant-based chicken being featured in restaurants include:

- Slutty Vegan, based in Atlanta, GA with 7+ locations, offers Incogmeato chicken on it’s Chik’n Head™ sandwich (they also offer Beyond Chik’n Tenders on their menu)

- Project Pollo is a fully plant-based QSR chain offering TiNDLE chicken made from plants along with other plant-based offerings (the company recently took on investment from former McDonald’s CEO Steve Easterbrook and has plans to be at 100 locations open by 2025)

Plant-Based Eggs Market Growing 27% Year-over-Year

It’s not just meat protein with plant-based competitors. The global plant-based egg market is expected to grow at a 27% CAGR, up to $800 million in value by 2027 (from $148 million in 2020). More than 95 billion eggs are eaten in the U.S. every year, and plant-based egg substitutes in the U.S. represent just $39 million in sales currently.

Companies like Yo! Egg (which offers the first plant-based egg substitute that can be poached or served sunny-side-up) and JUST Egg are expanding into the restaurant industry along with retail aisles. Egg is the second most common cause of food allergies in children and among the most common allergens in the general population, so plant-based substitutes can be a great offering for this group of consumers (among others).

Plant-Based Baby Formula: Another Allergen-Friendly Target Market

Speaking of common food allergies in children, cow’s milk is the leading culprit. There are plant-based and vegan baby formulas on the market that are entirely dairy-free (often soy-based) that offer a great alternative to the more common cow’s-milk derived formulas. With as much as 65% of the population developing some type of lactose intolerance at some point in life, the plant-based formulas can be helpful to avoid potential issues in the future, as well as (arguably) be better for the environment and a family’s carbon footprint.

Many Categories in Plant-Based Dairy Alternatives Still to Bloom

With an estimated nearly $3 billion in U.S. annual sales (and a global TAM of $21 billion), plant-based milk is the category that has been developed the most in the plant-based industry. This category includes almond, soy, and oat milk are common choices in homes and coffee shops.

The Danone Group is the leader in plant-based milk in the U.S. Other key players are Plamil Foods (UK-based), Hain Celestial Group, Sahmyook Foods (South Korea), and Earth’s Own Food Company. And there are plenty of categories yet to be explored — particularly with a more foodservice focus.

Consumers More and More Inclined to Plant-Based Coffee Creamer

Non-dairy creamers are a market valued at close to $2 billion as of 2022 globally and growing in the high single-digits. The largest share of non-dairy creamers is for almond-based creamers, followed by coconut, and soy. Liquid creamers dominate sales over powdered creamers.

Some of the most popular plant-based coffee creamers are the Chobani plant-based creamer, Silk Almond Creamer, Califia Farms, Nut Pods, Laird, and Oatly!

Plant-Based Buttermilk Offering a Vegan Alternative

Vegan buttermilk is a relatively new concept, as most people wanting a plant-based substitute for buttermilk would have to make it themselves from another plant-based milk substitute. Mill It! was the first plant-based buttermilk that is a 1-to-1 substitute to the real thing and can be used in smoothies, pancakes, biscuits, and sauces.

Plant-Based Butter (No, It’s Not the Same as Margarine)

During the heyday of the 1990s anti-fat fight, butter was widely considered public enemy #1 amongst dietitians. Margarine became a fan favorite substitute because it was lower in saturated fat (2 g in a tablespoon of margarine versus 7g in the same amount of butter) and cholesterol (0mg compared to 30mg, respectively). As science evolved, the level of trans fats in margarine became a concern, and recommendations evolved back to “butter is better” — but all things in moderation.

More recently, plant-based butters have become more popular. While margarine can still have traces of dairy, plant-based butters are fully vegan — derived from some type of plant oil (olive, avocado, and coconut are popular) combined with water. The health and nutrition aspects of the plant-based butters on the market are relatively comparable to butter (with fewer saturated fats), with bigger benefits deriving from environmental impact and allergen-friendliness.

Plant-Based Ice Cream Giving a Sometimes Healthful Alternative

Globally, the vegan, or plant-based, ice cream market is expected to grow at a CAGR of 13.7% through 2027 to reach an estimated $805.3 million.

The most common consumer-centric plant-based ice creams are made from either a base of soy, almond, cashew, coconut, or rice milk. Some of the popular brands lining supermarket shelves include Wicked Kitchen, Oatly, Mauna Loa, and even mainstream “traditional” ice cream brands like Breyers which introduced a non-dairy frozen dessert in four varieties.

Plant-Based Will Continue to Grow at a Supercharged Pace

Hight costs for production that translate into a higher final price than animal proteins is the biggest issue non-dairy companies face when trying to reach mass adoption. On the other hand, consumer trends away from animal proteins, and the possibility of new flavors and healthy ingredients are pushing the growth in the global market.

The growth rates seen in the plant-based category are something rarely seen in the restaurant industry, matching the growth in tech.

- The challenge for restaurant operators is to find reliable partners that will offer a high-quality product without compromising the supply chain.

- The issue for investors is to identify in which plant-based categories to invest, when to do so, and who are the players most likely to have steady and fast growth (avoiding the risk of swings like we’ve seen for Beyond Meats).

- For suppliers, the challenge is in the capabilities to unlock the value of the foodservice industry, develop legitimate business plans for investors, and generate the right amount of coverage and publicity (and at the right time).

Frequently Asked Questions on Plant-Based Alternatives

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.