In the wake of the coronavirus pandemic, there is going to be a spectrum of opportunity for restaurant acquisitions available for operators and investors alike. A myriad of distressed assets will lead to more consolidation and fewer, stronger players coming out the other side.

Savvy investors can look at this time of uncertainty as an opportunity to broaden the landscape of potential attractive acquisitions. While some may be moving into this scenario opportunistically — smelling blood in the water — the most successful are realizing that this can be the perfect timing for a mutually advantageous acquisition to optimize portfolios and gain market share.

We are seeing a variety of opportunities across geographies, categories, cuisines, and phases of the business lifecycle. And just as hunters do not wait until they’re hungry to go out hunting, preparing for this flurry of investment activity ahead of it kicking off lays the foundation for a successful hunt.

The Silver-Lining Investment Thesis for the Restaurant Industry

Once travel restrictions are lifted from the coronavirus lockdown, the M&A fever will be catching across geographies, cuisines, categories, and ownership types — and burning white-hot from foodservice tech startups and corporate venture capital initiatives to budding emerging brands and the consolidation of mature and distressed brands around the world.

We think foodservice-related investments can be grouped into one of three types.

- Distressed and Dislocated Restaurant Assets: Businesses that have been hit hard by the pandemic and are struggling to stay in business, some of which should be saved. On the sell-side, this presents an opportunity to find the right partner who will stay loyal to your brand, employees, and guests. For buyers, these businesses will likely be able to be purchased at a discount given current market conditions.

- Backing & Growing Strong Foodservice Operators: Chains with high growth potential and a strong balance sheet that could use cash to back further expansion. The advantages of having liquidity during a recession include the ability to recruit the strongest talent, get prime locations (often with better lease terms), and gain market share (often at the expense of competitors who cannot afford the necessary investments).

- The Future of Foodservice: Answering the question of “what does the industry look like in a post-coronavirus world?” — what categories, operators, and concepts will be the beneficiaries of changes impacting the industry? And what companies are spearheading this change? Innovations that were already in place will be accelerated with COVID-19 serving as the catalyst for the adoption of change.

Some investors could be interested in all three buckets, or in certain angles of just one. There is going to be capital that wants to operate and knows how to integrate well into existing platforms, but there are others who need specialized expertise to manage a new system (that may even be in a different segment, category, or geography). The best data and advisors can help with each or all investment buckets and to propel organizations and investors forward.

What are the Benefits of Restaurant Acquisitions, Consolidation, and Minority Investments?

Special Considerations for Restaurant M&A in Recessions

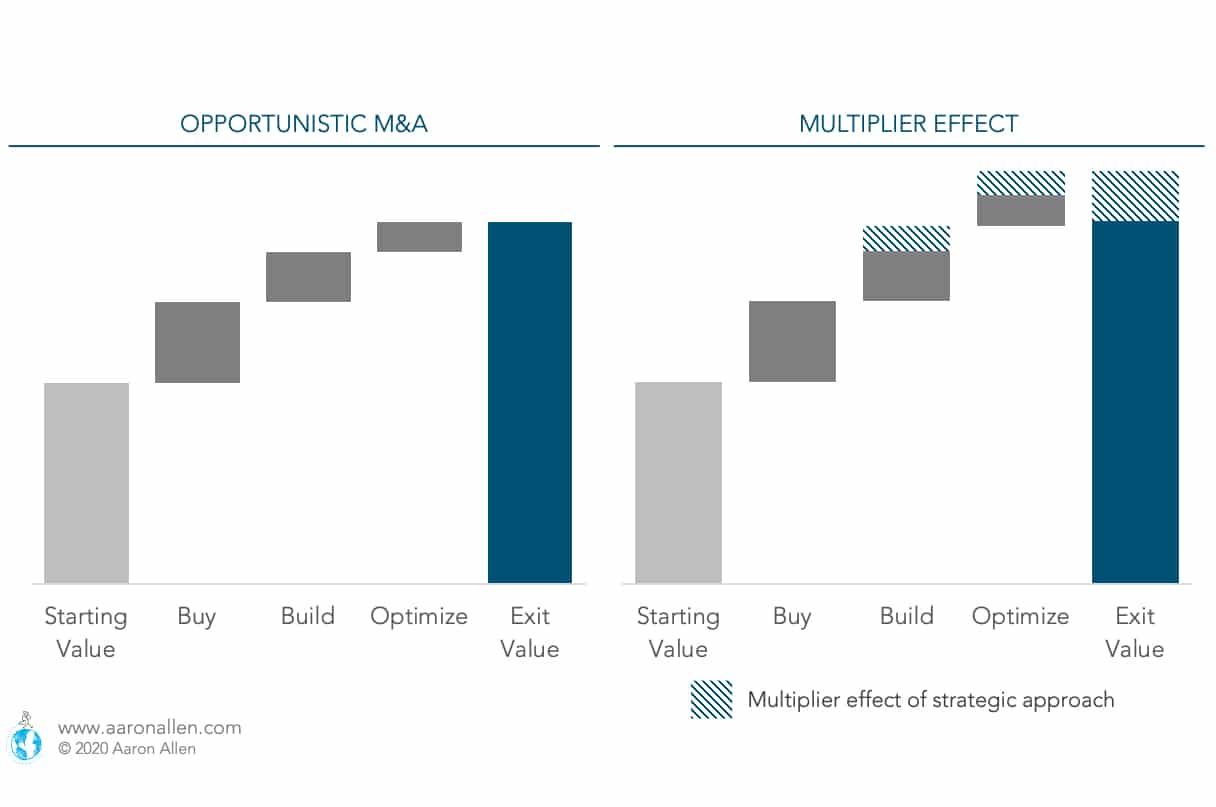

In the post-COVID-19 economic climate, foodservice investors will need to re-think and modernize the investment thesis. Long-term returns on opportunistic and reactive M&A will fall short compared to a strategic approach that achieves a multiplier effect at exit.

We expect to see the following:

- Valuations take haircuts (especially for distressed companies) though bidding wars may increase premiums for key restaurant acquisitions

- But because of the large amount of dry powder and availability of cheap capital, the drop on valuations may not be as large as in previous downturns

- There’s more room to enhance enterprise value and get favorable terms in the exit (improving performance for a company with a low bottom line is easier than that of a highly profitable business)

- Bolt-on acquisitions are more prevalent

- We expect even more emphasis on tech acquisitions (and funding via Joint Ventures) to accelerate go-to-market and product pipelines

- Projections for liquidity and capital requirements to revamp restaurant businesses will be troublesome and require industry-specific expertise (no more investment-banker models without operational input when extrapolating past growth rates)

- Restaurant mergers being used to trigger a transformation (from restating the vision and mission to portfolio strategy, new revenue centers, and approach to the supply chain)

Working with Specialized Advisors for Restaurant Acquisitions

There are a lot of moving pieces and parts when it comes to making a successful restaurant acquisition. And the companies that are most successful in their efforts are those that hire talented and experienced advisors, versus doing everything in-house.

Buy-Side: There’s a need for legal, financial, technological, and operations expertise. And while many restaurant companies have much of this in-house — or even may have gained the talent and IP in these areas through the acquisition process — it’s often overly taxing and a burden to the system when going through an acquisition on top of building out and making more efficient the existing operations.

Sell-Side: Whether taking some chips off the table by divesting a few units, bringing on a partner, or even a full sale of the business, expert advisors can help find the right investor, guide and accelerate the investment process and give a second opinion on what’s a fair valuation.

Seeking out new opportunities can be greatly benefitted with a partner to help lighten the load — particularly when that partner has specialized expertise across functional areas critical to the M&A landscape.

There’s plenty of capital to put behind foodservice companies, but what not everyone is seeing yet is just how much more the performance of the industry, experience for the guest, and returns for investors are shifting between segments, categories, cuisines, geographies, and formats. Some that are not even on the radar right now (or that have a strong base to pivot in the right direction) will jump to very large valuations in the next few years.

Those leveraging the best insights, expertise, and representation to build a modernized and globally oriented F&B investment thesis are set to lead (and even create) foodservice segments and categories.

Now Is the Time To Act

We help middle-market foodservice companies and investors as both buy- and sell-side M&A advisors. Our clients include restaurant chains, foodservice technology providers, and alternative foodservice formats. We also specialize in multinational, multi-brand portfolios, and cross-border transactions.

Going beyond the three financial statement models to identify and unlocked trapped potential and value-accretive opportunities by building a perspective from the most granular-level data to the big picture of a global marketplace, we apply a data-driven, analytical process combined with deep and specialized foodservice industry experience and expertise.

Our restaurant and foodservice industry M&A advisory services include:

- Investment Thesis Ideation

- Market Landscape Scanning

- M&A Readiness Assessment

- Investor Presentation Development

- Deal Sourcing and Target Identification

- Commercial Due Diligence

- Operational Due Diligence

- Value Creation Strategies

- Post-Acquisition Integration

- Board and Management Installation

- Growth and Expansion Planning

- Go-to-Market Strategy

- Performance Optimization

- Portfolio Planning and Rationalization

- Operating Partnerships

- Board Participation and Advisory

About Aaron Allen & Associates

Aaron Allen & Associates is a global restaurant consultancy specializing in brand strategy, turnarounds, and value enhancement, and accelerating the future of foodservice. We have worked with a wide range of clients including multibillion-dollar chains, hotels, manufacturers, associations, and prestigious private equity firms.

We help clients imagine, articulate, and realize a compelling vision of the future, align and cascade resources, and engage and enroll shareholders and stakeholders alike to develop multi-year roadmaps that bridge the gap between current-state conditions and future-state ambitions. Learn More.