Despite the recent struggles of some pockets of the restaurant industry, steakhouses have provided a bright spot in even the most dismal dining segments. While many Casual-Dining chains struggled, casual steakhouses came out on top. Fine-Dining chains (many of which are steakhouses) saw an uptick in sales, too.

Steakhouses and high-end restaurants tend to be less volatile to swings in the economy. Even when times are tough, people still celebrate special occasions (and the frequent visitor to a high-end steakhouse will likely cut consumption less than other consumers). The first quarter of 2014, for instance, offers just one example of that. That was when Del Frisco’s Restaurant Group saw revenues increase 11.4%, to $66.6 million, and same-store sales pop 1.6% on a calendar basis. The strength, said CEO Mark Mednansky, came from positive same-store sales at Del Frisco’s Double Eagle, the company’s fine-dining chain. The company’s other two more casual chains, meanwhile, suffered that same quarter.

In short, steakhouse restaurant sales in the U.S. offer a (pardon the pun) prime example of the opportunity remaining in the foodservice industry. Below, a look at how steakhouse restaurant sales stack up.

THE BIGGEST STEAKHOUSE PLAYERS CONTINUE TO INCREASE SALES

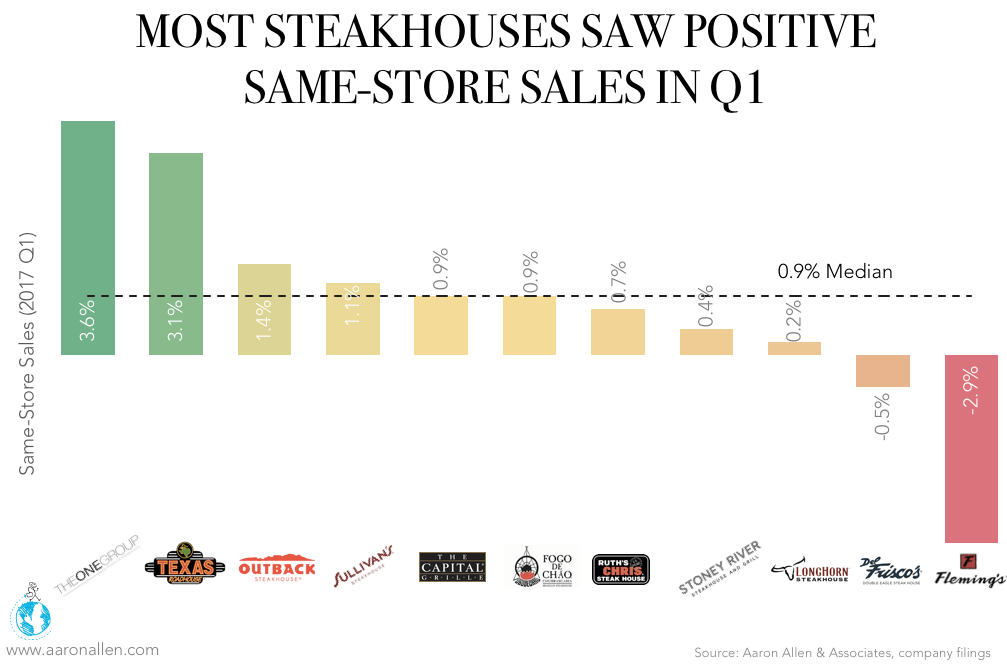

Most publicly-traded steakhouse chains managed to escape the declining same-store sales witnessed by many others in the Casual Dining segment during the first quarter of the year. In fact, steakhouse restaurant sales were largely positive. The ONE Group (STK’s parent company), for instance, experienced the greatest growth. Fleming’s was not quite as fortunate, registering a 2.9% decrease.

Texas Roadhouse’s second-quarter 2017 results (released in June) proved that the company has done a better job weathering the storm brought on by quick-service and fast-casual operators than some of its competitors in the Casual Dining Restaurant (CDR) space. A loyal customer base helped ward against poor sales, too, with revenue climbing 11%, outpacing the forecast of 10% growth. Net income went up 12%, to $37.6 million, right in line with what many investors had anticipated.

The company’s increased sales are spurring on its expansion, with seven new company-owned restaurants opening their doors during the quarter (bringing the total number of locations to 535, including locations in six countries outside the US).

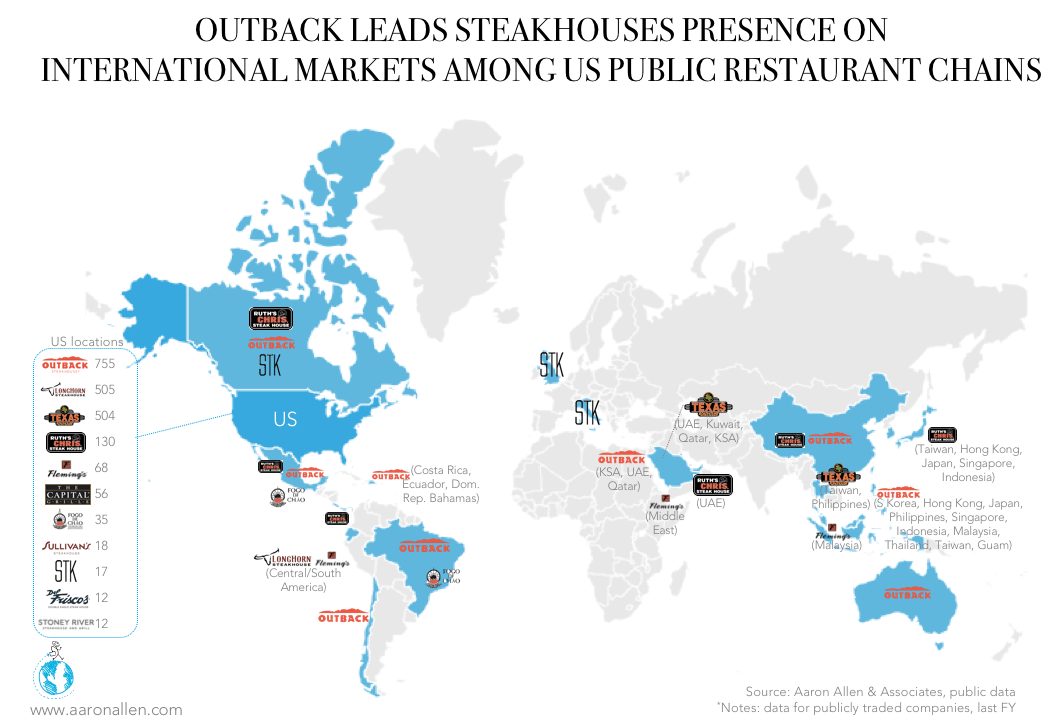

Public U.S. steakhouses are betting on international markets. Among eleven steakhouses brands owned by public companies, only four don’t have locations in other countries. With nearly 300 locations, Outback has the largest presence in foreign markets — Brazil, Hong Kong, and South Korea being the primary international markets for the chain. Texas Roadhouse, on the other hand, concentrates its international presence in the GCC (where its lead by international franchise operator Alshaya).

STEAKHOUSE RESTAURANT SALES CONTINUE TO CLIMB, EVEN AS OTHER SEGMENTS SUFFER

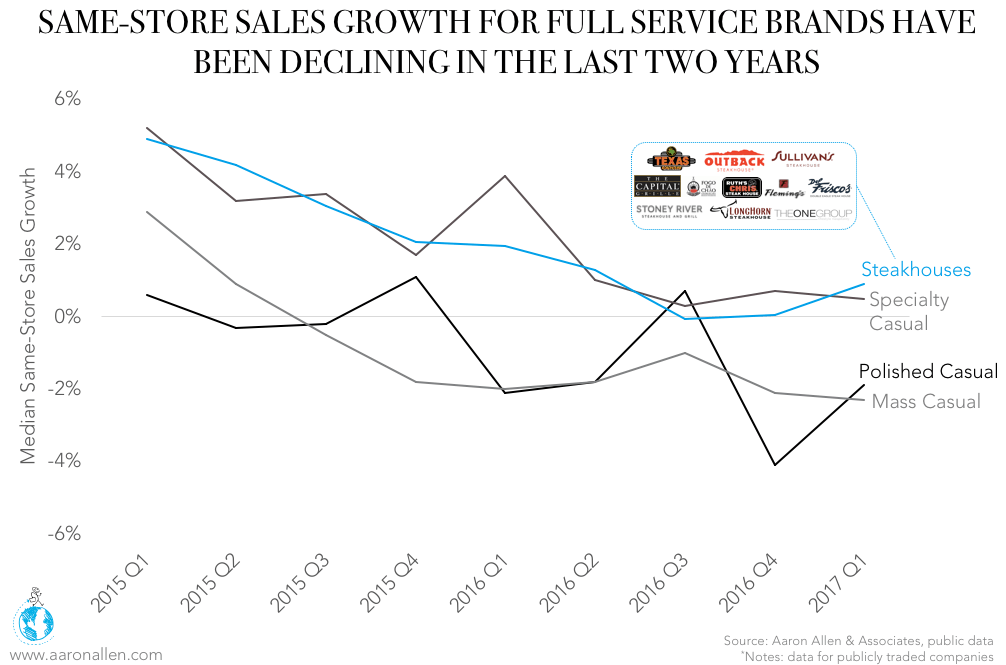

Overall, steakhouse restaurant sales continue to grow (the median growth of same-store sales has been 0.9% in the first quarter of the year), especially when compared to Polished- (those blurring the line between casual and fine-dining) and Mass-Casual concepts (including Darden, Bloomin’ Brands, Cracker Barrel, etc.), both of which are experiencing decreasing same-store sales close to 2%.

Same-store sales growth for full-service public restaurant companies has been declining over the last two years (as witnessed by the large number of recent bankruptcies.) However, many of those headlines fail to take into account that not everyone is suffering. In fact, those in the Steakhouse and Specialty Casual segments are still maintaining positive growth (a reminder to investors that the segment and concept in which to invest requires proper research and thorough due diligence).

EMERGING STEAKHOUSES SHOW GREAT POTENTIAL

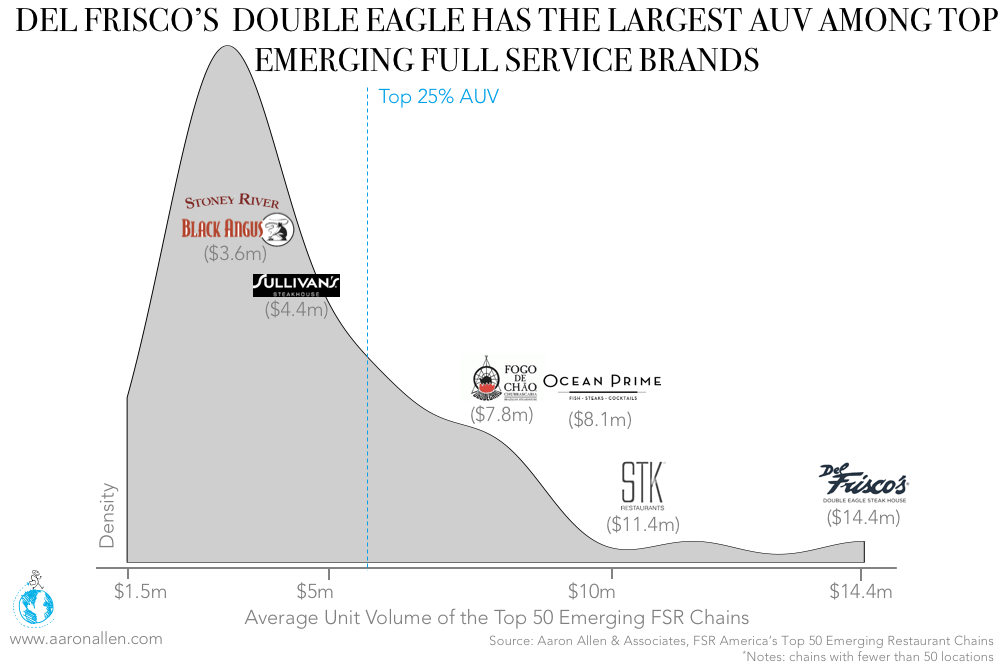

Within a ranking of the Top 50 Emerging Full-Service Restaurant Chains (a list published annually by FSR Magazine), at least seven of the emerging brands are steakhouses, and many are among those with highest average unit volumes. Del Frisco’s Double Eagle Steak House achieves the highest AUV at $14.4 million — 26% higher than the second-highest in AUV, STK, also a steakhouse and almost 20% higher than that of Fogo de Chao and Sullivan’s combined.

Among these, Fogo de Chão (with 48 units making 2.3 times the sales of the second-largest emerging chain, The Greene Turtle, with 46 locations) tops the list for sales and has also been pegged by analysts as a stock to watch. Canaccord analyst Lynne Collier recently listed the chain’s stock as one for investors to consider over the next six months. The Brazilian steakhouse chain, which specializes in fire-roasting high-quality meats using the churrasco technique, recently implemented a remodeling program, including menu innovation, daypart expansion, the introduction of value platforms, and a re-imaging of restaurants. The company has said it expects that program to provide a revenue boost of some 2-3% on average.

Of course, there remain challenges on the horizon. Labor costs, for instance, will of course impact sales — but just how much remains to be seen. Even after posting positive sales for the first half of 2017, Texas Roadhouse President Scott Colosi told investors that further growth was hindered by labor inflation (some of which was attributed to changes the company made to avoid being negatively affected by potential overtime rules).

HOW EMERGING STEAKHOUSE BRANDS COMPARE

There are seven steakhouses among the top 50 full-service emerging brands. Fogo de Chão leads in sales ($288 million in 2016), with Del Frisco Double Eagle coming in second in terms of steakhouse sales ($167 million). Especially interesting is that Del Frisco has only 30% as many locations as Black Angus Steakhouse, yet makes about the same amount of sales.

A look at how the emerging names stack up, by the numbers:

Stoney River

Owned by J. Alexander’s Holdings, Stoney River is an upscale steakhouse concept, specializing in hand-cut steaks and gourmet entrees. It currently has locations in seven states in the US, including Georgia, Illinois, and North Carolina.

Average Unit Volume: $3.6 million

Check Average: $45.99

Sullivan’s Steakhouse

Part of the Del Frisco’s Group, Sullivan’s specializes in hand-cut steaks, seafood, signature cocktails and live music at each of its 19 locations in the US.

Average Unit Volume: $4.4 million

Check Average: $100

Fogo de Chão

Founded in 1979 (though the first American restaurant didn’t debut until 1997), Fogo de Chão is a fine dining, full-service Brazilian steakhouse or churrascaria. Fogo de Chão currently operates some 35 locations in the US and 12 locations in foreign markets (Brazil and Mexico).

Average Unit Volume: $7.8 million

Check Average: $59.50

Ocean Prime

Specializing in both seafood and steaks, Ocean Prime currently owns 14 locations from coast to coast, with the original location, Mitchell’s Ocean Club, in Columbus, Ohio. The company is currently solidifying plans for continued expansion into cities including Boston and Chicago.

Average Unit Volume: $8.1 million

Check Average: $100

STK

STK blends a high-end steakhouse with a New York City lounge, operated by The ONE Group. As of April 2017, ONE owned and operated 11 restaurants; managed 13 restaurants and lounges under management agreements; and licensed one restaurant, with locations in the US and Europe. The company does not yet franchise its restaurants (Ruth’s Chris, by comparison, franchises roughly 53% of its restaurants).

Average Unit Volume: $11.4 million

Check Average: $113

Del Frisco’s Double Eagle

Founded more than 20 years ago, Del Frisco’s is an upscale concept with 18 locations in cities across North America. The fine dining steakhouse chain was founded in 1981 and is operated by Del Frisco’s Restaurant Group.

Average Unit Volume: $14.4 million

Check Average: $104

HOW STEAKHOUSES ARE PROJECTED TO PERFORM IN THE FUTURE

Some have already taken note of the optimistic future of steakhouses and steakhouse restaurant sales, plunging funding into chains that show potential for growth and expansion. Back in 2013, The ONE Group entered into a $44.3 million merger with Committed Capital Acquisition Corp., which then publicly sold shares of the high-end restaurant operator. The company later registered to trade on the Nasdaq stock market.

Of course, it’s safe to say the brains behind the STK brand knew a thing or two about investing. The chain was founded, after all, by Shawn Rubin, a managing director at Morgan Stanley Smith Barney who, along with a group of friends, put up the nearly $2 million that was needed to open the first location in Manhattan’s meatpacking district in 2004.

While some full-service, sit-down chains are losing out to fast-casual, steakhouses have by and large bucked the trend, with steakhouse restaurant sales showing strength even in the face of adversity. The fact that seven of top 50 Emerging Restaurant Chains are steakhouses shows that there’s plenty of room for growth, too.

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 70 countries for clients ranging from startups to multinational companies posting in excess of $37 billion. Collectively, his clients around the globe generate over $200 billion annually and span six continents and more than 100 countries.