The foodservice industry is a game of inches. With average restaurant margins falling between 3% and 5% profitability, chain leaders face incredible pressure to increase revenue, optimize costs, and make their operations more efficient.

This is a skill GCC foodservice companies will soon have to master. Even though these foodservice markets are some of the fastest-growing in the world, margins are shrinking.

Declining Oil Prices Slowing Down GCC Economies

Despite ongoing government initiatives to diversify their economies, GCC nations remain highly dependent on oil and gas exports. As a result, price swings in these resources can create less than ideal economic scenarios.

In many ways, the foodservice industry is more shielded to those fluctuations than other sectors, not only because of government diversification efforts but also because of the cushion offered by tourism. But foodservice players in the region are now operating in “a new normal” of slower growth.

GCC economies grew at a much faster pace between 2005 and 2015 (with oil prices reaching a median of $80 per barrel) than in the last three years (when oil prices only reached a median of $54pb).

The most extreme example is Qatar, which is growing only about 20% as fast as it did from 2005 to 2015. When comparing the medians of each period, the UAE is growing half as fast, and the KSA 41% as fast.

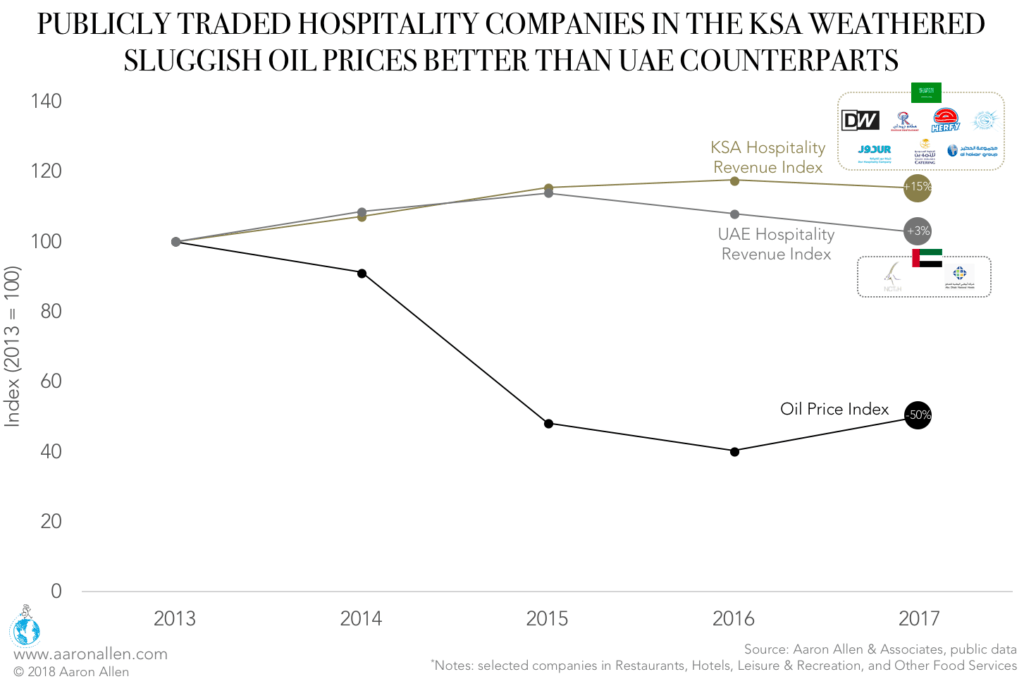

Publicly traded hospitality companies, including hotels and entertainment holdings, in these two nations are feeling the effects of this slow down, though KSA organizations have achieved more stable growth.

In the UAE, publicly traded companies in the hospitality sector (National Corporation for Tourism & Hotels and Abu Dhabi National Hotels) grew revenue by only 3%, while their counterparts in the KSA (Development Works Food, Raydan, Herfy, Tourism Enterprises, Dur Hospitality, Saudi Airlines Catering, and Al Hokair Group) achieved a 15% growth.

Restaurant Margins Are Shrinking: The Case of the KSA

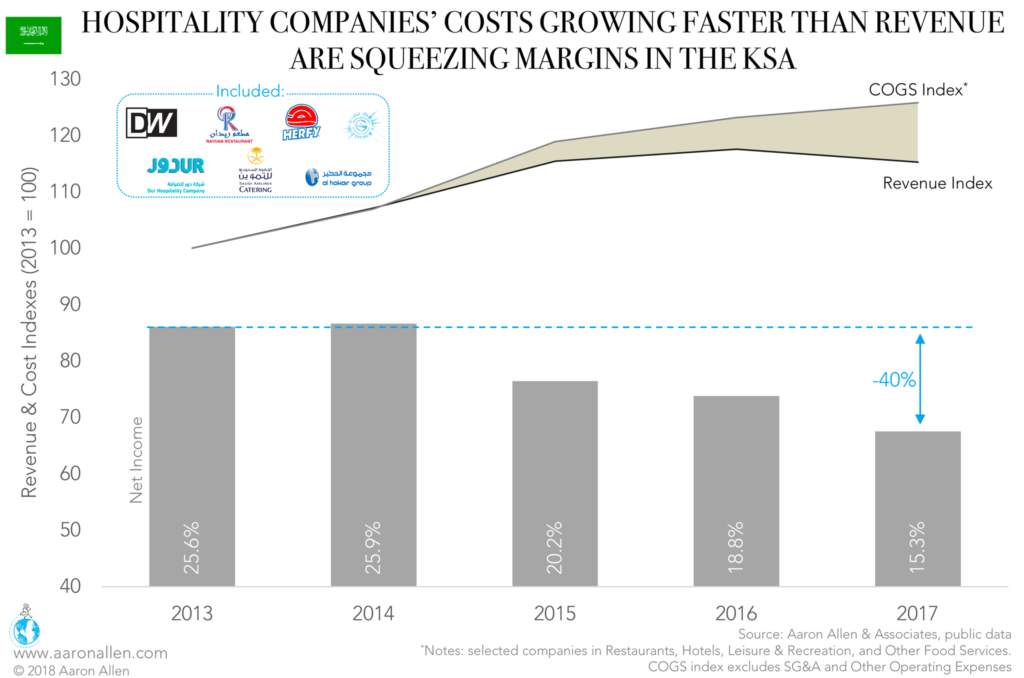

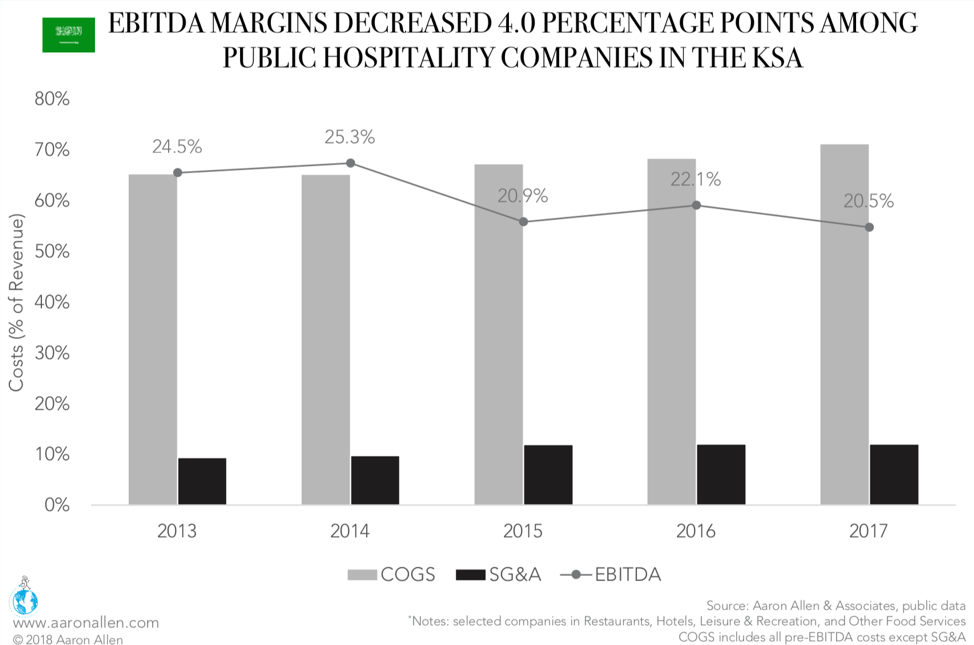

Looking more closely at Saudi Arabia, we see that EBITDA margins are shrinking due to a combination of rising cost of goods sold (COGS), which includes primarily food and labor costs (and other pre-EBITDA expenditures, excluding selling, general, and administrative (SG&A) expenses).

Meanwhile, charges affecting the bottom line (interest, depreciation & amortization, non-operating and unusual expenses) are further squeezing margins.

As a result, KSA foodservice operations have experienced a 40% drop in net income since 2013.

When facing stagnated or shrinking revenue and rising margins, companies sometimes look for quick, often unsustainable, ways to cut costs. Rather than lowering quality or skimping on ingredients, we suggest looking for ways to increase revenue and improve efficiency, which pay off better than slashing budgets. In fact, a 2% increase in sales is equivalent to a 10% reduction in food costs.

Here are 5 GCC-specific strategies:

1. Embrace National Labor

A number of GCC nations have recently adopted hiring quotas in an attempt to reduce unemployment by integrating more citizens into the workforce. Some companies have chosen to meet these requirements by simply hiring these national workers to simply meet quota, either to perform meaningless tasks or do no work at all. Meanwhile, they are keeping their expat employees on the payroll to continue to run the business.

This strategy is producing bloated payrolls and disengaged associates, and it’s also a serious missed opportunity. Embracing these employment quotas would mean not only reducing unemployment but also giving foodservice operations the opportunity to share the tradition of Arabic hospitality with younger workers.

Rather than seeing foodservice jobs as dead-end and demeaning, we encourage GCC restaurant and hospitality operations and their employees to embrace this historic orientation toward service and care.

This is no small task. It requires building this attitude into the operations from the C-suite to the kitchens.

But it will pay rich dividends. Defining why a company does what it does — what purpose it serves, what it contributes to the world — not only inspires employees, but also guests. People develop brand loyalty to brands because they see themselves — or a better version of themselves — reflected in the brand promise.

This regional tradition of hospitality, which kept travelers safe as they moved across the dangerous Arabian desert, is the kind of purpose and promise both employees and guests can support.

2. Measure, Track, and Celebrate Success

Happy and engaged workforces are great for the bottom line. Disengagement costs companies an estimated $550b every year, while organizations with engaged employees earn 2.5 times as much as those with dissatisfied workers.

The best way to build engagement among employees — especially in workplaces as diverse as those in the KSA — is to make sure even crew-level workers see themselves as essential to the operation, and not just cogs in the wheel.

A management-by-objectives (MBO) system, which ties incentives to quantifiable individual, team, and company goals, highlights the interconnected nature of the restaurant business, and rewards employees at all levels for their hard work.

In our experience, companies that adopt an MBO methodology see a 20% or more increase in revenue. In some instances, we’ve seen unit-level revenue double alongside increasing sales per employee and per labor hour.

3. While You’re At It, Measure Everything

You can’t manage what you can’t measure.

Our years of experience in the KSA, and around the region, has highlighted a key difference between American and Saudi business attitudes: while many Western foodservice operations are swimming in metrics and reports that track and measure everything from inventory to morale, many Saudi companies lack these systems.

For large companies, these dashboards are essential. Not only do they give the executive team a clear, real-time view of the business, but they also allow for important analysis of any gaps or hiccups in the operation. This knowledge is key in the context of declining margins, as it catches any inefficiencies and allows leaders to streamline operations with shorter lead times.

4. Go Digital

Mobile phone usage is some of the highest in the world in the GCC, with 76% of the population making use of these devices. Though everyone is aware of this statistic, very few restaurant operators are taking advantage of this high rate of tech penetration.

Not only do smartphones provide new ways of connecting with customers — via social media and customer loyalty programs — but innovators like Starbucks and Domino’s Pizza have demonstrated what a profound effect branded apps can have on a company’s performance.

With such high mobile usage, foodservice companies in the KSA can reach new customers on new channels by developing their own, proprietary systems. Most important, it will allow them to tap into the growing demand for delivery services, which is reshaping the global foodservice space.

5. Make Smart Acquisitions — and Divestments

Our recent analysis shows that smaller, more focused multi-brand operations have higher growth and produce more revenue per brand than massive systems. Collecting brands like some people collect stamps doesn’t always pay off.

But slimming down the portfolio isn’t just about hitting a magic number. The executive team should make acquisitions and divestments not only based on current performance but also on the forces that will shape the foodservice landscape in the future: everything from consumer behavior and trends to anticipated commodity prices and regulatory requirements.

When margins shrink, executive teams can be tempted to slash costs to the bone, but such decisions are self-defeating. A comprehensive brand audit can identify areas of opportunity for organizations across all functional areas, rather than simply focusing on ways to decrease expenses. This can result in strategies proven to boost revenue and streamline operations, both of which produce long-term and sustainable growth, regardless of market conditions.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in communications strategy, marketing, operational optimization, technological integration, and mergers & acquisitions for restaurant chains all over the world. We work alongside senior executives of some of the most successful foodservice and hospitality companies to visualize, plan, and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $200 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.