A slew of restaurant chains have made their initial public offerings in the past few decades. For some, the move has paid off. But for others, the future is a little more murky.

Below, we round up the restaurant Initial Public Offerings (IPOs) of the past two decades, with an emphasis on the most recent stock exchange dining debuts and who’s rumored to go next.

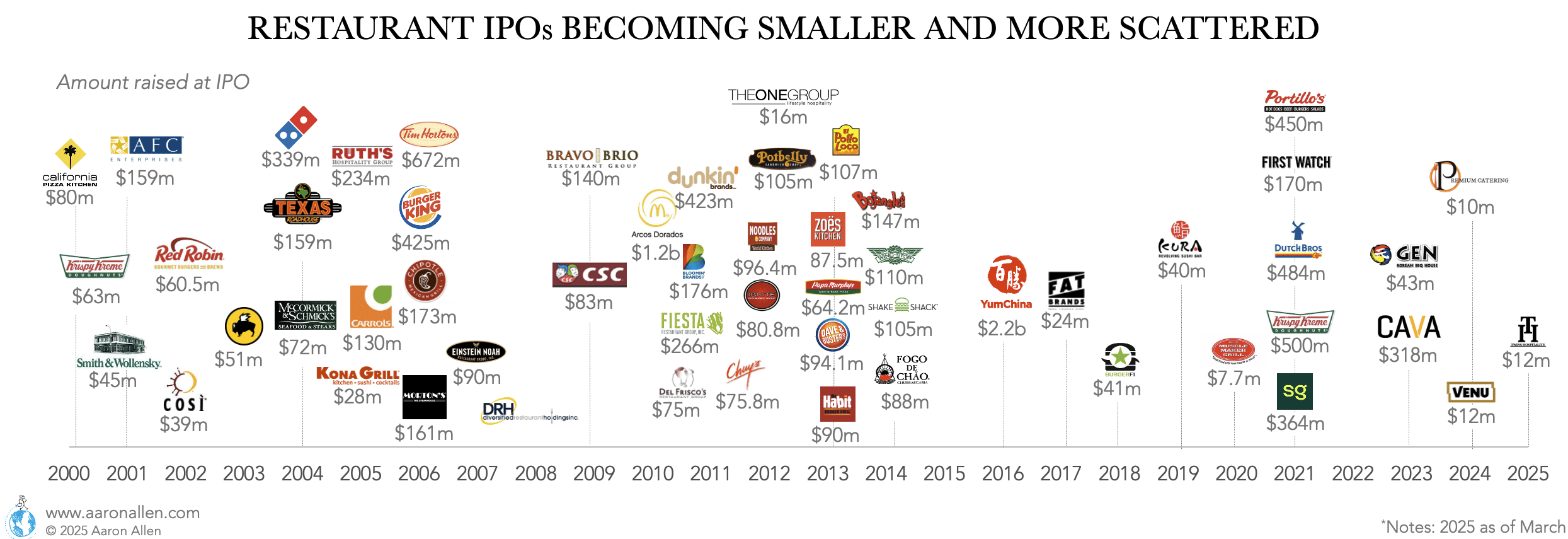

THE PAST FEW DECADES OF RESTAURANT IPOs

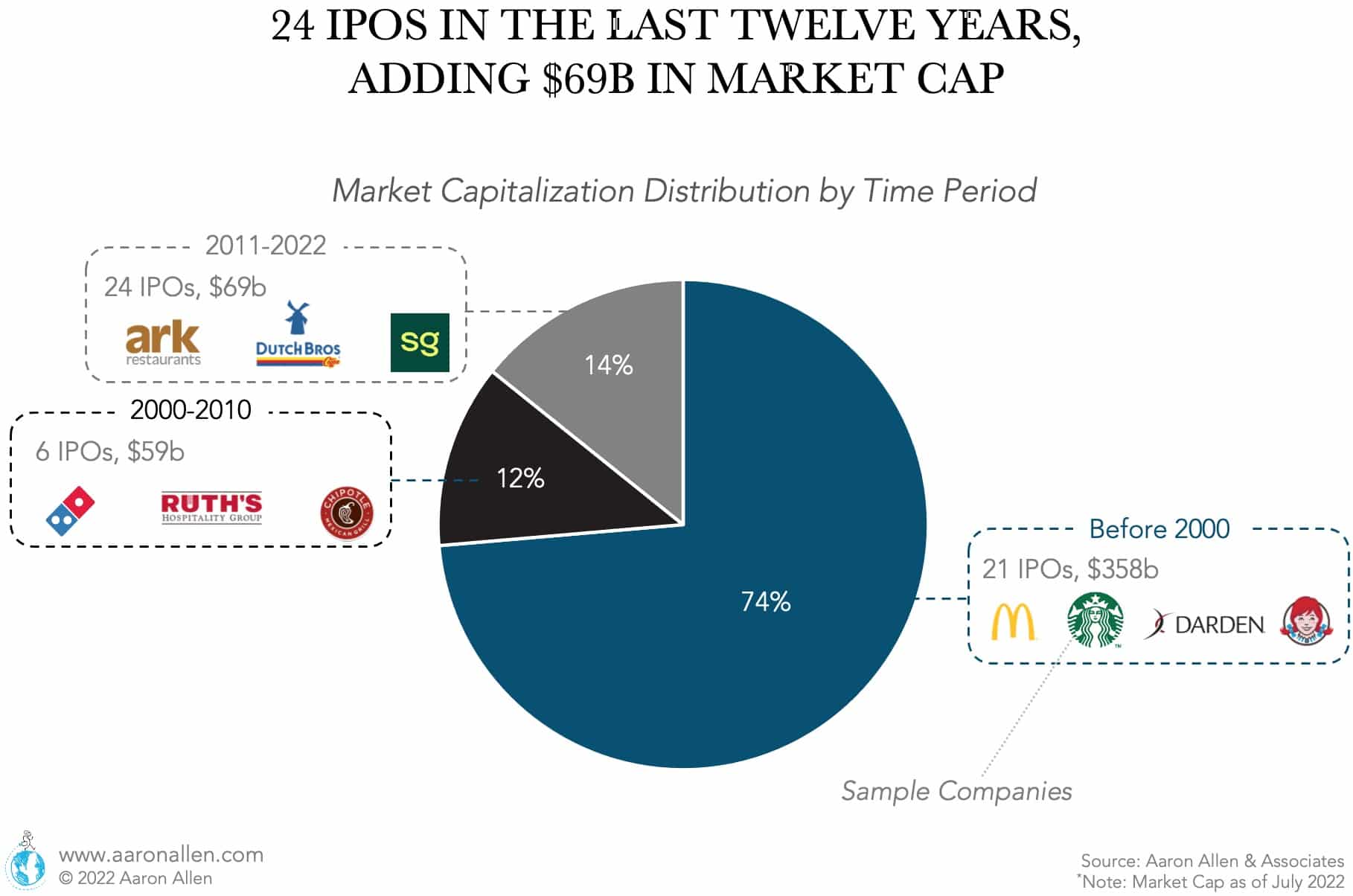

Investors have a lot of faith in restaurants, as evidenced by the sheer number of chains that have gone public in the past twenty years. Still, those that have hit the market most recently are struggling to counter the efforts of chains that went public decades ago. Just 14% of the current restaurant market capitalization can be attributed to companies that went public in 2010 or later, and 28% of the current market cap in restaurants corresponds to companies who launched restaurant IPOs after the year 2000 (as of 2023).

By comparison, McDonald’s and Starbucks, which together account for about 58% of all restaurant market cap, went public in 1978 and 1992, respectively.

IPO Readiness

Since the year 2000, we’ve seen several high-profile restaurant initial public offerings (IPOs), from Domino’s to Sweetgreen. Much of it, though, has occurred in spurts. There was a span of nearly two years (2008-2010), for instance, in which only one restaurant made its initial public offering, which can be largely attributed to the recession.

Between 2011 and 2015, though, the tables had turned, with dozens of big names (Dave & Buster’s, Potbelly’s, Bojangle’s, etc.) cropping up on stock exchanges in what some analysts dubbed “the restaurant IPO craze.”

There wasn’t a significant restaurant IPO between 2016–2018. IPOs, in general, saw a downtick in 2016, so the fact that no restaurant chains went public was hardly surprising (106 companies went public on U.S. exchanges in 2016, down from 164 in 2015). But that doesn’t mean 2016-2017 was a bad span for capital markets. On the contrary, we’ve seen plenty of activity on the Private Equity side, with angel investors, PE funds, and seed capital making their way into restaurant chains large and small.

There was a new flurry of restaurant chains going public in 2021, including unicorn Sweetgreen and Portillo’s, First Watch, Dutch Bros, and Krispy Kreme. And though 2022 was a quiet year, CAVA and Gen Restaurant Group went public in June 2023 (raising more than $300 million and $40 million, respectively).

The foodservice industry continues to evolve, showcasing resilience and adaptability in the face of changing economic landscapes. Restaurant IPOs over the past two decades reflect the sector’s dynamic nature, with emerging brands carving their place in a competitive market. While some of the most recent IPOs (2023-2025) raise smaller amounts, this trend underscores the opportunities for niche concepts and innovative dining experiences to access capital markets.

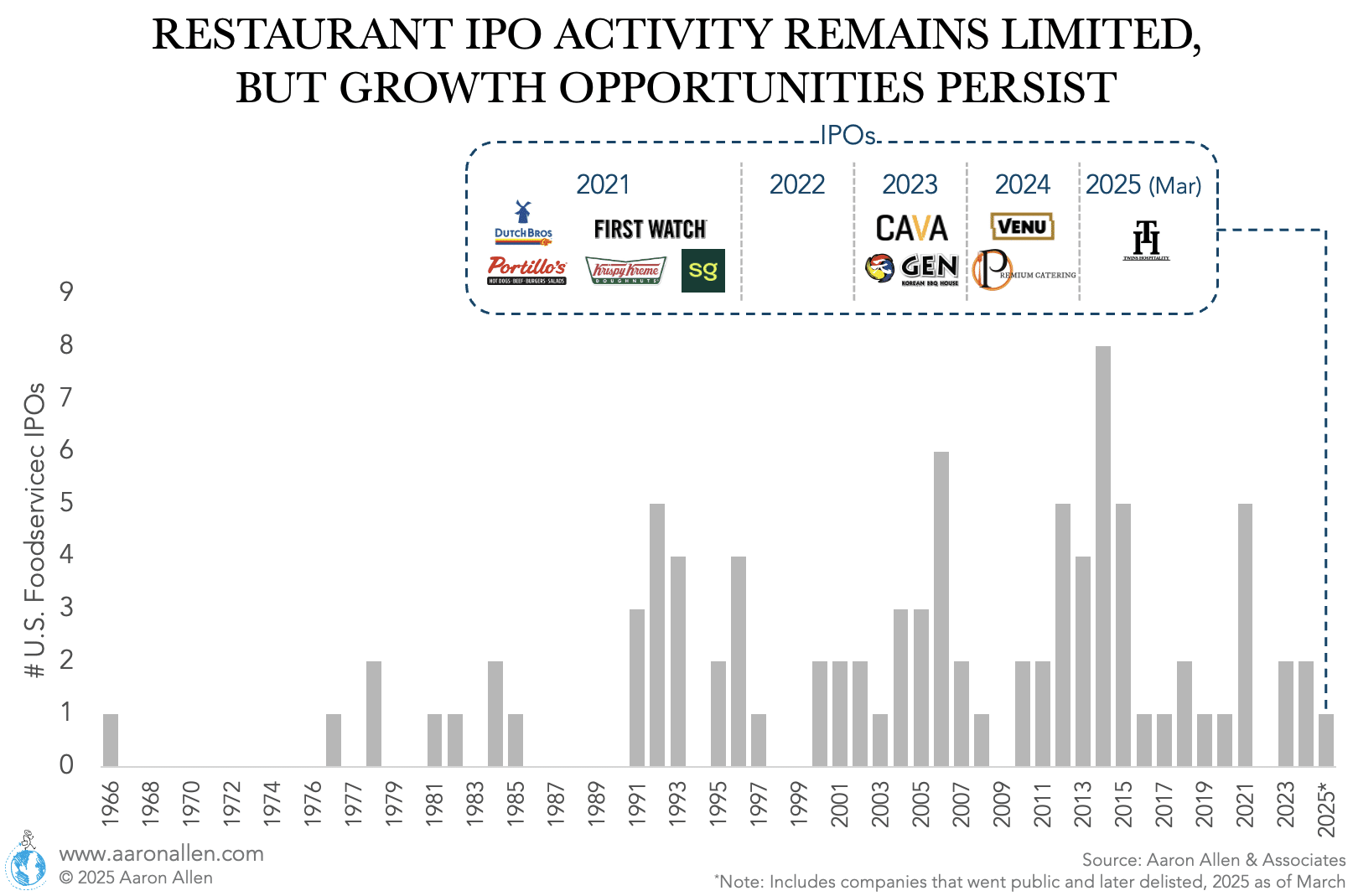

RESTAURANT IPO STATISTICS

- Since 2002 there has been at least 1 restaurant initial public offering every year except for 2009 and 2022.

- 2021 was the best year for Restaurant IPOs since 2015 and classifies as one of the second-best years along with 2015 and 1992, each with 5 IPOs.

- Five companies went public in 2021: drive-thru coffee chain Dutch Bros, casual dining First Watch, Krispy Kreme, QSR hot-dogs chain Portillos, and fast-casual salad focused Sweetgreen.

- 2014 was the year with most restaurant IPOs with 8 stocks going public including Dave and Buster’s, Del Taco, El Pollo Loco, One Group, Papa Murphy’s, Restaurant Brands International, Habit, and Zoe’s Kitchen.

- Except for years without restaurants’ initial public offerings, there are many with only one foodservice IPO: 1966, 1976, 1978, 1981, 1982, 1985, 1997, 2002, 2003, 2007, 2008, 2010, 2016, 2017, 2019, 2020.

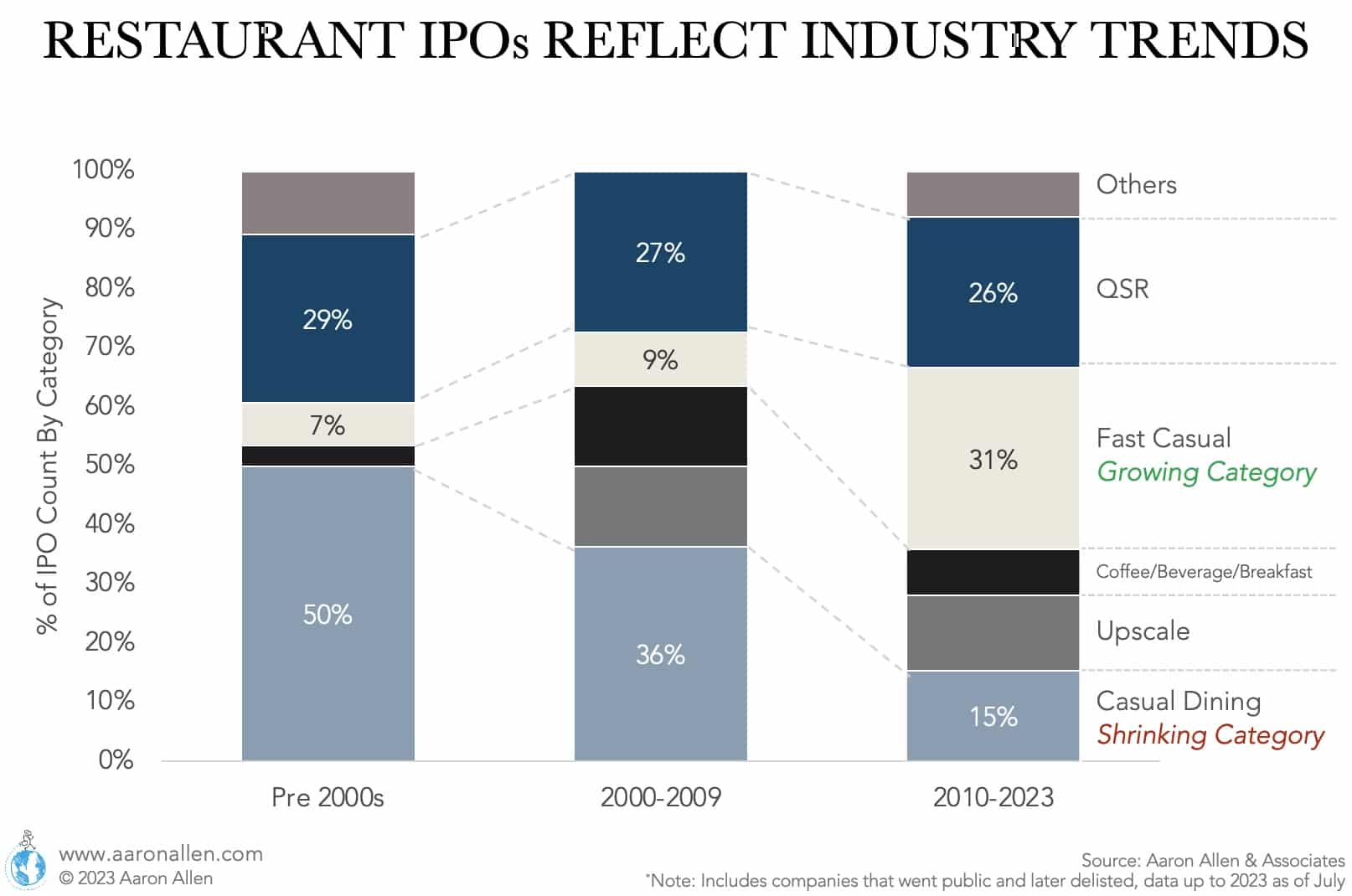

- IPOs reflect economic and sector trends, and the foodservice industry is no exception. Over time, we can spot the evolution of restaurant categories: before the 2000s (our records start in the mid-60s), half of the IPOs were in the casual dining category. Between 2000-2009 the share went down to about a third, and after 2010 only 15% of IPOs were casual dining restaurants (but there was a number of upscale chains going public such as Del Frisco’s and The ONE Group).

- On the other hand, the number of fast-casual chains going public increased to 31% of IPOs — reflecting the premiumization of limited-service.

Diligence Yourself Before Someone Else Does

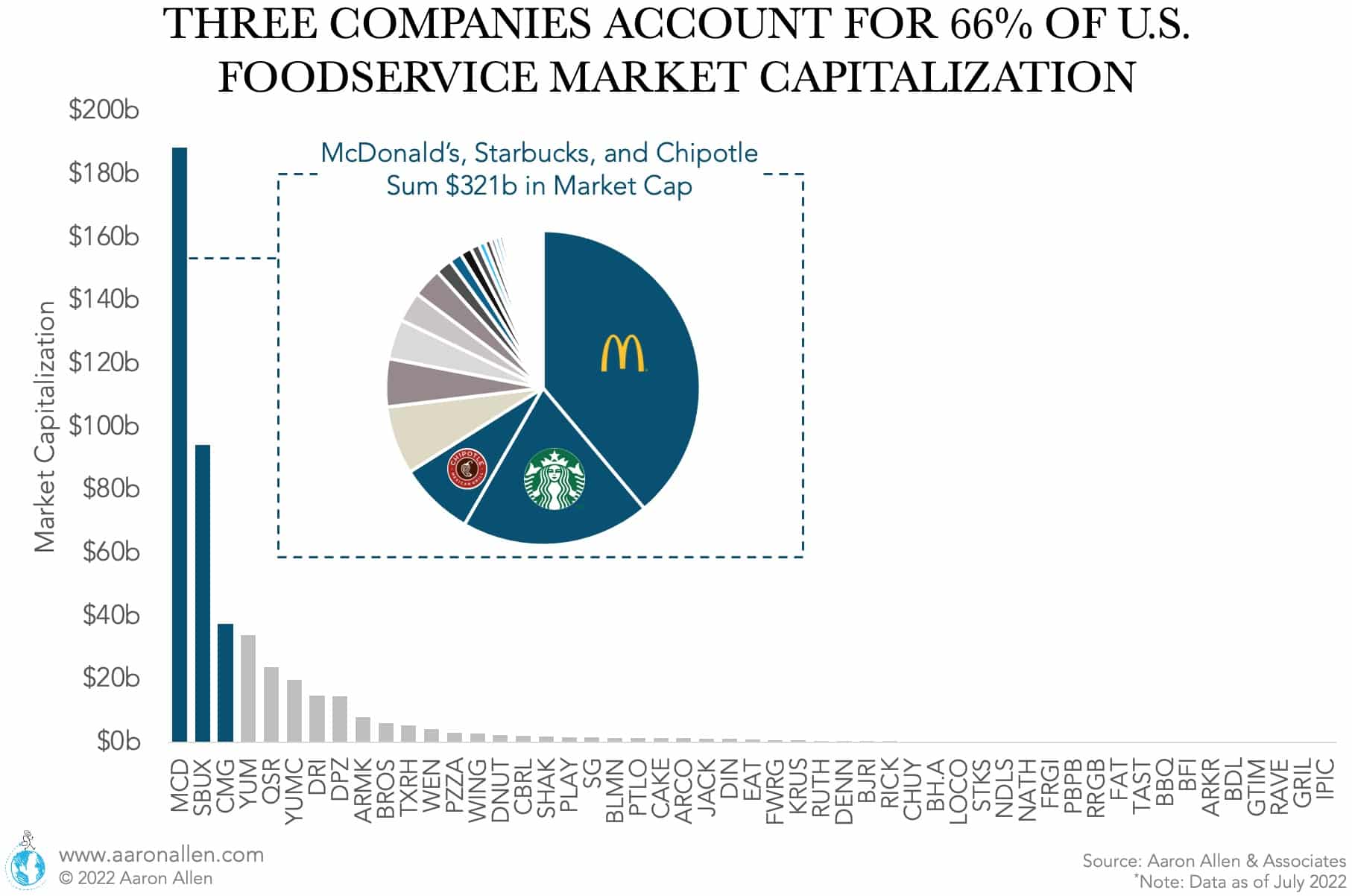

FOODSERVICE MARKET CAPITALIZATION

- The total market capitalization of foodservice stocks in the U.S. as of July 2022 is $485.5 billion (51 stocks between NASDAQ and NYSE, excluding over-the-counter stocks).

- There is a high level of concentration with the largest three restaurant chains McDonalds, Starbucks, and Chipotle accounting for 66% of foodservice market capitalization.

- The current market capitalization of McDonald’s (IPO 1978) is the largest in the history of the industry. So much so that it makes the initial public offerings of years 2017-2020 almost insignificant.

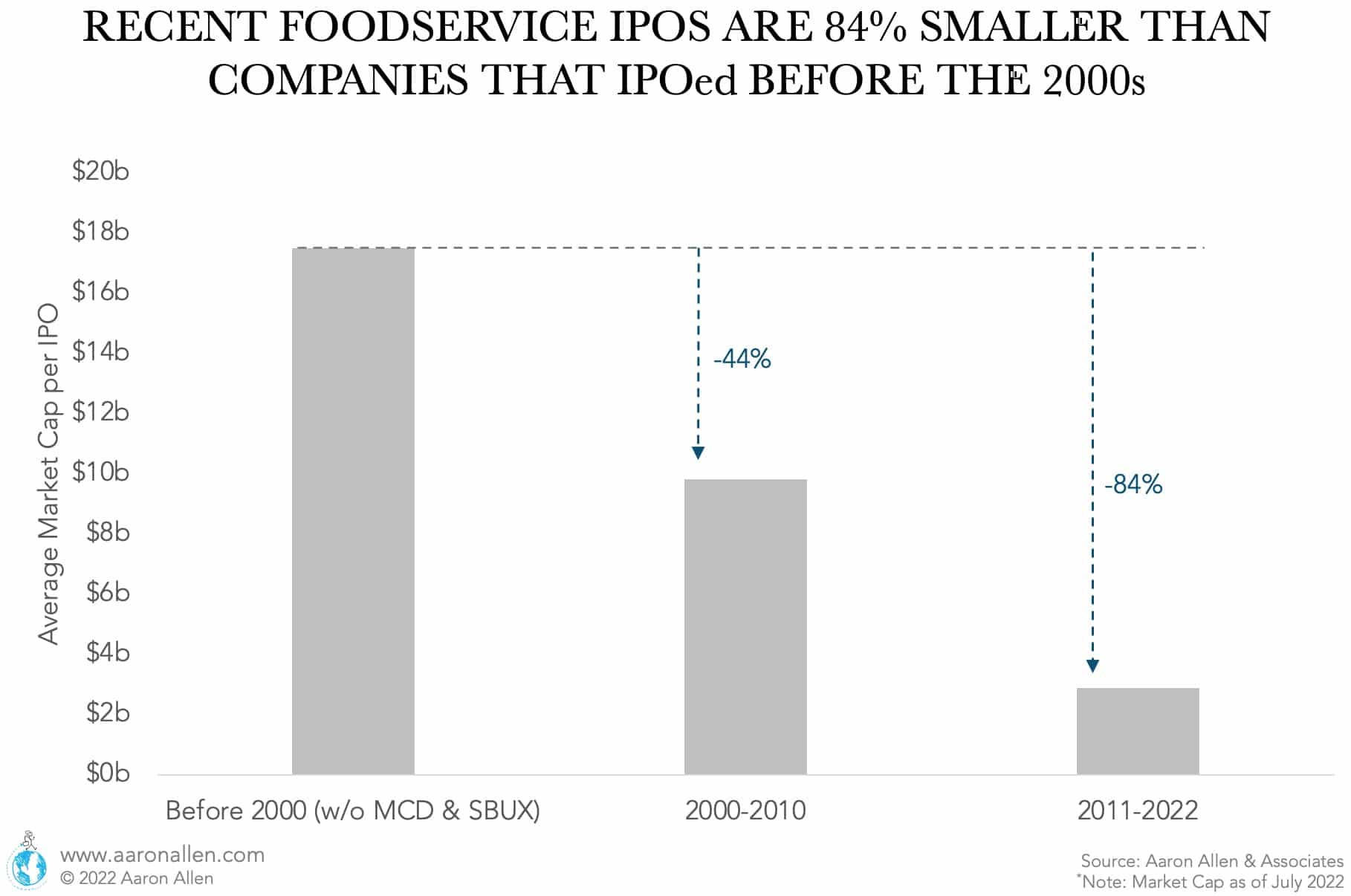

- The further in the past an IPO, the larger today’s market capitalization.

- Restaurant companies whose initial public offering was before 2000 have a much larger market capitalization than the other periods. Even though this is largely driven by McDonald’s (1978) and Starbucks (1992), the percentage of market cap by timeframe doesn’t change much if we exclude these two giants.

- It must be noted that the pre-2000 period is composed of IPOs since 1966 (34 years) while the following two are roughly decade periods.

- There were 37 foodservice companies’ IPOs in the last decade (2011-2023), which surpasses the number of public companies currently in the market that went public before the 2000s.

- Between 2000 and 2010 there were a IPOs (24). Similarly, between 2011 and 2023 there have been 26 IPOs.

- The recent foodservice IPOs are significantly smaller than established companies that IPOed before the 2000s (even excluding giants like McDonald’s and Starbucks). On average, the market cap of restaurant IPOs in the last decade has been $2.9b while companies that went public before the 2000s have current market caps averaging $17.5b. Part of this difference could be related to the maturity of those that have been public for more than two decades. But it also seems to be indicating smaller IPOs in recent years.

RECENT RESTAURANT IPOs, FOODSERVICE TECH IPOs, AND POTENTIAL FUTURE ACTIVITY

The most recent flurry of restaurant IPOs occurred in 2021, and offered a variety of restaurant industry segments (fast-casual, QSR, casual dining) and menu types (salad, hot-dogs, coffee, breakfast).

At the end of January 2025 Fat Brands spin off Twin Peaks in a NASDAQ IPO. At the time of the IPO, the casual dining sport-bar chain had 115 restaurants. Close to 95% of the shares were retained by former parent company Fat Brands.

Venu Holding Corporation went public under the trading ticker VENU in November 2024 at the NYSE. The company provides entertainment and hospitality, operates upscale music venues, outdoor amphitheaters, and full-service restaurants and bars in the United States. Some of the brands include Bourbon Brothers Presents (music venues), The Sunset Amphitheater (outdoor amphitheaters), Bourbon Brothers Smokehouse & Tavern, Notes Eatery, Roth’s Seafood & Chophouse, and Notes Hospitality Collection (restaurants); and Brohan’s (bar).

Singapore-based Premium Catering Holdings had its IPO in NASDAQ in September 2024. The company is in contract foodservice, providing meals to foreign workers, buffet catering services, and operating food stalls in Singapore. The total proceeds were $10 million.

The fast-casual restaurant chain went public in June 2023, raising $318 million at a $5.5 billion market capitalization. The chain sponsored by Ron Schaich has 263 restaurants and a menu focused on Mediterranean bowls and wraps.

The parent company of Gen Korean BBQ raised $43.2 million at an enterprise value of almost $320 million. The restaurant chain has 34 locations.

It’s the second time the company goes public (it had gone public in April 2000 until it was acquired by JAB Holdings in 2016 for $1.35 billion). The company has an enterprise value of $4.66 billion and a market capitalization of $2.7 billion. IPO was expected to be between $21 and $24 per share but the shares debuted at $17 on July 1st, 2021. Krispy Kreme adjusted EBITDA of $145 million put its valuation at a 32x EV/EBITDA multiple.

The Florida-based restaurant chain with over 441 locations in 28 states totaling over 10 thousand employees had a rough post IPO 2021 with a loss of $2.6M on December 26th. It’s award-winning Daytime Dining concept with made-to-order meals allowed it to turn a net income of $4.6 million in Q1 2022, compared to the net loss of $2 in the same period one year before. It also experienced a 35.6% increase in Q1 sales and expanded to 441 restaurant locations after 7 new openings.

The fast-casual chain filed for an IPO in June 2021. The company is valued at $1.78 billion.

PTLO launched its IPO in October 2021 at $20 per share after which it peaked at $54 in November of the same year which generated a promising outlook for the stock. However, it began a slow but steady decline back to its first public offering levels to $21.56 by July 2022. Profit levels have increased by 14.6% YoY to $134.5M driven by an 8.25% increases in same-restaurant sales and 5 new location openings. Inflation has generated a decrease in operating income to $6.8M (-37.2% YoY) but was compensated by a lower interest expense and an average menu increase of 1.5% which has resulted in a 500% net income increase.

Dutch Bros filed for a confidential IPO in June 2021. The company has 420 coffee shops. Estimates indicate the intended valuation would reach $3 billion.

One of the restaurant tech companies to go public in 2021 was Olo. The delivery and digital ordering platform raised $450 million in the NYSE. The company’s enterprise value is $5.08 billion (as of July 2021).

Early in 2019 there were rumors that the restaurant conglomerate was looking to take its coffee branch, the Acorn division, public (including brands such as Peet’s Coffee, Stumptown Roasters, Intelligentsia and Mighty Leaf Tea).

The SPAC had its IPO in early 2021 with the aim of raising $150 million. The targets enterprise value are in the $400 million to $850 million range or higher.

The company went public as part of a merger with a SPAC (OPES Acquisition Corp.) in December 2020. The enterprise value is $142 million as of July 2021.

The delivery company debuted on the NYSE in December 2020. At pricing, the company ended with an enterprise value 28% higher than expected. Shares soared 85% on the first day of trading.

This as a $7.7 million “mini-IPO” in February 2020.

the company went public in July 2019, raising more than $40 million (lower than the initial expectation of $57.5 million).

This mini IPO valued the company at $200 million in early 2018. By mid-2019, the company filed for bankruptcy.

In April 2019, CEC Entertainment (the parent company to Chuck E. Cheese’s and Peter Piper Pizza) announced plans to merge with Leo Holdings to go public. The deal was not completed.

In October 2017 FAT Brands went public, raising $24 million.

In May 2019 the plant-based maker went public. Share prices increased by 163% on the same day, a record since 2000.

The delivery company was considering an IPO but instead was acquired by Uber for $2.65 billion in July 2020.

Shake Shack more than doubled its IPO price in its 2015 debut though, as we’ve noted before, it and others in the Better Burger segment have been wildly overvalued in the past. Shack’s IPO debuted around the same time as better-burger rival, Habit Burger (HABT in November 2014 and SHAK in January 2015). Smash Burger was rumored to be mulling an IPO, too, but those rumors were eventually put to rest by the company itself, which said it hoped to “double its number of locations” before going public. The chains typify the fast-casual trend that has taken over the restaurant industry over the last decade, though the burger segment has shown some signs of flagging.

The Brazilian steak chain priced its IPO at $20 on its debut, well above its expected price range. The company struggled to regain that footing (a story seen often among many other full-service operators) and was taken private by PE firm GP Investments.

RUMORED RESTAURANT IPOs ON THE HORIZON

There are rumors of other chains potentially going public in 2025, including Panera Bread (currently owned by JAB Holdings), Fogo de Chao, and Inspire Brands.

Panera Brands (parent to Panera Bread, Caribou Coffee, and Einsteain Bros. Bagels) is planning an IPO after announcing in 2021 an agreement with Danny Meyer’s SPAC (USHG Acquisition Corp.) that later fell through.

In Europe, Restaurant Brands Iberia was preparing for an IPO in 2024. The company is a master franchisor with a portfolio including Burger King, Popeyes, and Tim Hortons in Spain and Portugal. The intended valuation was $2.7 billion and rumors indicated the exchange would be the Madrid Stock Exchange. In the end, the company decided to take a wait-and-see approach and weight other alternatives.

LXJ International, a Chinese fast-food chain known for its Lao Xiang Ji or Home Original Chicken brand, submitted an application for an IPO in Hong Kong in early 2025, following two unsuccessful attempts to list in Shanghai in 2024.

Latin American Delivery Company Rappi announced plans to be ready for an IPO within 2025.

RECENT INTERNATIONAL RESTAURANT IPOs

AlAbraaj Restaurant Groups Went Public in the Middle East in 2024

The Bahrain-based casual dining group (which also as a fast casual concept) went public in December 2024. This is the first homegrown foodservice company to have an IPO in the Kingdom. The offer was oversubscribed by 2.6 times.

Latin Food Chain Guzman Y Gomez Going Public in Australia

This Mexican food chain had a successful IPO in Australia in June 2024, raising A$335.1 million ($223.4 million). The company’s shares surged 37% on their debut, making it Australia’s best IPO performance in three years. The chain was founded in 2006 in Sidney.

Super Hi International Holding Trading in NASDAQ

This hot pot restaurant chain, which operates over 100 restaurants in 11 countries, had its IPO in 2024. The company is known for its authentic Asian dining experience.

Xiaocaiyuan International Raises $110 Million

This Chinese budget restaurant chain debuted on the Hong Kong Stock Exchange in December 2024.

Tab Gida Sanayi Went Public in Turkey in 2023

This was the largest IPO in the country since 2018. Tab Gida is a master franchisee for Burger King, Popeyes, Arby’s, Subway, Sbarro’s, and also has its own brand Usta Dönerci®️.

Super Hi International Listing in Hong Kong Since the end of 2022

The group serves Haidilao Hot Pot globally. The company was founded in 2012 and operated more than 100 restaurants in 11 countries at the time of the IPO.

Middle East: Americana Group Went Public at the End of 2022

The MENA master franchisor with a portfolio of global and domestic brands including KFC, Pizza Hut, Hardee’s, Krispy Kreme, Costa Coffee, and others had a dual IPO for a 30% stake in the Abu Dhabi Securities Exchange (ADX) and the Saudi Stock Exchange. The company had more than 2,000 restaurants across 12 markets at the time it went public and raised $1.8 billion.

Food Delivery Jahez Goes Public in Saudi Arabia with a Market Cap of $2.4 Billion

The online food delivery company had its IPO in January 2022 in the Saudi Exchange’s Parallel Market. Jahez was launched in 2016 and it was the first Saudi tech startup to go public. The offering floated less than 20% of the company’s equity with a market cap of $2.4 billion USD.

Master Franchisee Sapphire Foods Going Public in India

The KFC, Pizza Hut, and Taco Bell franchisee with locations in India, Sri Lanka, and Maldives went public at the end of 2021. At the time of the IPO, the company was operating more than 450 restaurants.

Casual Dining Chain Barbeque Nation Hospitality Limited

This leading chain in India went public in March 2021, employing the proceeds towards opening new locations, repayment of debt, and SG&A. The chain was first established in 2006 and grew organically and with acquisitions. At the moment of the IPO, the company had close to 150 restaurants (corporate run) over close to 80 cities in India and six locations in the UAE, Oman, and Malaysia.

European Delivery Giant Deliveroo Had a Bad IPO in 2021

Deliveroo had its IPO on the London Stock Exchange at the end of March of 2021 — reportedly the biggest IPO since 2011. The company stock declined in price more than 20% on the days following the IPO and as a result, valuation took a hit from $7 billion in the last private investment round in January to $5.1 billion. Analysts indicate that the stock was over-priced and investors were concerned about potential upcoming regulations that could negatively affect the company (in particular related to the gig economy workers Deliveroo was tapping into), thin margins (the company was not profitable yet), and uncertain growth pipeline.

India’s Food Delivery Giant Zomato Had a $12 Billion IPO

Zomato’s IPO in the National Stock Exchange of India in July 2021. The offering was oversubscribed 35 times — the stock price increased by 80% on the first day. At the moment of going public, the company was not profitable and revenue had dropped more than 20% year-over-year.

India’s Master Franchisee Devyani International Went Public in August 2021

Devyani is the largest Yum! Brands franchisee in India, operating KFC, Pizza Hut, and also Costa Coffee restaurants. At the moment of IPO, Devyani had close to 700 establishments across more than 150 cities. The company stock price increased over 50% during the first day. The use of proceeds indicates the repayment of debt and general purposes.

Valuation Opinions

HOW TO PREPARE FOR A RESTAURANT IPO

The prospect of going public is exhilarating, but also full of complexities. Usually, companies begin planning six to two years ahead of time and there are several functional areas involved.

Here we list what things are necessary to consider for IPO Readiness for a restaurant chain.

Legal: Corporate Governance, regulatory compliance, IP and property rights, legal structure (current entities and how do they align with the stock exchange requirements), litigation risks.

Financial: financial reporting systems that comply with PCAOB, audited financial statements for at least three years, restaurant chain valuation, internal controls, showing consistent historical and projected profitability and revenue, capital structure and debt-to-equity appealing to investors.

Operations: some of the things investors will want to see when a restaurant chain goes public match what the company would go through during due diligence if acquired by a private equity firm; these include assessments of the scalability of operations, how strong the supply chain is, the record of the management team, how the company is leveraging technology for operational efficiency, QA/QC systems in place, store-level and margin sustainability, SG&A (especially making sure the projections are adjusted for becoming a public company and consistent with the pipeline for growth), CAPEX deployment (openings, technology, infrastructure, etc.), consistency and benchmarking of food cost, labor cost, rent, and more.

- Commercial Viability: investors will want to see professionally crafted materials relating to market positioning, total addressable market, a compelling value proposition, growth strategy (including considerations for saturation risks, location strategy, franchising potential, acquisition prospects), customer demographics and psychographics, customer loyalty, competitive landscape, market trends, marketing and PR.

- ESG (Environmental, Social, Governance): the company policies and initiatives for sustainability, social responsibility, and governance.

- Communications: strategies to communicate with investors, employees, management, and customers, PR.

- Post-IPO: SG&A projections, targets, investor relations.

RESTAURANTS IPOs IN CONTEXT OF OTHER INDUSTRIES

Companies That Had Their IPO in 2021

2021 was record-breaking for IPOs. In the U.S. close to one thousand companies went public. Some of the high-profile companies that had their IPO in 2021 were Roblox (online gaming), Compass (real estate), Coinbase (crypto-trading), Robinhood (trading app), and Warby Parker (eyewear).

For restaurants, 2021 saw the IPOs of Portillo’s, First Watch, Dutch Bross, Krispy Kreme, and Sweetgreen.

Companies That Had Their IPO in 2020

There was a total of 480 IPOs this year. At the time, this was an all-time record after surpassing the 2000 397 IPO mark 2 decades prior and more than doubling the previous year with a strong impulse of SPAC IPOs. The leading companies were Airbnb (hospitality), Doordash (Food tech), Snowflake (Tech), Palantir (Tech) and Royalty Pharma (pharmaceuticals).

Regarding restaurants, 2020 was the year of Muscle Maker’s IPO.

Companies That Had Their IPO in 2019

This year saw the first fall in number of IPOs (since an upwards trend that began in 2016) with a total of 232. 2019 saw IPO offerings of high-profile companies such as UBER and Lyft (transportation tech) as well Pinterest and Zoom (Tech). Other successful and high-profile IPOs were Avantor (Process industries) and SmileDirectClub (Health services).

For restaurants, 2019 was the year of Kura Sushi IPO.

Companies That Had Their IPO in 2018

There was a total of 255 IPOs in 2018 of which the most important and well-known company to go public was Spotify (Tech) which had the highest offer at $9.2 billion. Another big name to launch its IPO was DropBox (Tech) alongside top performers such as Pagseguro Digital(Tech) IQIYI (Consumer Goods) and AXA Equitable Holdings (Finance).

The restaurant sector only saw an IPO from BurgerFi.

Companies That Had Their IPO in 2017

There was a total of 217 IPOs this year of which Snapchat’s (Tech) had the highest profile and also one of the largest of the year. Other prominent, but less known public offerings, were Garden Denver Holdings (Business Services), Invitation Homes (Real Estate) and Cloudera (Tech).

Within the restaurant sector, only FAT Brands launched its IPO in 2017.

Companies That Had Their IPO in 2016

The 2016 IPO count hit the lowest count since 2009 with a total of 133 offerings. It was also de lowest Venture Capital-Backed tech IPO since that same year, of which only 10 were still positive by December of that year. 2016 was so bad that the biggest IPO by the Chinese package delivery service, ZTO Express, had flopped by the end of the year. Some of the other high-profile IPOs were Valvoline (Oil & Gas), Patheon (Pharma) and Red Rocket Resorts (Hospitality).

In the restaurant business, YUM! China was the only IPO.

Companies That Had Their IPO in 2015

There was a total of 206 IPOs this year but were made up of mostly unknown companies to the general public such as FirstData (Payment processing), Tallgrass Energy GP (Natural Gas) and Columbia Pipeline Partners (Energy and Infrastructure) were the top 3 IPOs of the year. Things weren’t any better in the restaurant space with a total of zero IPOs, a record not even beaten during the 2008 crisis.

Companies That Had Their IPO in 2010

The year 2010 was the recovery year post-2008 crisis with a total of 190 IPOs with more public offerings than 2008 and 2009 combined. This was also a year for very high-profile companies going public such as Facebook and Alibaba (Tech) and other lesser known but important companies such as the Saudi national oil company Saudi Aramco (Oil & Gas) and AIA (Insurance).

However, it was not a hot year for the restaurant industry, only Bravo Brio launched its IPO and has since delisted from the stock exchange.

Companies That Had Their IPO in 2008

In line with the rest of the economy, 2008 was a very slow year for IPOs with only 62 companies going public. This marks the lowest count since the year 2000. The only well-known firm that was brave enough to launch into the stock market in 2008 was VISA. It was the biggest IPO of 2008 worldwide.

The restaurant industry only saw the IPO of the now delisted Diversified Restaurant Holdings Inc.

THE BEST (AND WORST) RESTAURANT STOCK PERFORMERS

As of 2017, some of the best performers since their initial public offerings (IPOs) were Popeye’s, Domino’s, and Chipotle. Back in February, shares of Popeye’s spiked some 19% upon news that Burger King and Tim Horton’s owner Restaurant Brands International would acquire the company in a deal valued at $1.8 billion.

THE RESTAURANT INDUSTRY IS RIPE FOR INVESTMENT

The restaurant and foodservice industry touts plenty of opportunity. The challenge for private equity firms looking to invest in a chain or restaurant company is, often, a lack of knowledge about the industry itself — an understanding of the trends and factors impacting restaurant chains around the world and what will shape them throughout the holding period.

Having consulted with a number of PE firms in the past, we offer a solid understanding of all of the above, and are adept at communicating with industry targets, speaking their lingo, and understanding both back-of-house and front-of-house operational implications on the financial performance of the business.

For those looking for help protecting, enhancing, and unlocking value throughout every phase of the investment lifecycle, we offer several service geared toward Private Equity firms, including: Deal Origination, Commercial Due Diligence and Operational Due Diligence, Operational Support and Value Creation Throughout the Holding Period, and Maximizing Value at Exit.

* * *

How Aaron Allen & Associates Can Help

Our clients include restaurant chains, foodservice technology providers, and alternative foodservice formats. We also specialize in multinational, multi-brand portfolios, and cross-border transactions.

Our restaurant and foodservice industry advisory services include:

- Valuation Opinions

- Market Landscape Scanning

- IPO Readiness Assessment

- Investment Thesis Ideation

- M&A Readiness Assessment

- Investor Presentation Development

- Deal Sourcing and Target Identification

- Commercial Due Diligence

- Operational Due Diligence

- Value Creation Strategies

- Post-Acquisition Integration

- Board and Management Installation

- Growth and Expansion Planning

- Go-to-Market Strategy

- Performance Optimization

- Portfolio Planning and Rationalization

- Operating Partnerships

- Board Participation and Advisory

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $300 billion, span all 6 inhabited continents and 100+ countries, with locations totaling tens of thousands.