Restaurant enterprise value (EV) is easy to calculate: market cap + debt – cash. It’s much harder to understand what causes EV to rise and fall.

To help unravel this mystery, we examined EV enhancements among publicly traded restaurants over the past 20 years, looking for trends that produced long- and short-term gains.

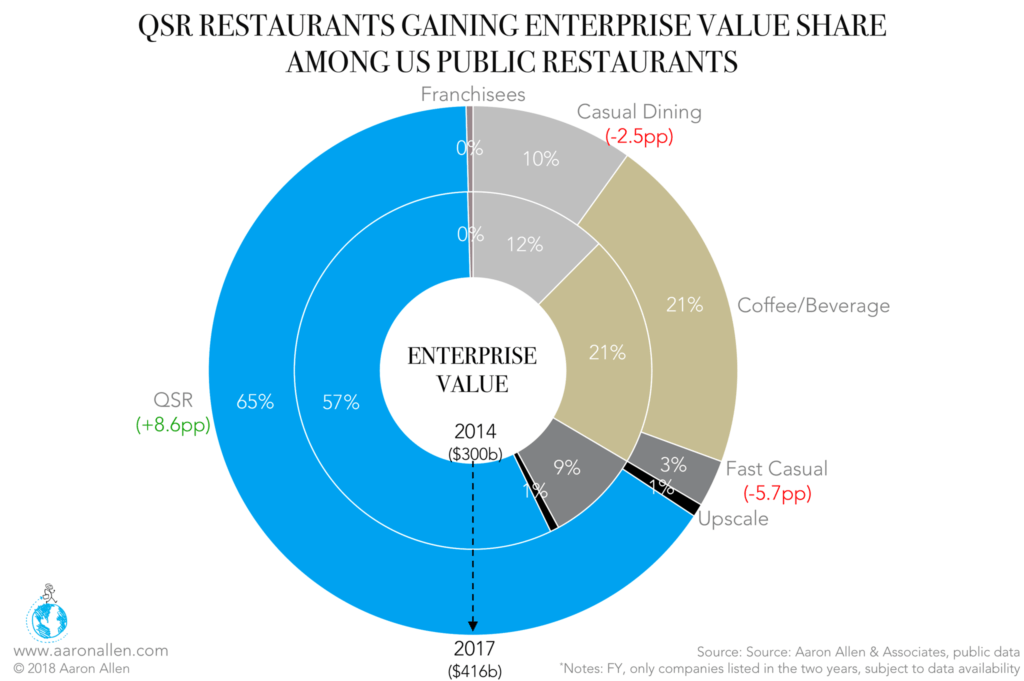

We found that most of the big, sustainable enhancements were made by quick-service (QSR) brands, which is the largest segment of publicly traded restaurants in the US, accounting for 65% of all restaurants’ EV.

The QSR segment has enjoyed the fastest median growth over the last three years, adding 8.6 percentage points, mostly at the expense of fast casual (-5.7 pp) and casual dining (-2.5 pp).

Though there’s no secret formula for growing EV, the most successful companies added value by maintaining their brand identities, carefully expanding their footprints, strategically investing in technology, and making smart acquisitions.

Expansion Drives EV & Stock Price Gains

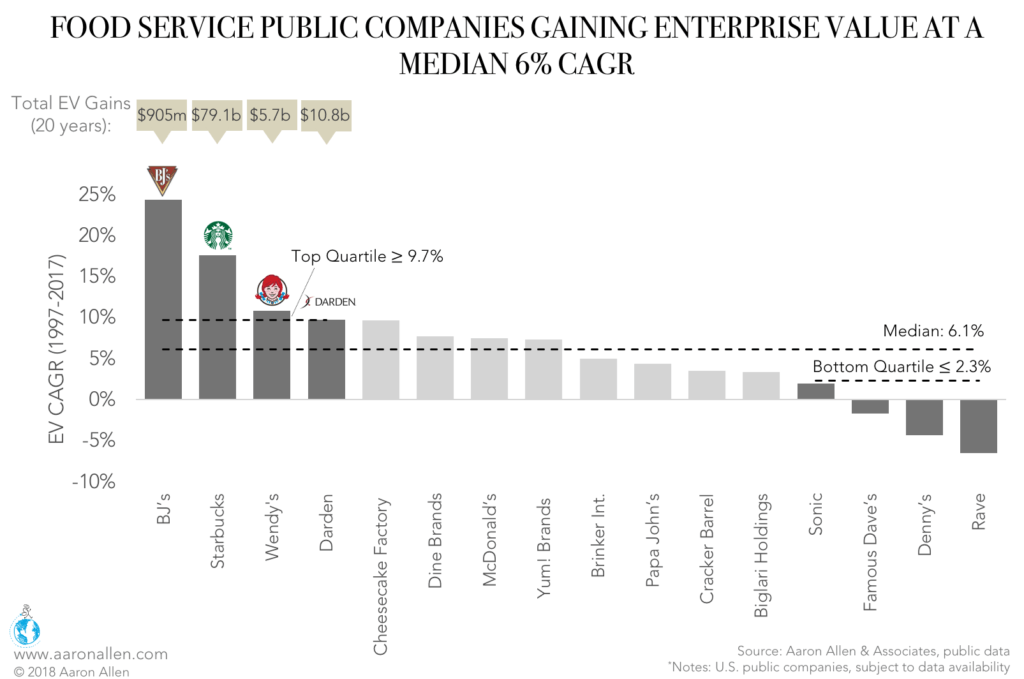

Only 16 of the 48 publicly traded restaurant companies analyzed have data that go back 20 years. Of those, BJ’s restaurant has by far the highest EV CAGR: 24.4% to second-place Starbucks’ 17.6%.

The coffee giant’s second-place finish can be attributed to the timing of this twenty-year snapshot. BJ’s went public in 1996, and that same year, it massively expanded its footprint by buying and retrofitting 26 Pietro’s Pizza locations. Since then, it has grown even more: now 11 breweries supply over 130 locations with the chain’s award-winning beer.

In contrast, Starbucks was already well on its way to global domination in 1996. When it first went public in 1992, it already had 140 outlets, and, in 1996, it had already reached 1,000. (It currently has over 23,000 units around the world.)

Because enterprise value is by definition highly correlated with stock price gains, it should come as no surprise that the companies with the highest EV gains also had top-quartile stock performance. Under this metric, Starbucks and BJ’s trade places.

Starbucks’ stock price grew from a humble $1.86 per share in 1997 to a remarkable $56.21 in 2017, amassing total gains of 2,914%. As a result, the coffee chain’s EV grew by $79.2b — the equivalent of Yum! Brands’, Restaurant Brands International’s, and Darden’s 2017 EVs combined.

High Stock Prices Don’t Always Translate into EV Gains

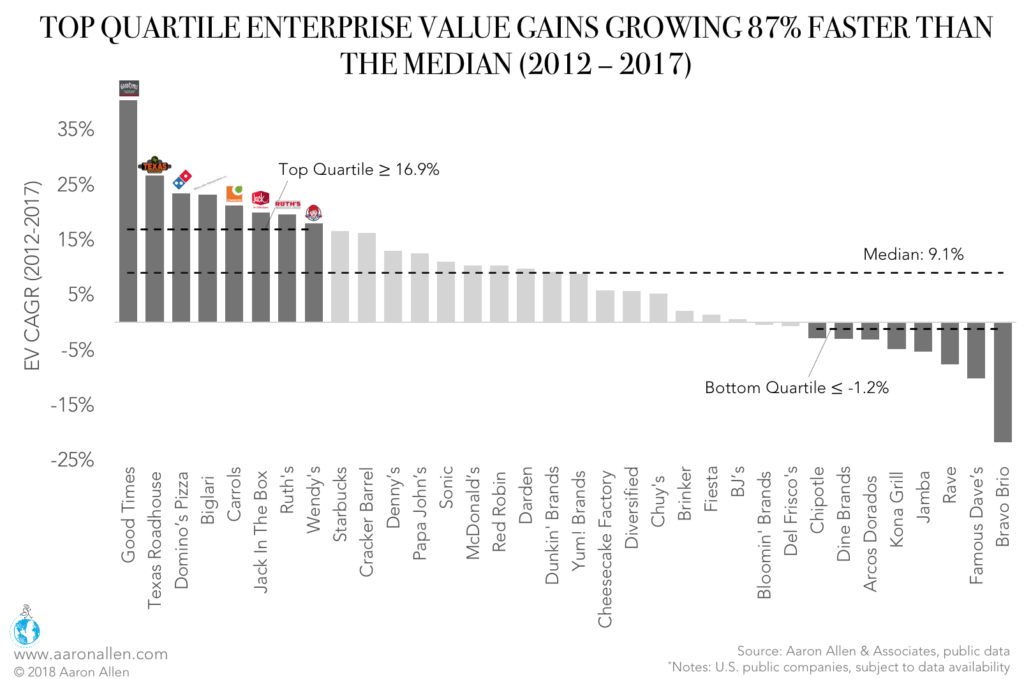

Good Times Restaurants’ EV value grew the most over the period 2012–2017, with a five-year CAGR of 40.3% or a total gain of 443.9%.

The company’s enterprise value was only $6.8 million in 2012, but it skyrocketed to $36.8m in 2015 after it acquired Bad Daddy’s Burger Bar for $21m. Despite this massive EV rise, the company’s stock price has fallen by 15.2% over the same period because it has been unable to successfully integrate the newly acquired business into its operations.

Texas Roadhouse and Domino’s Pizza also appeared among the top gainers as they saw their enterprise values rise by 226.0% and 187.0%, respectively. Both could be explained by increased in stock price: Domino’s has increased 393.5% (from $43.84 in 2012 to $216.32 in 2017) and Texas Roadhouse’s has appreciated 268.8% (from $15.86 in 2012 to $58.47 in 2017).

On the opposite side of the spectrum, Bravo Brio’s share value was slashed by 70.6% (from $14.90 in 2012 to $3.43 in 2017) as sales slumped due to recurring hurricanes in Texas and Florida and as the company closed down poorly performing restaurants in response to a downturn. The Italian restaurant chain was recently taken private by Spice Private Equity.

Smart Franchising Strategies Can Increase EV for Franchisee & Franchisor

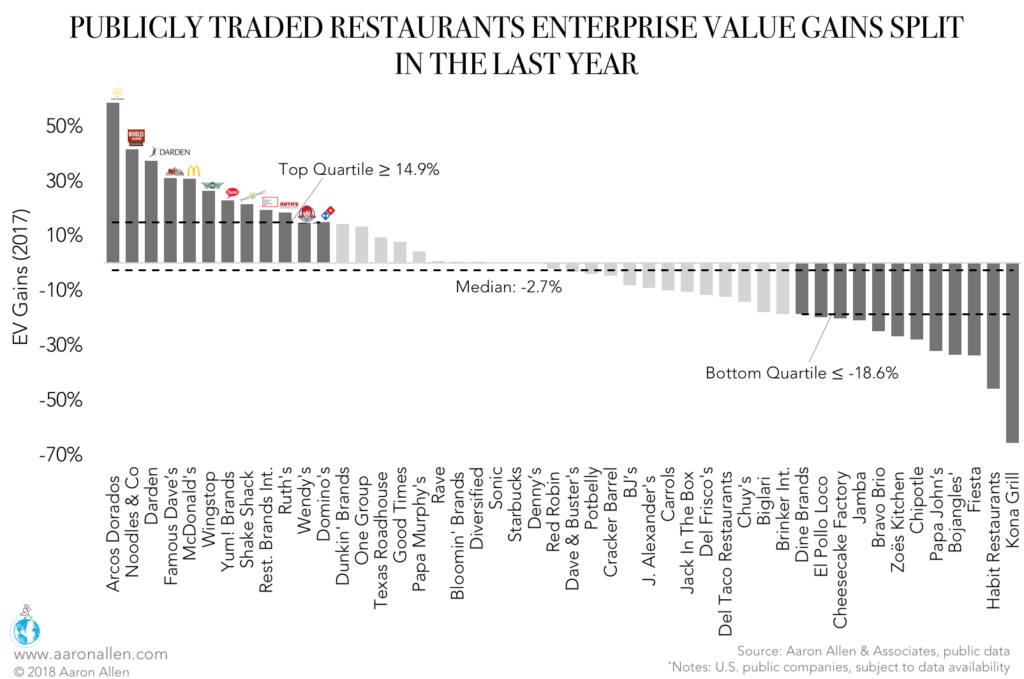

In 2017, Arcos Dorados — the largest McDonald’s franchisee with around 2,000 locations in Latin America — achieved the highest enterprise gain, with a total growth rate of 58.5% (from $1.6m in 2016 to $2.6m in 2017), driven by a sharp increase of 76.7% in its stock price.

The franchisee also posted outstanding earnings results thanks to the parent company’s refranchising plan, adding 50 restaurants in 2017, in addition to its efforts to streamline cost structures and reduce debt levels.

Consistent Restaurant EV Enhancements Come from Brand Identity, Technology, and Expansion

The following companies had the highest EV enhancements over the past 20 years and offer eight important lessons for growing value.

Two-thirds of these companies were QSR chains, showing that this segment has incredible staying power. Each operation has important lessons.

1. STARBUCKS: Successful acquisition activity and strong customer connections

Starbucks’ enterprise value has expanded from $3.2b in 1997 to $82.3b in 2017 (+2,463%). In this period, the coffee giant has sought to diversify its offerings by acquiring Tazo, Ethos Water, Teavana, and others. Starbucks has always fought for brand loyalty by emphasizing its third-place strategy, and it continually draws customers into its store by offering hugely popular limited time offers.

2. WENDY’S CO: Successful franchise incentives

Wendy’s enterprise value grew from $838.9m in 1997 to $6.5b (+676.8%) in 2017. The fast-food chain launched its Image Activation Program in 2013 to incentivize franchise locations to remodel, recognizing that dine-customers spend more per order than carry-out or drive-thru guests.

3. DARDEN RESTAURANTS: Distinct brand identities

Darden Restaurants’ enterprise value grew from $2.0b in 1997 to $12.8b in 2017 (+537.5%). This growth has been powered by the company’s large scale of operations and distinct identity for each restaurant brand in its portfolio. Each concept stands on its own merits, allowing the company to cater to diverse customer segments.

4. DOMINO’S PIZZA: Heavy tech investments

Domino’s enterprise value grew from $1.9b in 2004 to $11.4b in 2017 (+478.9%). The pizza chain has long been on the bleeding edge of delivery technology, anticipating the consumer demand for convenience much earlier than its competitors.

5. YUM! BRANDS: International expansion & a solid franchise business

Yum! Brands’ enterprise value grew from $8.2b in 1998 to $36.4b in 2017 (+316.0%). Efficient store modeling allowed the company — which owns KFC, Pizza Hut, Wingstop, and Taco Bell — to generated strong unit-level returns. Further, the high ratio of franchise-owned restaurants has helped Yum! reduce operating costs and expenses.

6. TEXAS ROADHOUSE: A consistent business model

Texas Roadhouse has grown its EV from $960.0m in 2004 to $3.7b in 2017 (+285.3%). The company has been able to deliver strong traffic growth in a difficult casual dining environment thanks to the unique dining experience. The addition of Bubba’s 33, a newer sports bar concept, has offered higher profitability and margins.

7. McDONALD’S: Brand positioning

McDonald’s EV grew from $38.9b in 1997 to $163.2b in 2017 (+319.8%). Over the past 20 years, McDonald’s strong credit rating has given it the flexibility to invest in key growth initiatives, while returning significant amounts of cash to shareholders. At the same time, Steve Easterbrook’s brilliant repositioning of McDonald’s as a value brand has brought customers back into stores over recent years.

8. RUTH’S GROUP: Healthy sales growth and improving balance sheet

Ruth’s EV grew from $442m in 2005 to $702m in 2017 (+58.9%). The company has seen healthy growth across the operation. The company behind Ruth’s Chris Steak House and Mitchell’s Fish Market has a mix of company-owned and franchised stores and has worked to improve its balance sheet and boost shareholders’ returns via a growing dividend.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We help restaurant operators and investors make informed decisions, minimize risk, and maximize sustainable value. With experience on both the buy- and sell-sides of transactions, we have a robust understanding of trends and factors impacting restaurant chains and private equity funds around the world. We help protect, enhance, and unlock value throughout every phase of the investment lifecycle. Collectively, our clients post more than $200 billion in annual sales, span all 6 inhabited continents and 100+ countries, with tens of thousands of locations.