Restaurant executives have to decide whether they want to be a tortoise or a hare. In the age-old fable, the tortoise moves ploddingly down the race course — slow and steady — eventually surpassing the hare, whose off-the-blocks speed can’t make up for his overconfident blundering.

In Aesop, the choice is easy: be the tortoise. In business, it’s much more complicated.

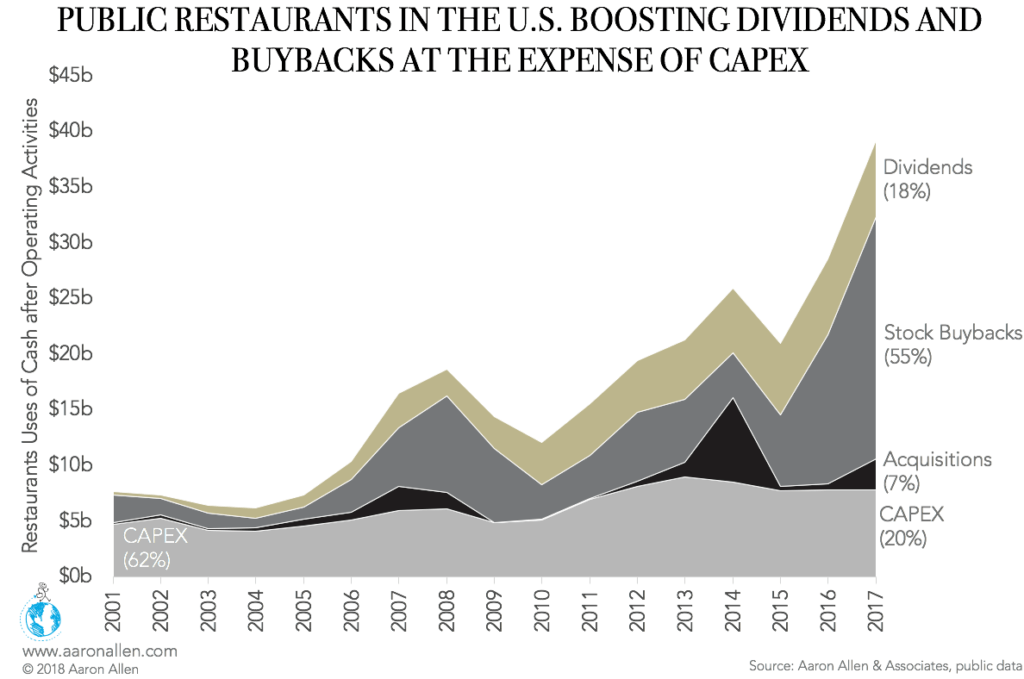

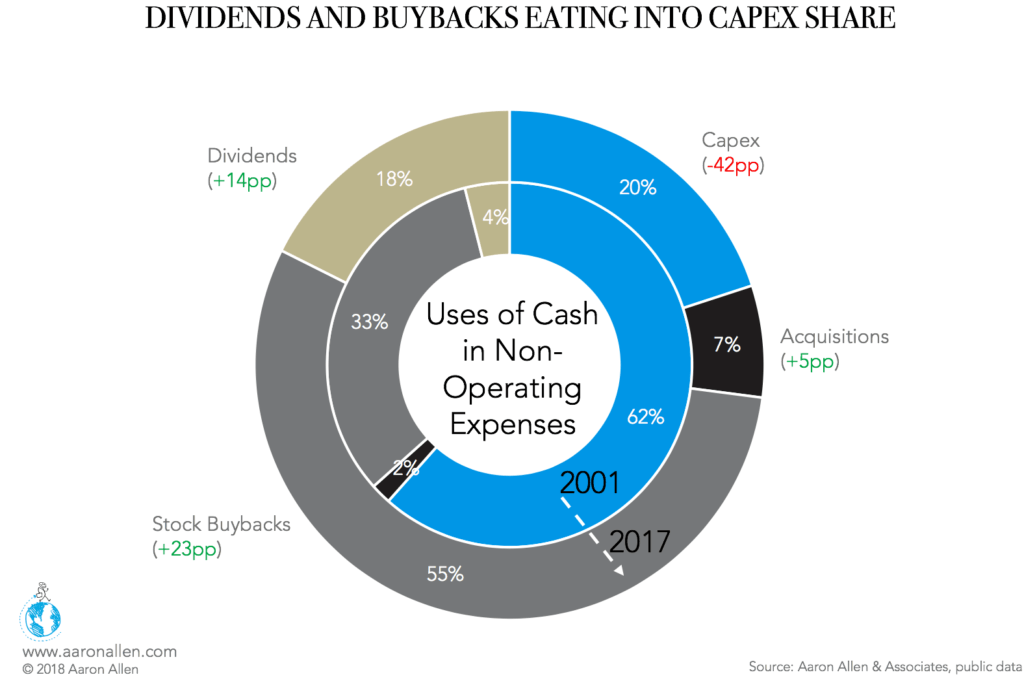

Operators must balance long-term initiatives against shareholders’ desire for short-term returns. Restaurants’ capital expenditure investments in technology, unit remodels, and new units boost revenue and create substantial value over the long-term, but, over the past two decades, many publicly traded foodservice companies in the U.S. have used their extra capital on share buybacks, dividend payouts, and acquisitions.

While the market is rewarding this hare-like thinking, a number of companies have taken a slower approach — and seen incredible increases in profit margins, stock price, and enterprise value.

Buybacks and Dividends Eating Into Restaurant Capital Expenditure

CAPEX spending can have a negative effect on short-term profits, which motivates some investors to sell shares. Other shareholders might move their capital to companies that use their non-operating cash flow to generate immediate gains, like dividends and stock buybacks.

Most publicly traded foodservice companies in the U.S. are listening to their investors and using the record amounts of cash on hand to generate short-term returns rather than long-term results.

Though the amount of restaurant capital expenditure hasn’t changed significantly since 2001, the share of capital going to CAPEX has decreased by 42 percentage points.

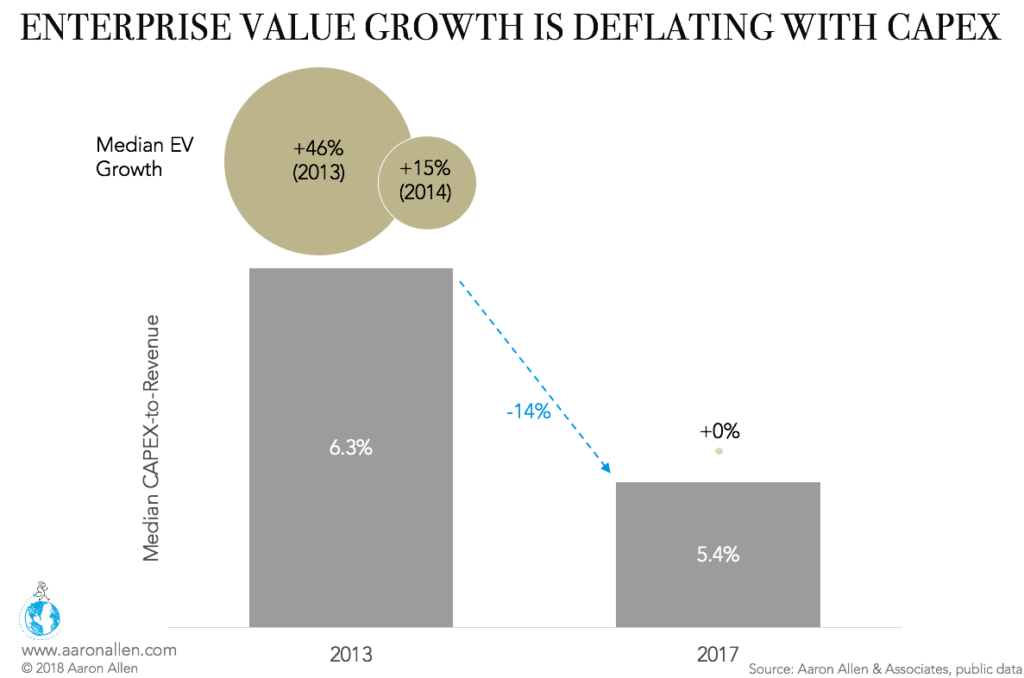

The focus on dividends and buybacks seems to be having a negative effect on enterprise value: as CAPEX spending has decreased, EV growth has as well.

Ten companies went against the grain during this period and increased their CAPEX spend, and each claimed both stock price and EV gains. Further, nine of ten saw profit margins and revenue increase with CAPEX spends.

Here are three good reason to increase CAPEX investments — with one big warning.

1. Investing CAPEX in Technology Offers Restaurants Competitive Advantage

All ten of the companies listed above have focused on technology: integrating smart systems into the supply chain, developing mobile ordering capability, and rolling out automated kiosks and state-of-the-art point-of-sale (POS) systems.

For instance, Domino’s has invested approximately $214.2m (2.8% of 2015–17 revenue) in capital expenditures since 2015. Most of that capital went to supply chain centers, a proprietary POS system (Domino’s PULSE), a digital ordering platform, and internal enterprise systems.

Domino’s saw a surge of 184% in stock returns and a boost of 110% in enterprise value since 2013 thanks to its impressive — and immersive — digital experience. Now, Domino’s likes to think of itself as “an e-commerce company that sells pizza.”

Other chains, including Sonic, Cracker Barrel, Del Taco, and Dave & Buster’s, have also invested in proprietary POS platforms, mobile ordering systems, and self-service kiosks. During peak rush hours, line-busting digital ordering allows patrons to order and cash out on the spot. CEO Cliff Hudson promised that Sonic’s Integrated Customer Engagement platform, or ICE, will become “the most personalized customer experience in QSR.” These tech investments allow chains to increase their store’s performance while enhancing the customer experience.

Finally, smart use of tech and digital delivers massive amounts of data, which restaurants can use to understand what’s driving revenue and profit. This has allowed them to become more adaptive and responsive, allocating extra funding to areas and initiatives that are working and changing course on projects that haven’t delivered.

2. New & Remodeled Locations Create Foundation for Sustainable Success

All ten restaurants in the group allocated significant CAPEX to new-store openings. In 2017, Flanigan’s purchased property and equipment for $7.2m and spent $2.4m on construction.

Ruth’s CAPEX investments went mostly to acquiring six franchisee-owned restaurants, and, in 2016, Cracker Barrel launched Holler & Dash, a fresh fast-casual concept serving a Southern-style menu to a younger segment.

Cracker Barrel’s risk has paid off, and Holler & Dash has rapidly opened new units across Georgia, Tennessee, and Florida. In 2017, Good Times Restaurants spent $9.1m to develop Bad Daddy’s locations in Colorado and North Carolina.

3. Investing in Remodeling Initiatives Boosts Traffic and Drives Sales

Besides openings, many restaurants allocated funds to improve or renovate existing restaurants. Ark Restaurants has spent big on renovating Sequoia, and Del Taco launched Ambiance Shake-Up, a remodeling initiative that cost an average $45,000 per store.

The program has helped accelerate same-store sales by aligning the unit design with the brand image. Del Taco witnessed a 243% increase in enterprise value and 117% increase in profit margin from 2013 to 2017. The big boost in profit margin came from menu engineering and supply chain optimization.

Warning: Markets Not Rewarding CAPEX Post-Financial Crisis

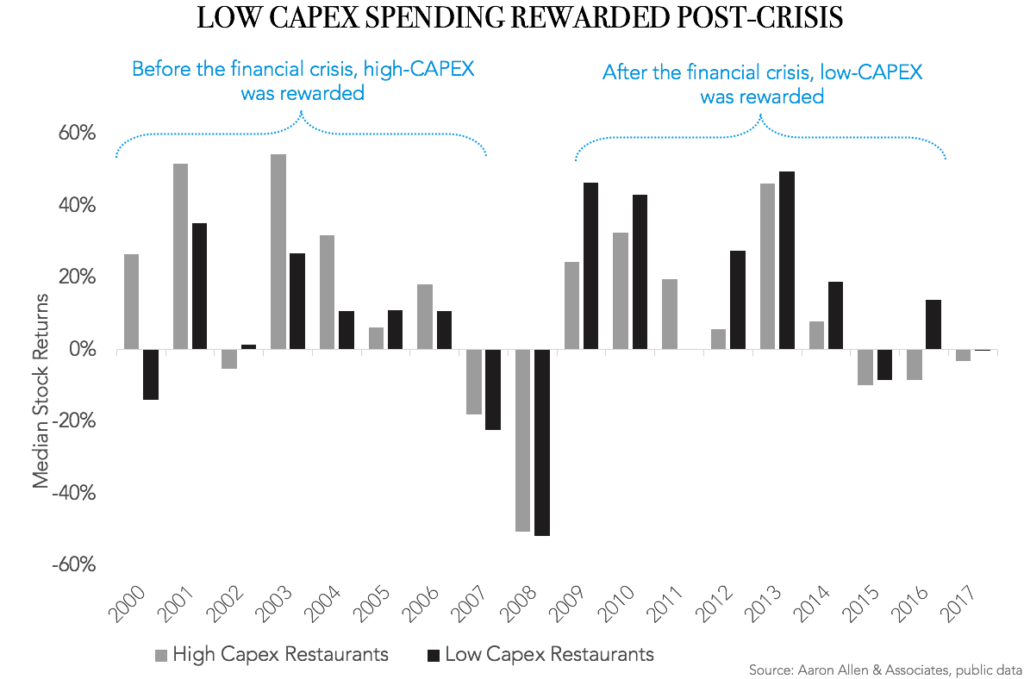

While these ten companies have landed on successful strategies for translating CAPEX investments into revenue and enterprise value boosts, there’s good reason to tread carefully. Before the 2008 crisis, higher-than-median CAPEX restaurants outperformed low-CAPEX companies in most years, likely owing to their growth prospects and general economic optimism. However, the financial crisis hit these organizations harder, and they incurred greater losses compared to their low-CAPEX peers.

Since 2008, the markets have rewarded low-CAPEX companies — many of which include highly franchised systems — for their conservative behavior, and many operations have remained cautious, investing only in carefully examined opportunities that are anticipated to create value.

Since 2015, the median stock return for high-CAPEX restaurants has been negative (-10% in 2015, -8% in 2016, and -3% in 2017). These companies are hindered by high operating and interest expenses arising from the debt often used to finance CAPEX.

Not all CAPEX spending is created equal. Naturally, a restaurant chain that spends heavily on opening new locations before the industry begins contracting will have a very different fate than one that expands as the market is booming. Inventing a new inventory system that doesn’t actually improve efficiency costs the same amount of money as developing one that increases margins. The secret is making strategic capital investments because these are proven to increase revenue and boost value.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.