How profitable are the most successful restaurant operations? The answer to that question will change based on the margins used to measure the organization’s performance. In this series, we examine three metrics that investors and managers use to gauge a foodservice operation’s profitability: gross margin, operating margin, and profit margin.

How to Calculate Restaurant Profitability Margins

Each margin calculates the relationship between a company’s revenue and its liabilities, from labor and food costs to administrative expenses and debt payments.

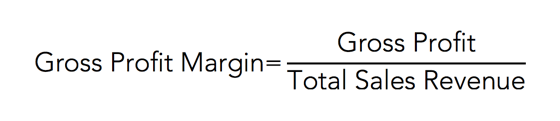

Gross margin reflects what percentage of revenue a restaurant operation keeps after paying for the costs of the products or services it sells. The higher ratio, the better, indicating a lower cost of goods sold (COGS), which includes any expenditure directly necessary for producing the items on a restaurant’s menu.

The ratio is calculated using the following expression:

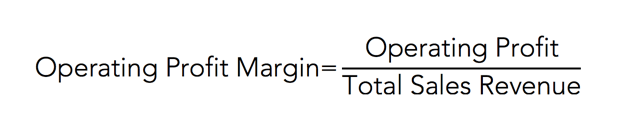

Operating profit margin indicates what percentage of revenue remains after all operating costs have been deducted, including COGS, selling, general, and administrative (SG&A) expenses, and others. That is, operating profit includes more costs than gross profit, because it takes into account line items like marketing, managerial salaries, and other expenses not directly related to production.

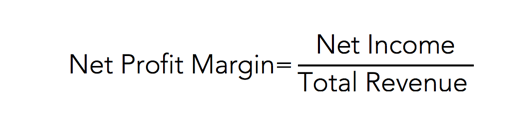

The net profit margin ratio includes every expense an organization pays out before calculating the percentage of each revenue dollar it gets to keep. It also considers other sources of revenue besides sales, like interest income.

While gross and operating margins are entirely under the company’s control, net profit considers line items including taxes, depreciation, debt payments, and extraordinary items.

It is calculated as follows:

These equations give management teams and potential investors different ways of slicing through the operation’s performance to help discover where costs may be excessive relative to performance.

Simple Menus and Streamlined Operations Key to High Margins

From a comparison of public companies, Dunkin’ Brands came in first for all three margins, owing not only to the recent decision to simplify its menu and refocus on the breakfast segment, but also to the coffee-and-donut giant’s 100% franchise rate, which stabilizes costs for the parent company.

Across margin calculations and segments, concepts with focused menus performed better than those that offered a lot of options. Highly franchised chains have operating margins about 5.5x the industry median.

Though these margins are by no means definitive, they are useful metrics for comparison, helping executives and investors see how other operations in their space perform.

ABOUT AARON ALLEN & ASSOCIATES

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, and commercial due diligence for emerging restaurant chains and prestigious private equity firms. We work alongside senior executives of some of the world’s most successful foodservice and hospitality companies to visualize, plan and implement innovative ideas for leapfrogging the competition. Collectively, our clients post more than $100 billion in sales, span all six inhabited continents and 100+ countries, with locations totaling tens of thousands.