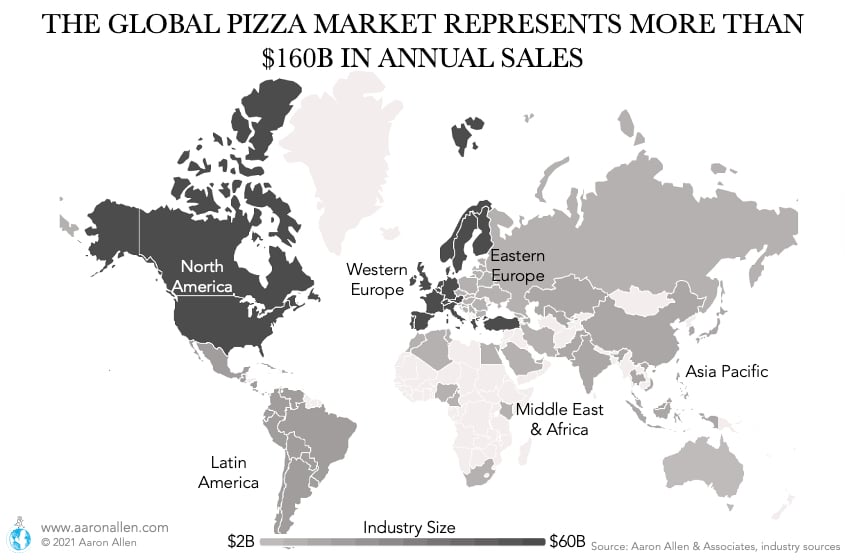

The $160 billion-plus global pizza industry is not for the faint of heart. Major chains account for roughly a third of the industry globally (and more than 50% in mature markets like the U.S.), and costs—including labor, rent, and commodities—will likely continue to rise. However, success stories are still possible in pizza as operators find ways to continuously innovate with technology.

In many ways, this foodservice segment may serve as a precursor for other QSR categories, where the larger players continue to gain share but smaller players embracing new technologies to level the playing field.

Here’s everything restaurant CEOs need to know about the pizza industry.

Table of Contents

Pizza Industry Statistics

The following pizza industry statistics cover the most relevant figures for the pizza industry, including how much is the pizza industry worth, what is the pizza industry growth rate, the U.S. pizza market share, and how many people is employed by pizzerias.

- The global pizza industry represented $160 billion in sales in 2020, $85 billion of which came from the QSR category

- There are more than 245,000 pizza restaurants in the world, with around 77,000 in the U.S. alone

- From 2012–2019, 6,000 new pizza restaurants were opened in the U.S.

- The U.S. pizza category employed more than 830,000 people prior to COVID-19

- U.S. consumers spent more $20 billion on QSR carry-out pizza in 2020, and another $14 billion on pizza delivery

- Connecticut had the largest number of pizza places per capita in the United States in 2019 with 3.65 units per 10,000 people in 2019; Pennsylvania (3.62), Rhode Island (3.59), New Jersey (3.54), and Iowa (3.44) round out the top 5

- Norway consumes the most pizza in the world on a per capita basis, with each resident eating about 11 pounds annually

- More than 5 billion pizzas are sold worldwide each year

- Gennaro Lombardi is generally credited with opening the first pizzeria in the U.S. in 1905

- Among the three largest pizza chains in the U.S., Pizza Hut is the oldest (founded in 1958 in Wichita, Kansas), followed by Domino’s (1960 in Ypsilanti, Michigan) and Papa John’s (1984 in Jeffersonville, Indiana just outside of Louisville)

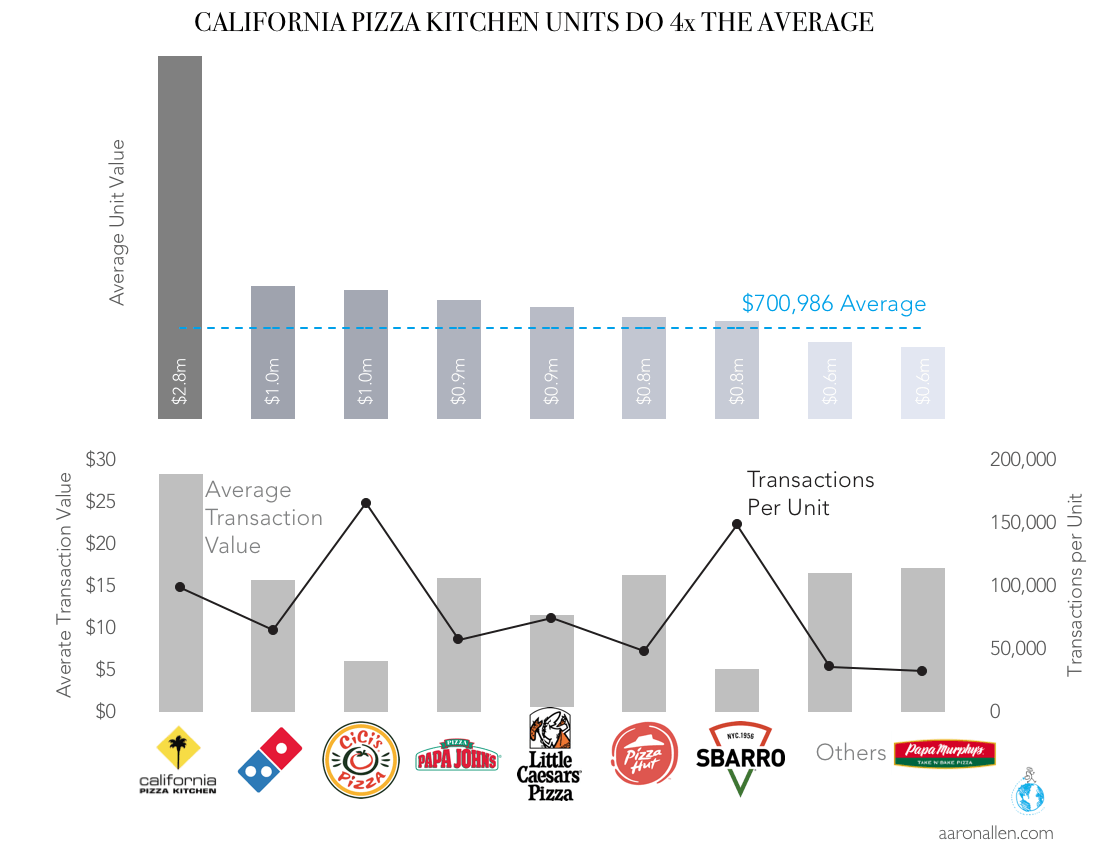

- On average, chain pizza brands generate average unit volumes (AUVs) of $656,000, while independent pizza businesses generate AUVs of $385,000

- According to Domino’s, there are 34 million possible pizza combinations on its menu

- The average pizzeria uses about 55 pizza boxes per day

- The top 5 highest-grossing pizza sales days in the U.S. are Super Bowl Sunday, New Year’s Eve, Halloween, Thanksgiving Eve, and New Year’s Day

- Pizza technology is increasingly more important; more than 70% of Domino’s orders come through digital channels

- Most publicly traded pizza company franchisors allocate between 2%-3% of revenue annually for capital expenditures (including technology investments)

- The largest pizza chains in the world are American

Pizza Industry Expert Advisory

We have advised some of the leading pizza chains globally in themes related to market landscape, total addressable market, sales growth, domestic and international expansion, franchising, acquisitions, optimizing margins, technology adoption, and much more.

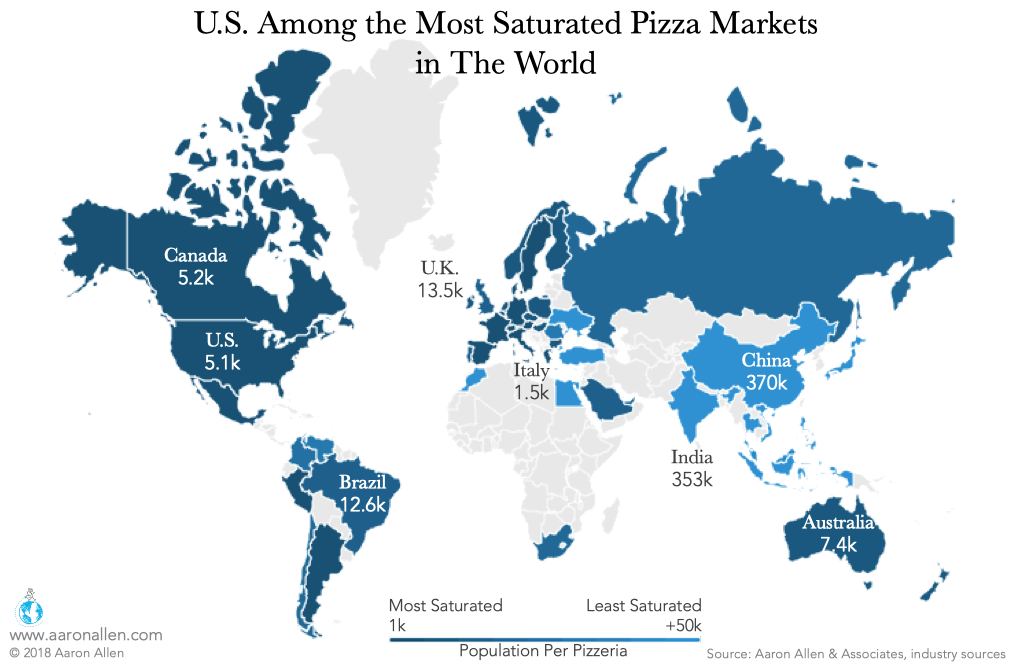

Emerging Markets Offer Opportunity Away from Saturated U.S.

The U.S. pizza industry is among the most saturated in the world with one pizzeria for every 5.1k people. That’s not slowing down chains with hustle though. In fact, the fast movers are cannibalizing others with a ferocity that should be cause for alarm for those not investing in the arms race that is shaping up.

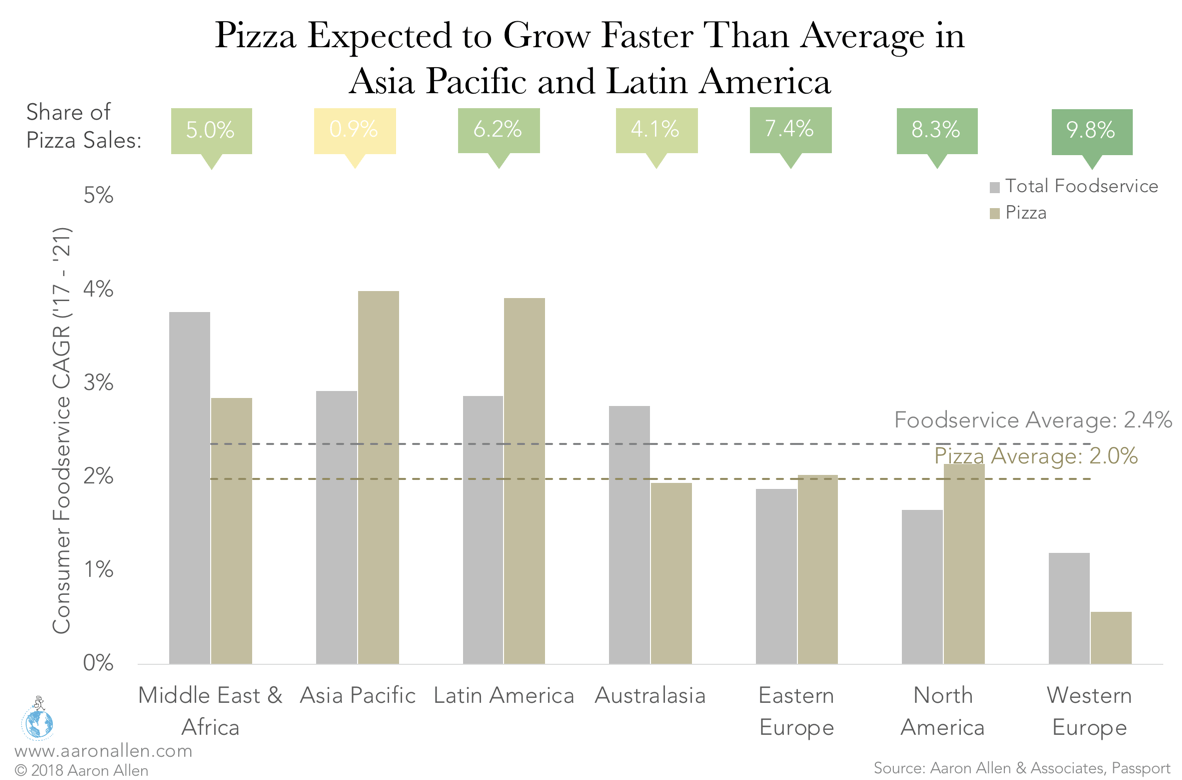

Growth in these mature markets is slow. On the contrary, markets with low saturation are expected to post high growth rates for the pizza segment: in Asia Pacific and Latin America, pizza sales are expected to grow 1.4x as fast as the restaurant industry in general.

Both Pizza Hut and Domino’s have their sights set on these emerging markets. Domino’s is pursuing expansion in Brazil, India, Russia, and China. Pizza Hut is pushing growth in Sub-Saharan Africa, where it plans to have 250 units across 25 countries by 2020. In May 2018, it also announced a partnership deal with Telepizza that gave the Spanish company master franchise rights in three European countries, Latin America (excluding Brazil), and the Caribbean. This alliance will put Pizza Hut in first place in the latter two geographies.

Pizza Industry Trends: What to Expect in the Next Five Years

We’re currently seeing a whole host of pizza chains (from the household names like Domino’s and Pizza Hut to the rapidly expanding fast-casual players) racing toward the same finish line. The sheer amount of pizza businesses is a signal that some likely won’t finish the race, falling by the wayside as more competitive chains forge ahead.

These are some of the trends the pizza industry will face in the next few years (and check out our article on how restaurants are coping with different changes:

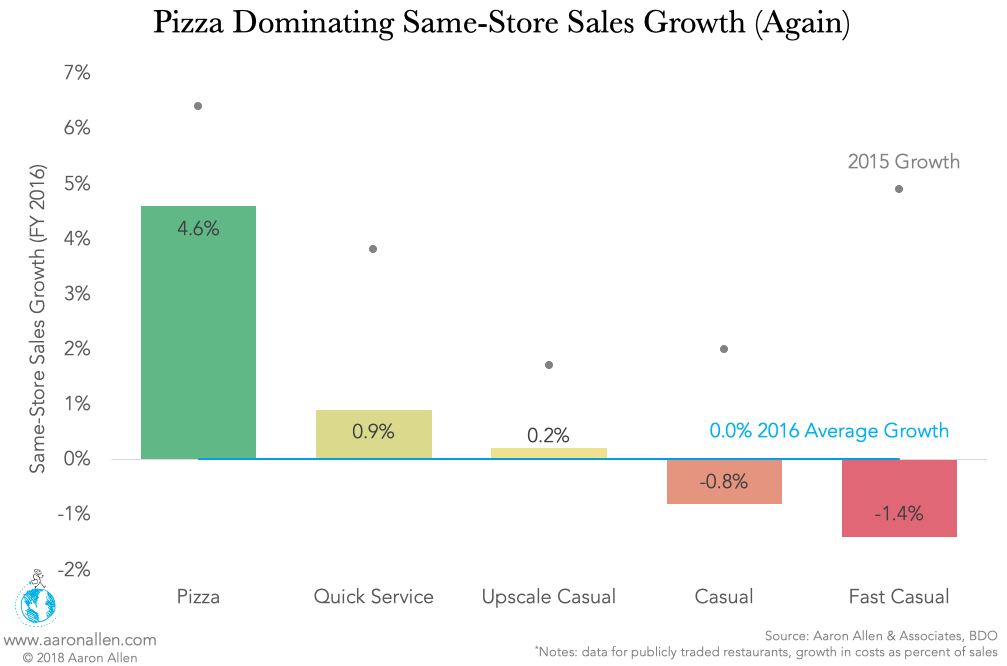

- The pizza industry in the U.S. is likely to experience lower growth than the foodservice industry overall (while Food Away From Home sales have grown, on average, 6.2% annually over the past three years, the pizza segment is expected to experience a CAGR of 4.6% in current dollars).

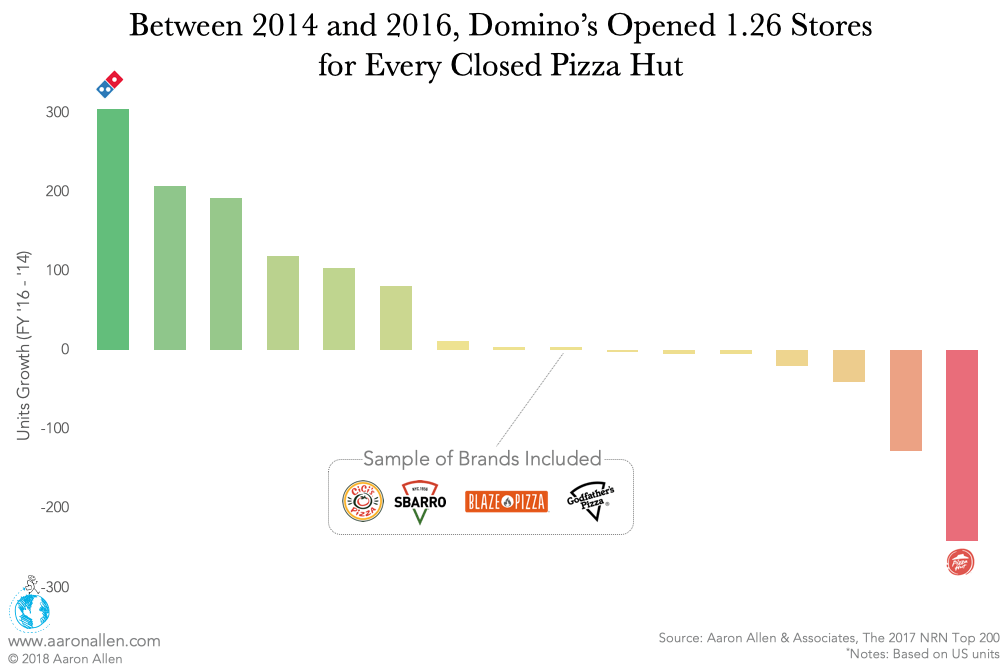

- The weaker concepts and chains will be gobbled up or lose share as the segment continues to grow crowded. (For every Cici’s and Sbarro pizzeria that closed, we’ve noted 1.2 Domino’s pizzerias have opened.)

- The biggest players will continue to unveil innovative ways to order, forcing independent operators to increase their investment into tech (but not without putting plans in place to ensure its efficacy).

- Labor, rent, and commodity costs will force chains to enact plans farther in advance than they have historically.

- Seismic shifts in technology and convenience will see pizza chains compete against non-traditional players and segments. Change will occur at a much faster pace than ever before.

Below, we outline a handful of hurdles facing pizza chains today, and how restaurants can best begin to tackle them.

New Concepts Keep Cropping Up, But Growth Won’t Be Enough to Support Them All

Like the Better Burger segment, the pizza market is becoming crowded with a slew of similar concepts. A potential pizza industry bubble doesn’t mean pepperoni and cheese pies will go away. Nor will Domino’s, Pizza Hut, or Blaze fade into obscurity any time soon. But with some fast-casual concepts growing at rates of more than 100% (pre-Covid), and newer players continuing to pick up funding (Blaze, for instance, touts investors including LeBron James and private equity firm Brentwood Associates), cannibalization is naturally on the horizon.

Those in the most danger will be the independent pizzerias not keeping up with modern technology, as well as chains not offering anything unique enough to distinguish them from the pack. The shift from independent pizza businesses to pizza chains in just a ten-year window is striking (in the last decade, American independents have lost 21% market share in terms of sales and 19% market share in terms of units to chains) — but it’s likely to grow at an even more rapid clip.

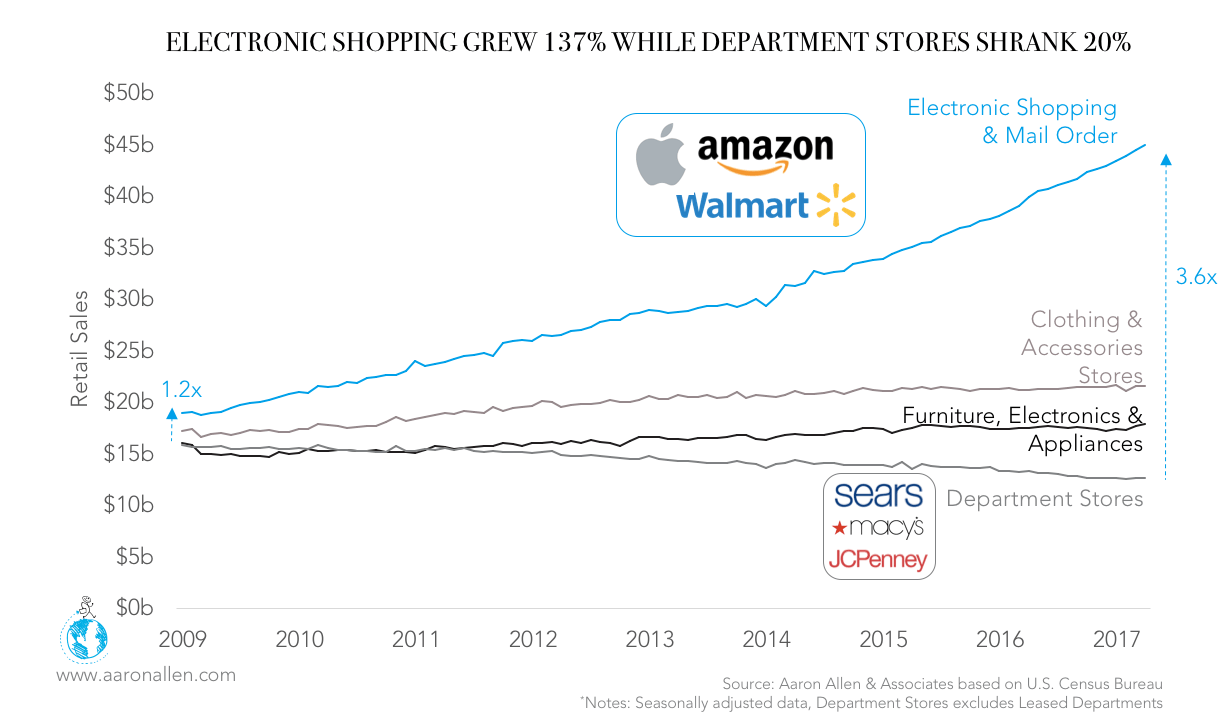

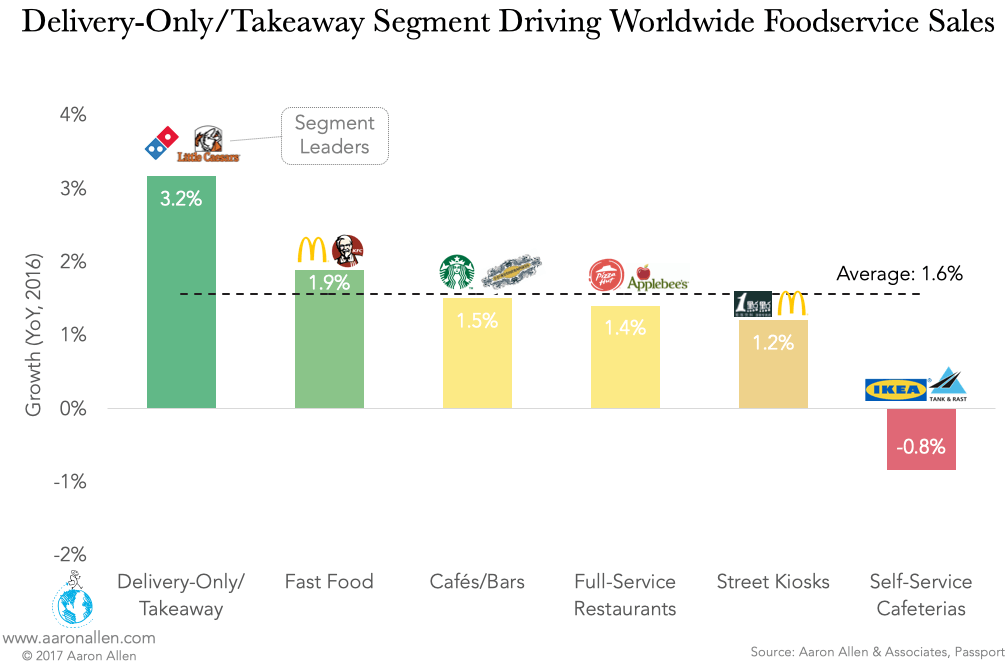

Competition is Not Only Coming from the Big Pizza Chains

Historically, pizza chains saw huge shares of revenue being driven by delivery or carry-out. But gone are the days when the only two delivery options were pizza and Chinese food. The danger of competitors has grown and a slew of tech-savvy, energetic concepts have emerged. As a result, share is no longer just being stolen by “the big guys,” but from entirely new segments, a range of restaurants with mobile apps, and third-party delivery apps, like the Uber Eats and Grubhubs of the world. As delivery expands and more convenient options become ubiquitous, innovation will continue to take a toll on low-tech operators.

But just because the U.S. market doesn’t necessarily need another pizza restaurant (unless it’s incredibly distinct), doesn’t mean there’s no untapped opportunity. Emerging markets (including the Gulf Cooperation Council, Brazil, China, India, some parts of Africa, and other parts of Asia with booming populations and fragmented foodservice) offer enormous potential. Of course, there are international players, as well — 800 Degrees, for instance, has outlets in Dubai and Tokyo as well as the U.S. — but there remain numerous opportunities around the globe.

There Will Be Consolidation in the Pizza Industry

The bulk of pizzerias see within $600K and $1M in Average Unit Volume. On the high end, California Pizza Kitchen has an AUV of $2.8M, explained largely by a higher check average. Cici’s and Sbarro sit on the opposite end of the spectrum, characterized by low ATV (and high traffic) – a model that doesn’t appear to be as successful as it once was, considering both chains saw negative growth over the last five years. Domino’s, Papa John’s, and Pizza Hut, meanwhile, compete at similar values of Average Transaction Value and traffic.

People won’t stop eating pizza, but there will be consolidation, with weaker players getting gobbled up. A lot of chains in the mature part of the life-cycle are already ripe for consolidation. For private equity firms looking to invest in a restaurant concept, the opportunity abounds. There’s also an increased need for firms to help rehabilitate and improve those mature brands that have not kept up with the times. Through the proper investment (plus help from a seasoned expert), firms can provide the necessary capital and management insights required to reimagine a future for an older brand, and seed relevance within the increasingly competitive pizza category.

Commodity, Labor, and Rent Costs Will Also Rise

The restaurant industry faces a slew of challenges, including the fluctuating costs of commodities and rent and labor inflation. There was a period of time when commodity costs were relatively low. Pizza chains will be especially impacted by higher dairy, wheat, and flour costs.

Expect major inflation to impact commodity costs, especially more premium items like steaks and higher-end seafood. Already in 2021 (YTD) corn, chicken wings, and pork have gone up more than 30% compared to last year.

For some, commodity price increases will be manageable in the overall context of a business. But for others, the impact will be felt in a deeper sense (though proper planning can provide a better cushion).

Even if rising costs aren’t yet impacting chains, restaurant companies should plan ahead — we expect to see rent and labor costs spike within the next five years. Rising wages and lower unemployment rates will prove especially potent for the industry. Minimum wage hikes have already taken effect in more than two dozen states and municipalities, with plenty more expected to follow suit soon enough.

Seismic Shifts (in Technology, Convenience, and More) Will Occur at an Even More Rapid Pace

Today’s business environment is a survival of the fittest. The weakest chains and concepts will have a limited life span; poor planning could spell the difference between distinct and extinct.

We’ve seen the fate that awaits those who take a wait-and-see approach. While Amazon continues to dominate the retail industry, companies like Sears and JC Penney have suffered. Many restaurant chains (particularly those in the pizza segment) will face similar challenges. Those who wait too long risk missing the path toward recovery.

The most dramatic reshaping of the industry to happen in decades will occur over the next five years, and complacency will be a death knell for restaurant concepts. Restaurant guests don’t expect chains to innovate as rapidly as Apple, but they are growing more and more accustomed to convenience and the tools that enable it.

On the one hand, chains have to work from the inside-out — a holistic approach that our firm has long touted. On the other hand, though, working from the inside out requires an outside-in approach. Restaurant chains must start with looking at their own company: their promise, their people, their processes. But if they really want to understand why they’re struggling, they must start at the widest, most global levels, determining which forces are bearing down on them and how they’re being re-shaped as a result.

The world doesn’t need another pizza place. What it does need is something new — a unique promise and positioning strategy that will resonate with consumers. Chains that can bake that unique promise into their pies, and top it off with all of the non-negotiables (convenience, service) will be rewarded with a larger slice of share.

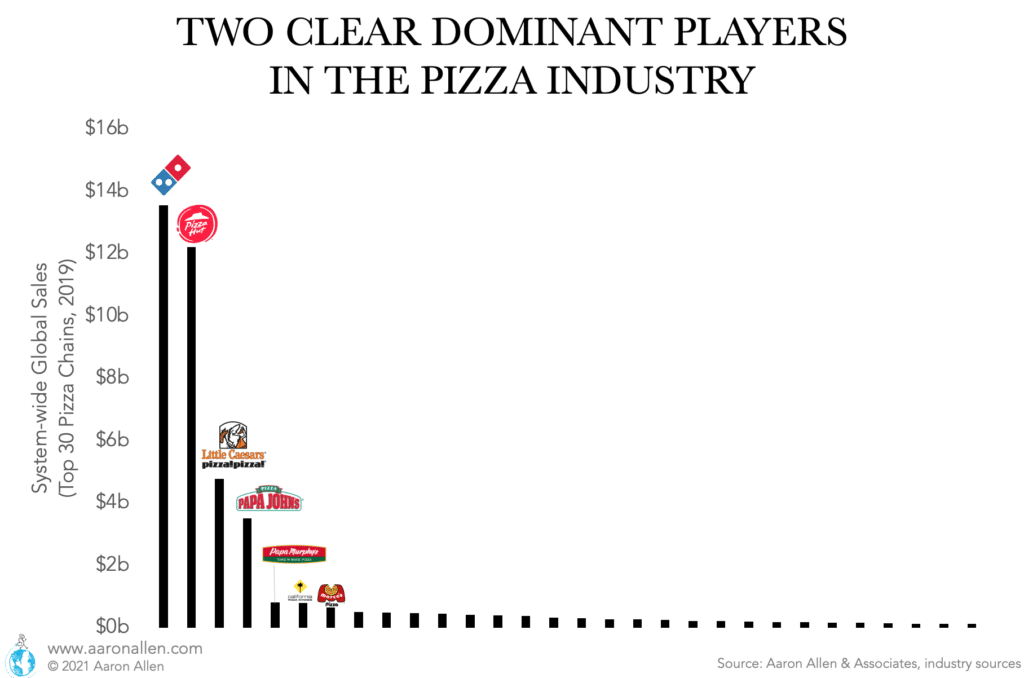

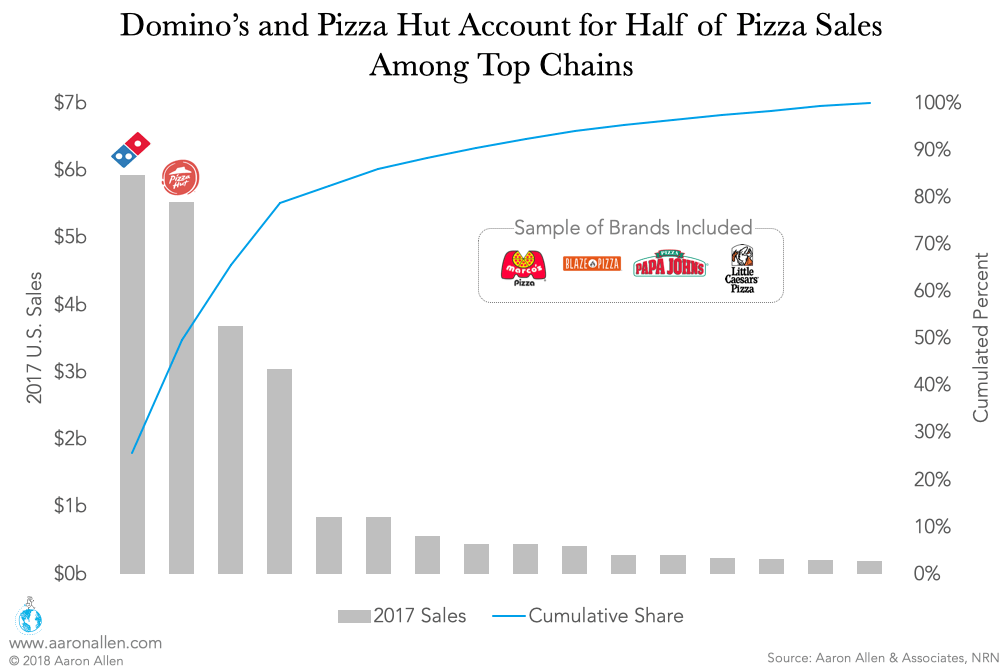

The Top 100 Pizza Chains Represent $45.6 Billion in Sales

The largest pizza chains in the U.S. account for more than $45.6 billion in global sales and some 60k stores. There are clearly two leaders in this category that dominate sales. Domino’s and Pizza Hut represent 56% of sales among the top 100 pizza companies — largely because of their presence in international markets.

- Domino’s Pizza: $16.1 billion global sales in 2020, almost equally split between the U.S. (52% of sales) and internationally. Domino’s was founded in 1960 and has more than 17,600 stores in more than 90 markets. The company’s success has largely been linked to the development of its own tech stack. In 2020 more than 70% of U.S. sales were achieved via digital channels.

- Pizza Hut: $12.0 billion global sales in 2020 with more than 17.6k restaurants. 45% of Pizza Hut’s sales take place in the U.S. and more than 30% in Asia (including China and India).

- Little Caesars’ Pizza: $4.8 billion in sales in 2019. The company has restaurants in more than 25 countries and territories including Latin America, Europe, and Asia.

- Papa John’s International: $3.5 billion in sales in 2019 with ~5,400 restaurants in 48 countries and territories. About 60% of the company’s footprint is domestic.

- Papa Murphy’s International: More than $800 million in sales in 2019 with ~1,400 restaurants.

The fast movers are cannibalizing others with a ferocity that should be cause for alarm for those not investing in the arms race that is shaping up.

Pizza Today publishes the rank with the top 100 every year.

What Are the Best Pizza Companies (Besides the Traditional Players)?

One could argue the largest pizza companies are the best ones. However, there are several pizza companies that stand out for different reasons (besides their scale).

- New Haven Pizzerias: there are three top pizzerias in New Haven that are renown for their pies and probably in the top ten best pizzerias in the United States. These are Frank Pepe Pizzeria Napoletana, Sally’s Apizza, and Modern Apizza.

- Dodo Pizza: Russian based pizza brand, this company has beaten several international benchmarks in terms of growth. Same-store sales growth reached 5.4% in 2020, outperforming Domino’s international segment (at 4.4% SSS growth). Over the last eight years (2012-2020) it has grown faster than one of the fastest-growing restaurant companies in the U.S.: Wingstop. While Dodo Pizza opened stores at a 74% CAGR Wingstop’s growth was 12% annually.

- Maestro Pizza: This has been one of the fastest-growing restaurant chains in the Middle East. Based in Saudi Arabia, the company has more than 150 locations.

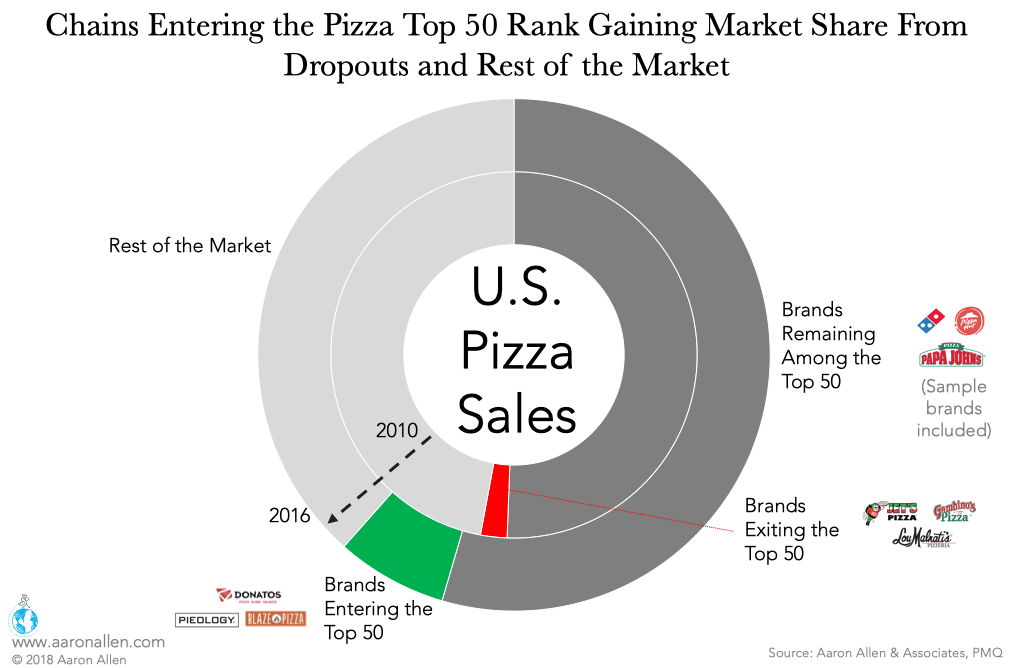

In the Pizza Industry, Gains are Coming at the Expense of Competitors

The largest 50 U.S. pizza chains have increased their market share in the last few years, mostly thanks to the new brands that entered the rank.

While those brands remaining among the top 50 between 2010 and 2016 increased their market share (from 51% of the pizza market to 55%), the new brands (many of which are fast-casual) took market share from the dropouts and smaller competitors. These new entrants claim a 7% share — 5 percentage points more than the exiting brands did in 2010.

This ongoing battle helps illustrate just how competitive the pizza industry — and nearly every category of foodservice — is these days. Gains for one almost always come at the expense of another.

One case in point: between 2014 and 2016, Domino’s opened five stores for every four Pizza Hut stores that closed.

Pizza Industry Events, Conferences, and Trade Shows

Given the breadth of the pizza market, it makes sense that there are several industry-specific events held throughout the year. Here are highlights of some of the most popular:

Pizza Expo

An international conference that takes place every year in the U.S., including keynote speeches from industry experts, demos and best practices workshops, pizza design ideas, and a large floor of vendors for equipment and other supplies. It hosts more than 13k attendees and more than 550 vendors.

Pizza & Pasta Expo

The annual Pizza & Pasta Northeast trade showcases more than 200 top suppliers and exhibitors to over 2k qualified buyers. This event is also organized by International Pizza Expo.

The European Pizza & Pasta Show

This event gathers around 200 exhibitors, 1k brands, and 4k buyers. There are also seminars and competitions.

Investments in Guest-Centered Innovation Key to Future Success in Pizza Segment

What can be deduced from all of the data and information available on the pizza industry? Here are five key takeaways for leaders across foodservice segments:

1. Global Growth

Category leaders will increase their global footprint and market share. The speed of emerging brands and scale and strength of established systems are both contributing to a shuttering of small mom-and-pop pizzerias and a siphoning of share from middle-market players not aging well.

2. Consolidation

Independent operators that fail to differentiate their brand (product, packaging, positioning, value proposition, and so on) will be forced to close or suffer painfully thin profit margins. Chains will continue to cannibalize independents in the foreseeable future. Among the chains, those that have figured out the formula for international development and made MarTech investments ahead of what was required will reap the most bountiful harvests. The divide between the leaders and laggards will continue to widen, leading to collapse for some of the tired brands among the top 50.

3. Convenience

The story of the pizza industry is not about delivery or technology. It is about engineering greater convenience — we call this Convenience Engineering™ — into the business. This should first be guest-centered, but it should also ripple out to all essential constituencies (employees, investors, members of the media, and more) as well as the modernization of the internal systems and infrastructure that move the most important commercial levers within the business.

4. Innovation

Domino’s has innovation in its corporate DNA. They invented the cardboard box, the plastic pizza table that keeps the top of the pie from being crushed, the original 30-minute guarantee, and even a pizza-centered automobile and autonomous delivery vehicles. The real strategic lessons of the Domino’s case studies are often lost in the sensationalism of the tactics surrounding technological investments and successes (or a sharp criticism of the product). The company has cycled through many of the same challenges any decades-old business must eventually face. It is interesting though to consider for a moment how easy it is to throw around the term innovation, yet how much more it requires to accomplish it. Easy to say, hard to achieve. What Domino’s teaches us is that all innovation must relate to the brand’s unique value proposition. Domino’s is the world leader in pizza delivery, and every new invention, technology, or marketing push is designed to keep that position secure.

5. Investment

Margins will fluctuate with commodity costs, market share will ebb and flow among those with hustle, and growth in mature markets can be challenging, but pizza is not a waning beanie baby–type fad; it has staying power. Significant capital is required to retool and refresh the relevance of aging pizza brands (including dollars for pizza marketing), but there is clear evidence that those investing in innovation are being rewarded on levels rarely seen in foodservice.

Frequently Asked Questions About the Pizza Industry

Pizza Hut is among the eldest of all foodservice chains in the U.S., and the oldest pizza chain. It was founded in 1958 in Wichita, KS.

Domino’s became the largest pizza chain in the world when it surpassed Pizza Hut in 2018. According to the company, they sell more than 500 million pizzas each year, globally.

The global pizza industry is worth $160 billion in annual sales. The biggest market is in Western Europe, with $60 billion in annual sales, followed by North America (U.S. and Canada with $56 billion).

The pizza industry is growing, but the growth rate can be very different based on the geography. For example, Eastern Europe and Asia Pacific are among the fastest growing pizza regions in the world, with CAGR higher than 5% over the last five years. On the other side, mature markets like North America and Western Europe are only growing around 3% annually.

Yes, the pizza industry is highly competitive because there are very low barriers to entry and the product can be easily replicated. However, large chains have been able to dominate. In the U.S., the two largest chains (Domino’s and Pizza Hut) account for 56% of the sales among the top 100 pizza chains.

The coronavirus pandemic created a lot of opportunity for pizza off-premise consumption. In the U.S., pizza was the fastest-growing segment in 2020 with a median same-store sales growth of 11.6%

The global pizza industry is one of the most mature categories in foodservice, reaching a growth rate of about 2% per year — slightly lower than the restaurant industry's annual growth.

Past Pizza Industry Insights

Pizza Related Articles

Pizza Marketing: Get insights on some of the post successful promotions and marketing campaigns.

Pizza Technology: We cover the upcoming pizza startups and how the big chains are growing with technology.

Pizza Design: Get innovative ideas to improve your pizzeria’s interior and exterior design.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims. We have helped clients with deep-dive corporate intelligence, portfolio optimization strategies, data-driven diagnostics, advanced analytics, and holistic approaches to business and brand strategy.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.