Buying American restaurant chains is becoming a hot topic among the inquires we receive from clients. And we’re not talking Patriotism, here. There are a myriad of reasons why now’s the perfect time to invest in American-based restaurant chains.

For the foodservice industry, in particular, buying American can have significant benefits: from less volatility than emerging markets to portfolio diversification to the access to innovation hubs and talent.

But the time to define goals and selection criteria and identify targets is quickly passing by.

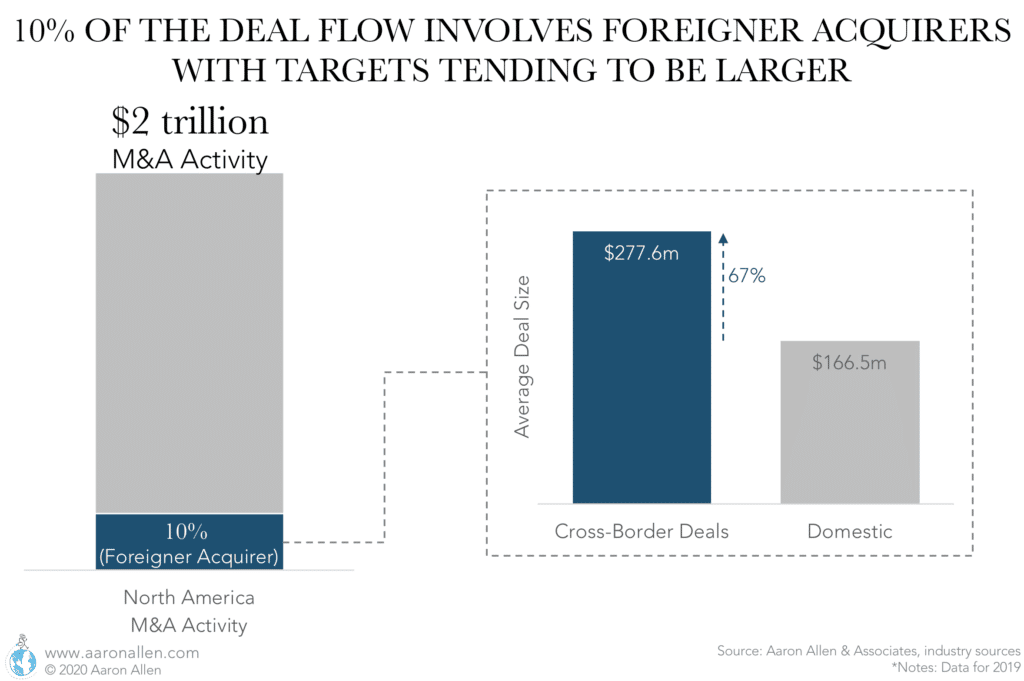

In North America, M&A activity reached close to $2 trillion in deals throughout 2019 (across all industries). Of these deals, 10% involved a foreign acquirer — and the average size of those deals was two-thirds higher than the average size of deals involving only domestic players.

Here, we dive into some of the components that make the market landscape in the U.S. attractive when it comes to the investment into restaurant chains (for both foreign and domestic buyers).

A Macroeconomic Environment Ripe for Investment

- Economic Stability: There’s less volatility than emerging markets and a stable currency. In the last 20 years, GDP variance in emerging countries was 20% higher than the U.S. and inflation averaged 6% annually (affecting exchange rates and consumers’ purchasing power).

- Second-Largest Foodservice Market Globally: In 2019, the U.S. foodservice industry (i.e., money spent in restaurants or other establishments outside of the home) reached $854 billion in sales, second only to China. And to put that into perspective, the U.S. is responsible for about 20% of global restaurant spend with only about 5% of the world’s population (China accounts for about 25% of the spend with 16% of the population).

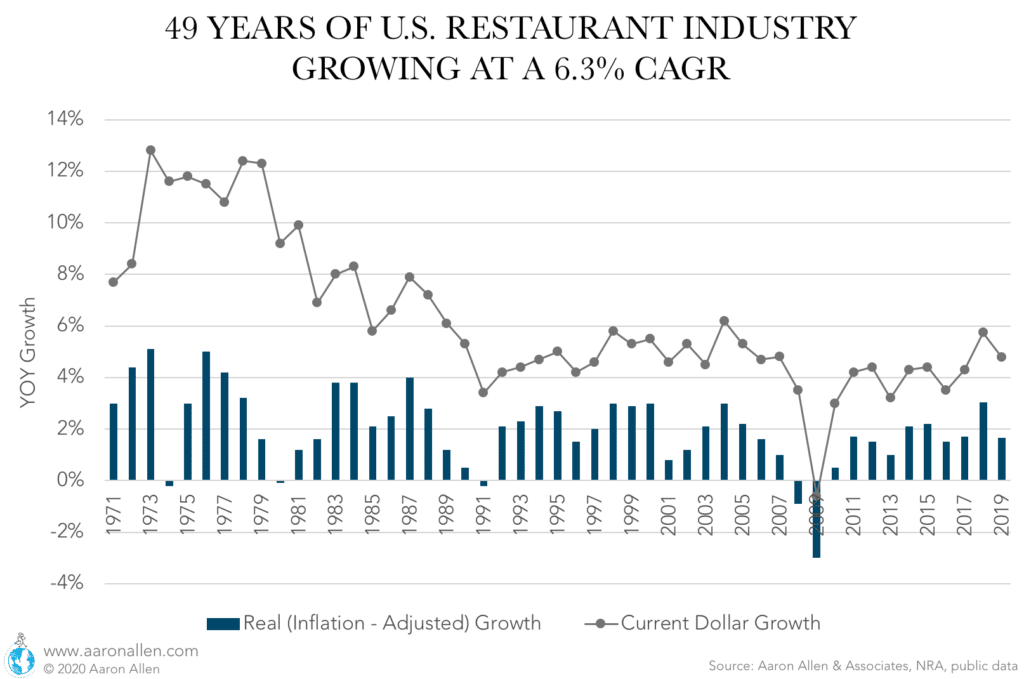

- Stable and Strong Restaurant Growth: One of the reasons investors often seek to invest in the U.S. foodservice industry is its predictability. Food Away From Home (FAFH) growth closely follows the economic cycle (with a correlation of 92% in the last 20 years, in the U.S.). And though in 2020 the U.S. GDP is expected to contract by around 6% due to impacts from the coronavirus pandemic, 2021 is forecasted to bounce back (many put that growth at close to 5%).

- Property Laws and Intellectual Property Protections: Good ideas can be more contagious than the coronavirus. But the U.S. is the best-ranked country on the International IP Index, making it easier to recover the investment that goes into building IP.

- Credibility: Having a significant and successful presence in the U.S. market lends a sense of legitimacy and credibility in the industry. Out of the 10 largest restaurant chains globally, 7 are American.

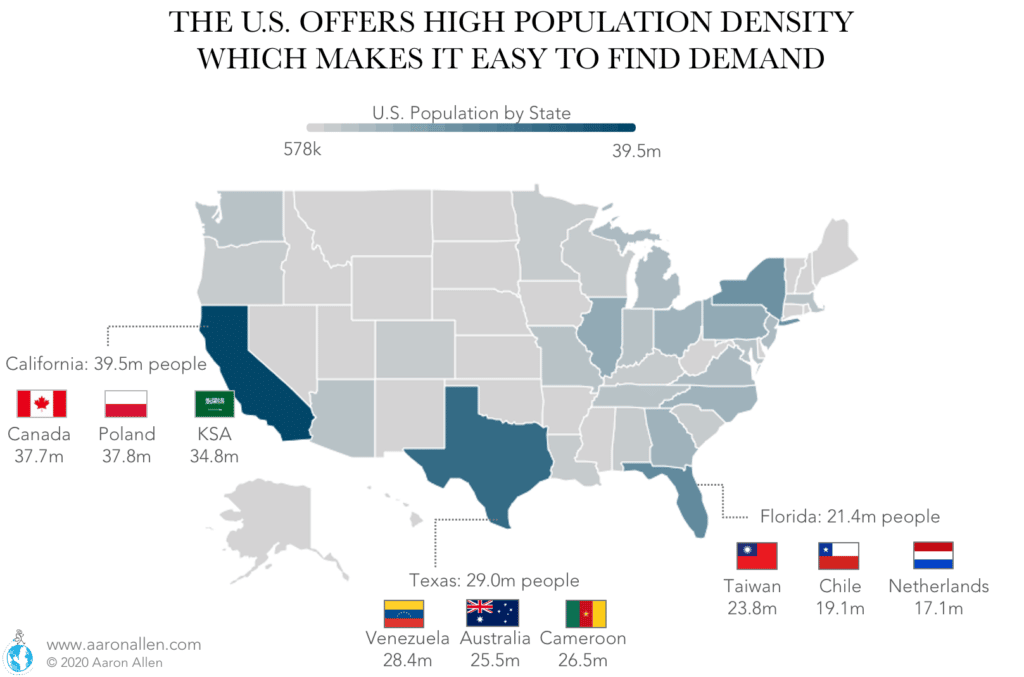

- Large Open Geographical Expansion: Sure, there are some state law differences, but the U.S. lends much more consistency and scalability than smaller geographical countries. Largely open border access across 50 states and coast-to-coast distribution systems make large-scale expansion far easier as there’s just one currency, national service/product providers/suppliers, and other benefits.

- Residency Privileges: There are government incentives for investors including the EB-5 immigrant investor program and H-1B visas allowing foreign citizens to work in the U.S. for a certain period of time.

- Possibility to Leverage Earned-Media: Operating in the U.S. enables access to more major media markets and earned media exposure (which is particularly important ahead of an IPO or investor roadshows).

- Support and Exposure: Unlock access to support organizations (check our list of the most important restaurant associations globally) and trade shows based in the U.S. The National Restaurant Association Show had more than 42k attendees in 2019 alone (and then there are more specific conferences, including the International Pizza Expo with 13k attendees, and the Restaurant Finance and Development Conference focused more on the business and investment aspects of the industry, for example).

- Innovation and Education: Access to innovation hubs (three of the top ten startup ecosystems are in the United States) and top university systems (from leading business schools like Wharton and Kellogg to renowned hospitality institutions like Cornell’s School of Hotel Administration and The Culinary Institute of America).

Cross-Border M&A Can Benefit Your Foodservice Portfolio

Learn How

Financial Benefits or Foreign Investment

- Diversification: Foreign portfolio investment allows a better risk-adjusted return (reducing the overall volatility for investors).

- Access to Financing: As a median, U.S. publicly traded restaurants finance 80% of their assets with debt.

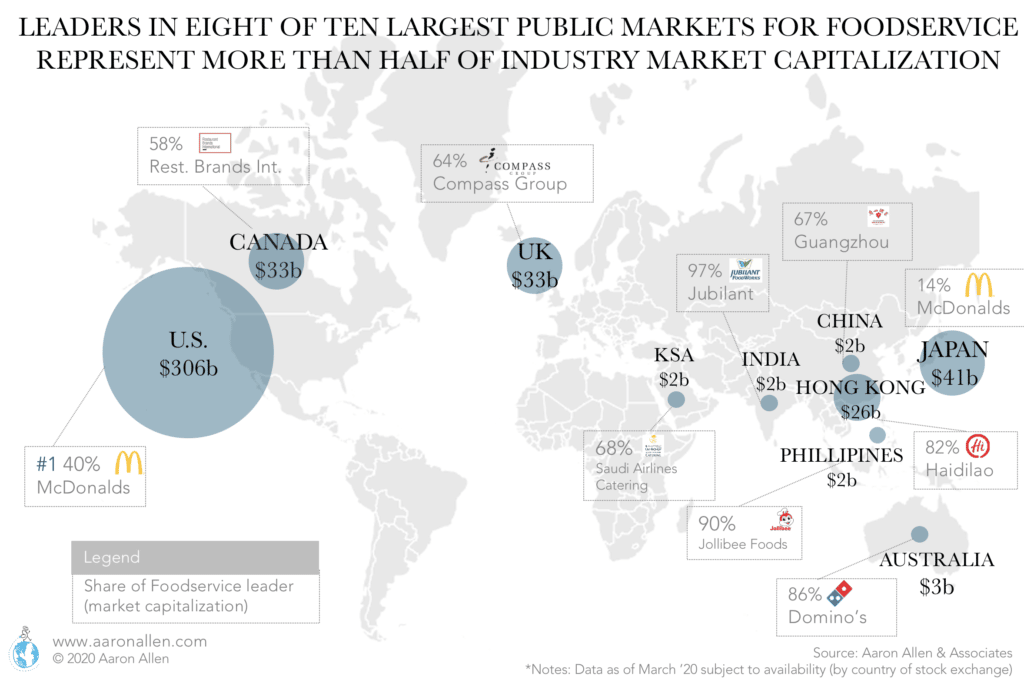

- Access to Funding: Whether via stock exchanges or private markets, there is plenty of capital available in the U.S. It has the largest restaurant stock market in the world by far: more than $300b in foodservice market capitalization, 7x larger than the number two (Japan). There is also plenty of dry powder at the hands of private investors: $900b as of 2019 for PE firms only (in comparison, European investors have about one-third as much).

- Largest Stock Exchange: Both of the largest stock exchanges in the world — the New York Stock Exchange (NYSE) and the NASDAQ — are based in NYC. Listing in the U.S. has benefits like facilitating future M&A, accessing a wider pool of investors, and even keeping control with minority ownership (via share classes not permitted in other countries). Also, in the last five years, the S&P 500 and the Dow Jones have beaten the BSE SENSEX (India’s reference index) and the Shanghai SSE Composite index. Additionally, an important issue when buying American restaurant chains is that on average restaurant valuations are not higher in the U.S. than in countries like India or China, but they have grown 40% in the last three years.

- Ease of Doing Business: Oftentimes, companies (large and small) are easier to buy and sell in the U.S. than in other markets. The ease of doing business index (built based on indicators ranging from how many days does it take to start a new business to the processes to pay taxes) ranks the U.S. sixth.

- Tax Benefits: In 2017, the corporate tax rate in the U.S. was lowered to 21% (from 35%) and about $320b in benefits were stipulated for private businesses.

Efficiencies to be Gained Inside the Business When Buying American Restaurant Chains

- Access to Tech: Oftentimes it’s easier to buy a technology than to try to develop it internally. Examples of this are McDonald’s acquisition of Dynamic Yield to improve in-store customer experience and the Sweetgreen acquisition of Galley giving it a delivery arm.

- Access to Talent: There’s an existing, skilled restaurant-specific workforce, as 7 in 10 American’s have worked in a restaurant at some point in their lives. This means a big talent pool with industry experience in an economy that considers working in restaurants to be a profession with dignity.

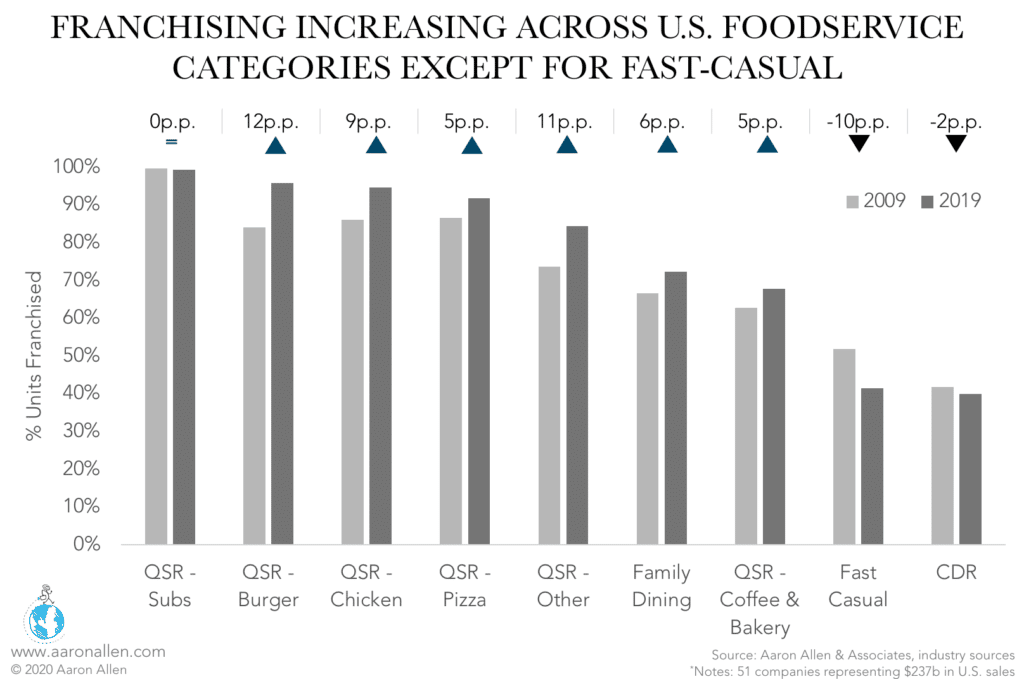

- Being the Franchisor, Not the Franchisee: On average, the top 200 restaurant chains in the U.S. have 74% of their systems franchised. Franchising is another (less capital-intensive) way to expand to domestic and international markets.

- Easy Recruiting: Operating in the U.S. makes it easier to recruit and keep high-caliber, U.S.-based talent that’s less likely to move abroad immediately but will bring value and travel if needed, among other cross-cultural team benefits.

- Improved Supply Chain Capabilities: Buying American restaurant chains gives access to reliable suppliers, high-quality product, and distribution logistics. The U.S. is a leader in “one-click, delivered in two hours” distribution culture.

- Access to Networks: There are existing, sophisticated eco-systems including franchising, real estate, accounting, legal, architectural design and development, construction administration, marketing and media management, kitchen designs and new prototype development, commissary and co-packer solutions, and more.

- Strengthened Reporting Systems & Standards: There’s a reason that many Western brands are used as performance benchmarks globally. Developed SOPs, standardized reporting, goal cascading, real-time KPIs and dashboards, and implementing MBO and meritocracy help to overcome cognitive bias, organizational inertia, and to enthuse and empower the people and systems inside an organization to perform at optimal levels. Combined with initiatives and strategic capital allocations to accelerate sales, it’s possible to deliver significant enterprise value gains no matter the size of the organization.

A Proven Strategy: Successful Foreign Restaurant Investment Case Studies

- European food delivery company Just Eat Takeaway announced the acquisition of U.S.-based Grubhub in June 2020. This enabled the business to enter the U.S. market for the first time and creates the largest food delivery company outside China. With the merger, Just Eat Takeaway immediately gained access to the business of 300k subscribed restaurants (and about $1.5b in annual revenue).

- The Philippines-based Jollibee has been one of the leading foreign restaurant brands buying American restaurant chains as its strategy to enter the U.S. and get a foothold in the market. Its purchase of California-based Coffee Bean & Tea Leaf, along with a majority investment in Smashburger (based in Denver, CO) led to an estimated 15% of its systemwide sales coming from the U.S., with a goal to increase that to 30% over the next decade.

- In 2017, European JAB Holdings acquired U.S.-based Panera Bread for $7.5 billion. At the time of the transaction, Panera’s EBITDA margin was 35%, 3 times what’s standard for European foodservice companies. Since then, the company has grown sales at 6.1% CAGR, reaching $6b in sales.

Why Now Is the Right Time to Invest in American Restaurant Chains

- Access to technology will allow faster implementation of automation, safety, and sanitation procedures than in other countries, where financing may be restricted and red-tape may get in the way of innovation.

- The bounce-back from the coronavirus pandemic is likely to be faster in mature markets than in developing economies (things like development/rollout of vaccines, financing, and government help to rescue small businesses).

- Setbacks in developing economies pressuring exchange rates may result in a further loss of purchasing power (due to inflation and possible devaluations) in those countries, with a consequent loss of wealth.

While we’re certainly living through a time where uncertainty and “unprecedented” is the word of the year — it presents a chance to broaden the landscape of potential attractive acquisitions.

We support companies evaluating investments in the foodservice space with advisory services ranging from getting a clear picture of the market landscape to narrowing down a target and developing a rock-solid investment thesis.

CROSS-BORDER DEAL ORIGINATION

Due to our unmatched depth and breadth of foodservice industry specialization and advisory experience, Aaron Allen & Associates is uniquely positioned at the intersection of capital, concepts, and management. Meaning, our significant global know-how and know-who can bring together a powerful blend of influential industry leaders and proprietary tools to effectuate remarkable results for middle-market investors and operators across the full spectrum of the industry and globe.

Buy-Side Advisory

- Industry Intelligence

- Investment Thesis

- Deal Origination

- Commercial Due Diligence

- Operational Due Diligence

- Post-Acquisition Strategy

- Operating Partner

- Advisory Board

Sell-Side Advisory

- Readiness Audit

- Valuation Opinion

- Value Enhancement Strategy

- Business Plans

- Financial Models

- Investor Presentations

- Buyer Identification

- Deal Management

Put Our Experience to Work for You

ABOUT AARON ALLEN & ASSOCIATES:

Aaron Allen & Associates is a leading global restaurant industry consultancy specializing in growth strategy, marketing, branding, commercial due diligence for emerging restaurant chains and prestigious private equity firms. Aaron has personally lead boots-on-the-ground assignments in 68 countries for clients ranging from startups to multinational companies. Collectively, our clients around the globe generate over $200 billion annually and span six continents and more than 100 countries.